Catastrophe bonds transfer risk from insurers to investors by issuing securities that pay off only if a predefined catastrophe event occurs, providing capital relief and risk diversification. Parametric insurance offers predefined payouts based on measured parameters, such as wind speed or rainfall, rather than actual losses, enabling faster claims settlement and reduced moral hazard. Explore the nuances of catastrophe bonds versus parametric insurance to understand their roles in modern risk management.

Why it is important

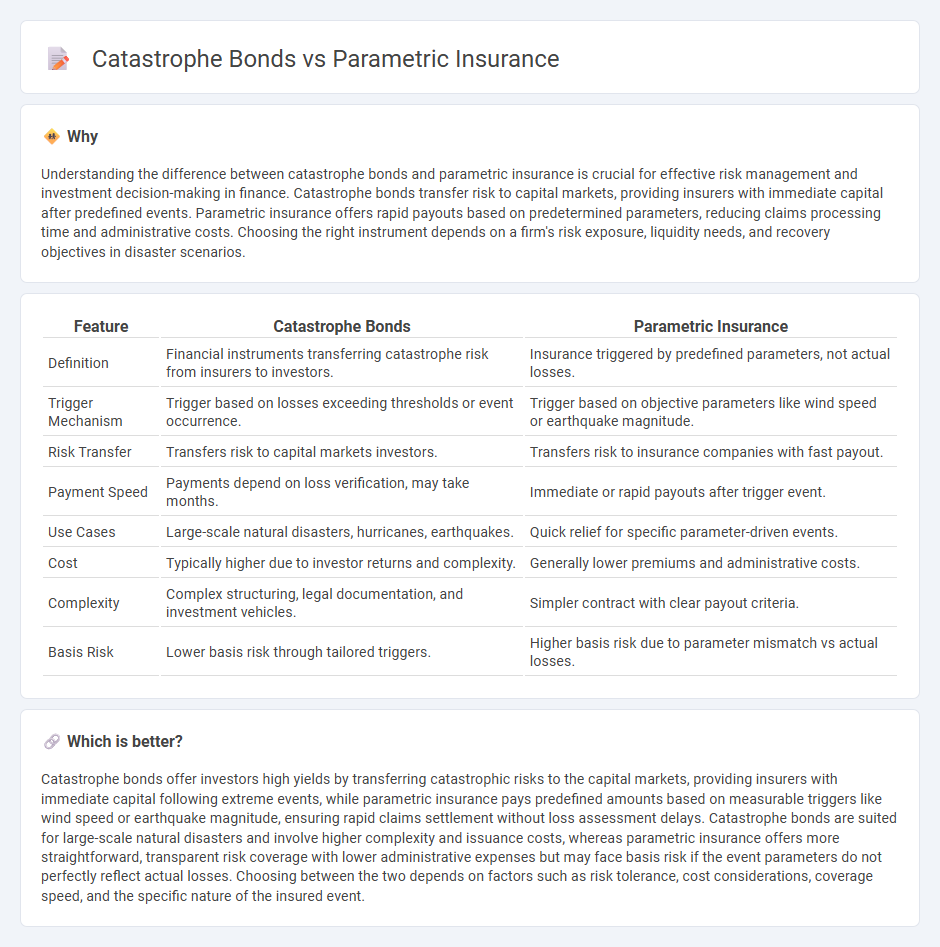

Understanding the difference between catastrophe bonds and parametric insurance is crucial for effective risk management and investment decision-making in finance. Catastrophe bonds transfer risk to capital markets, providing insurers with immediate capital after predefined events. Parametric insurance offers rapid payouts based on predetermined parameters, reducing claims processing time and administrative costs. Choosing the right instrument depends on a firm's risk exposure, liquidity needs, and recovery objectives in disaster scenarios.

