Liability Driven Investing (LDI) focuses on aligning investment strategies with future liabilities, primarily for pension funds and insurance companies to manage risk effectively. Outsourced Chief Investment Officer (OCIO) services provide institutional investors with expert management, integrating asset allocation and liability considerations under one external advisory. Explore how each approach tailors financial solutions to optimize portfolio stability and long-term funding goals.

Why it is important

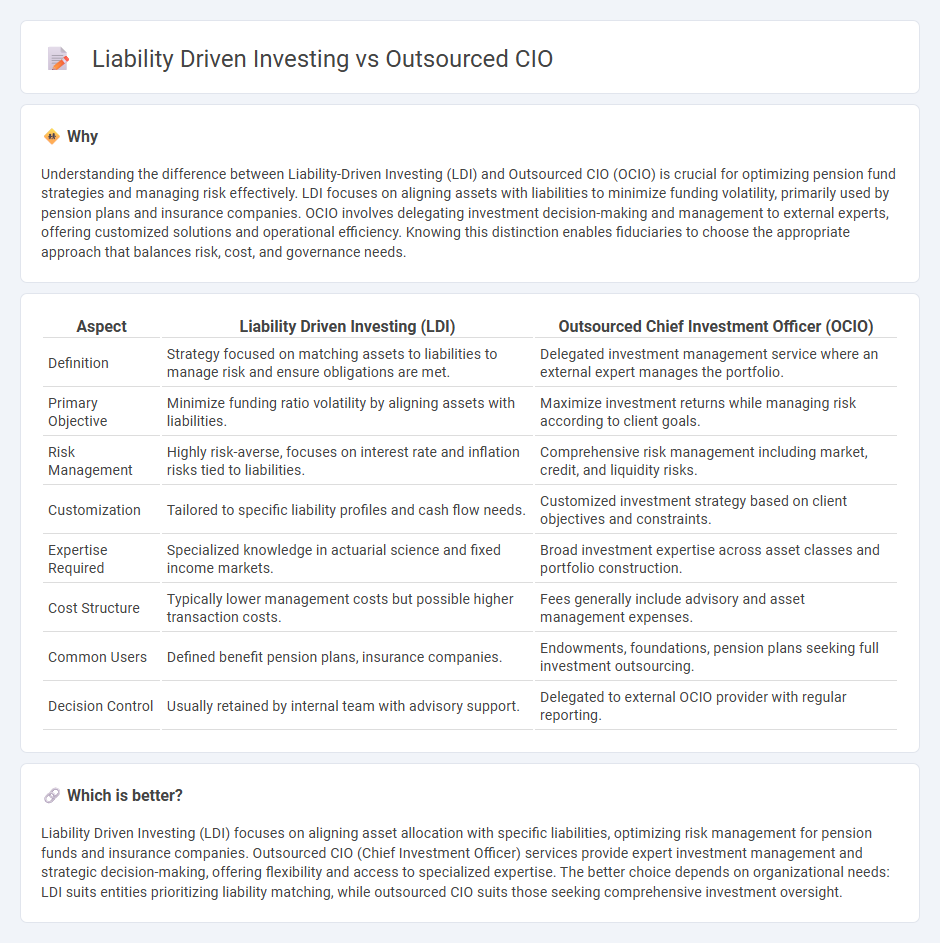

Understanding the difference between Liability-Driven Investing (LDI) and Outsourced CIO (OCIO) is crucial for optimizing pension fund strategies and managing risk effectively. LDI focuses on aligning assets with liabilities to minimize funding volatility, primarily used by pension plans and insurance companies. OCIO involves delegating investment decision-making and management to external experts, offering customized solutions and operational efficiency. Knowing this distinction enables fiduciaries to choose the appropriate approach that balances risk, cost, and governance needs.