Comparison Table

| Feature | Catastrophe Bonds | Parametric Insurance |

|---|---|---|

| Definition | Financial instruments transferring catastrophe risk from insurers to investors. | Insurance triggered by predefined parameters, not actual losses. |

| Trigger Mechanism | Trigger based on losses exceeding thresholds or event occurrence. | Trigger based on objective parameters like wind speed or earthquake magnitude. |

| Risk Transfer | Transfers risk to capital markets investors. | Transfers risk to insurance companies with fast payout. |

| Payment Speed | Payments depend on loss verification, may take months. | Immediate or rapid payouts after trigger event. |

| Use Cases | Large-scale natural disasters, hurricanes, earthquakes. | Quick relief for specific parameter-driven events. |

| Cost | Typically higher due to investor returns and complexity. | Generally lower premiums and administrative costs. |

| Complexity | Complex structuring, legal documentation, and investment vehicles. | Simpler contract with clear payout criteria. |

| Basis Risk | Lower basis risk through tailored triggers. | Higher basis risk due to parameter mismatch vs actual losses. |

Which is better?

Catastrophe bonds offer investors high yields by transferring catastrophic risks to the capital markets, providing insurers with immediate capital following extreme events, while parametric insurance pays predefined amounts based on measurable triggers like wind speed or earthquake magnitude, ensuring rapid claims settlement without loss assessment delays. Catastrophe bonds are suited for large-scale natural disasters and involve higher complexity and issuance costs, whereas parametric insurance offers more straightforward, transparent risk coverage with lower administrative expenses but may face basis risk if the event parameters do not perfectly reflect actual losses. Choosing between the two depends on factors such as risk tolerance, cost considerations, coverage speed, and the specific nature of the insured event.

Connection

Catastrophe bonds transfer risk from insurers to capital markets by triggering payouts when specified disaster parameters are met. Parametric insurance relies on predefined triggers based on measurable events such as hurricane wind speed or earthquake magnitude to expedite claims processing. Both financial instruments enhance risk management by linking payouts directly to quantifiable data, reducing loss adjustment costs and improving response times.

Key Terms

Trigger Mechanism

Parametric insurance uses predefined parameters such as wind speed or earthquake magnitude to trigger payouts immediately after an event, minimizing claim processing time. Catastrophe bonds rely on triggers tied to specific loss thresholds or modeled loss estimates, transferring risk from insurers to investors through capital markets. Explore the detailed distinctions in trigger mechanisms to optimize your disaster risk management strategy.

Payout Structure

Parametric insurance offers predetermined payouts based on specific triggers such as wind speed or earthquake magnitude, enabling rapid claims settlement without extensive damage assessment. Catastrophe bonds provide investors with returns unless a defined catastrophe event occurs, at which point the bond principal is used to cover insured losses, creating a direct link between payouts and disaster severity. Explore the detailed differences in payout structures to determine which risk management tool best suits your needs.

Risk Transfer

Parametric insurance offers predefined payouts based on specific triggering parameters like wind speed or rainfall, providing rapid risk transfer without loss assessment delays. Catastrophe bonds transfer risk to capital markets by allowing insurers to offload catastrophic event exposure to investors, who receive high yields in exchange for bearing the risk of significant losses. Explore further to understand which risk transfer method aligns best with your catastrophe exposure profile.

Source and External Links

What is parametric insurance? - Swiss Re Corporate Solutions - Parametric insurance, also called index-based insurance, provides pre-agreed payouts when a specific measurable event parameter (like earthquake magnitude or wind speed) meets or exceeds a defined threshold, focusing on event likelihood rather than actual loss assessment, enabling quick payouts aligned with the insured's risk tolerance and business continuity plans.

Parametric insurance - Wikipedia - Parametric insurance is a non-traditional product that triggers a payout based on verified occurrence of a predefined event exceeding threshold parameters, offering faster claims than traditional indemnity insurance but with a risk that payouts may not match actual losses due to basis risk.

Parametric Insurance Solutions - Amwins - Parametric insurance pays out according to pre-defined event triggers (e.g. windspeed, seismic magnitude) using near real-time public data for rapid claims, providing insured parties with liquidity to cover any financial losses related to the event, regardless of actual damage assessment.

dowidth.com

dowidth.com