Comparison Table

| Aspect | Liability Driven Investing (LDI) | Outsourced Chief Investment Officer (OCIO) |

|---|---|---|

| Definition | Strategy focused on matching assets to liabilities to manage risk and ensure obligations are met. | Delegated investment management service where an external expert manages the portfolio. |

| Primary Objective | Minimize funding ratio volatility by aligning assets with liabilities. | Maximize investment returns while managing risk according to client goals. |

| Risk Management | Highly risk-averse, focuses on interest rate and inflation risks tied to liabilities. | Comprehensive risk management including market, credit, and liquidity risks. |

| Customization | Tailored to specific liability profiles and cash flow needs. | Customized investment strategy based on client objectives and constraints. |

| Expertise Required | Specialized knowledge in actuarial science and fixed income markets. | Broad investment expertise across asset classes and portfolio construction. |

| Cost Structure | Typically lower management costs but possible higher transaction costs. | Fees generally include advisory and asset management expenses. |

| Common Users | Defined benefit pension plans, insurance companies. | Endowments, foundations, pension plans seeking full investment outsourcing. |

| Decision Control | Usually retained by internal team with advisory support. | Delegated to external OCIO provider with regular reporting. |

Which is better?

Liability Driven Investing (LDI) focuses on aligning asset allocation with specific liabilities, optimizing risk management for pension funds and insurance companies. Outsourced CIO (Chief Investment Officer) services provide expert investment management and strategic decision-making, offering flexibility and access to specialized expertise. The better choice depends on organizational needs: LDI suits entities prioritizing liability matching, while outsourced CIO suits those seeking comprehensive investment oversight.

Connection

Liability Driven Investing (LDI) focuses on aligning investment strategies with future financial obligations, commonly used by pension funds to manage risks associated with liabilities. Outsourced Chief Investment Officers (OCIOs) provide expert management of these strategies, offering tailored portfolio construction and risk mitigation that match the specific liabilities of an institution. The integration of LDI and OCIO services enhances asset-liability matching and optimizes long-term financial outcomes for institutional investors.

Key Terms

Fiduciary Responsibility

Outsourced CIO services provide fiduciary oversight by integrating liability driven investing (LDI) strategies that align asset management with pension obligations, reducing risk and enhancing long-term financial stability. Fiduciary responsibility ensures outsourced CIOs act in the best interest of clients, implementing tailored LDI solutions that address interest rate and inflation risks inherent in pension liabilities. Discover how combining outsourced CIO expertise with liability driven investing strengthens fiduciary commitment and portfolio resilience.

Asset Allocation

Outsourced Chief Investment Officers (OCIO) enhance asset allocation by leveraging specialized expertise to tailor diversified portfolios that align with an institution's risk tolerance and financial goals. Liability-driven investing (LDI) specifically targets asset allocation to match liabilities, reducing funding ratio volatility through customized duration matching and risk mitigation strategies. Explore the distinct advantages and strategic implications of OCIO versus LDI for optimized portfolio management.

Risk Management

Outsourced Chief Investment Officers (OCIO) provide specialized risk management by tailoring investment strategies to meet fiduciary standards and organizational goals, especially in liability-driven investing (LDI) frameworks. LDI focuses on aligning asset portfolios with future liabilities, employing hedging techniques to minimize interest rate and inflation risks, which OCIOs expertly manage through dynamic asset allocation. Discover how integrating OCIO expertise with LDI strategies can optimize risk mitigation for pension funds and institutional investors.

Source and External Links

What Is OCIO? An Explanation - OCIO stands for Outsourced Chief Investment Officer, referring to the full or partial outsourcing of an organization's investment function to a third party, enabling institutional investors to improve governance, reduce risk and costs, and enhance investment management by delegating some fiduciary duties to the outsourced CIO provider.

What Is OCIO? An Explanation - An OCIO provider helps institutions by extending investment staff capabilities, lowering costs, potentially reducing volatility, and delivering customized investment solutions aligned with the organization's goals, while the organization maintains some fiduciary responsibility.

OCIO Services - An outsourced CIO acts as a full-service third-party provider, managing strategic asset allocation, selecting portfolio managers, and guiding overall investment decisions, freeing up advisors' time, reducing costs, and providing customized financial solutions tailored to each firm's unique needs.

dowidth.com

dowidth.com