Insurtech leverages advanced technology to transform the insurance industry by enhancing underwriting, claims processing, and customer experience through AI and big data analytics. Robo-advisors utilize algorithms and automation to provide personalized investment management and financial planning services with lower fees and greater accessibility. Explore how these innovations reshape financial services and offer new opportunities for consumers.

Why it is important

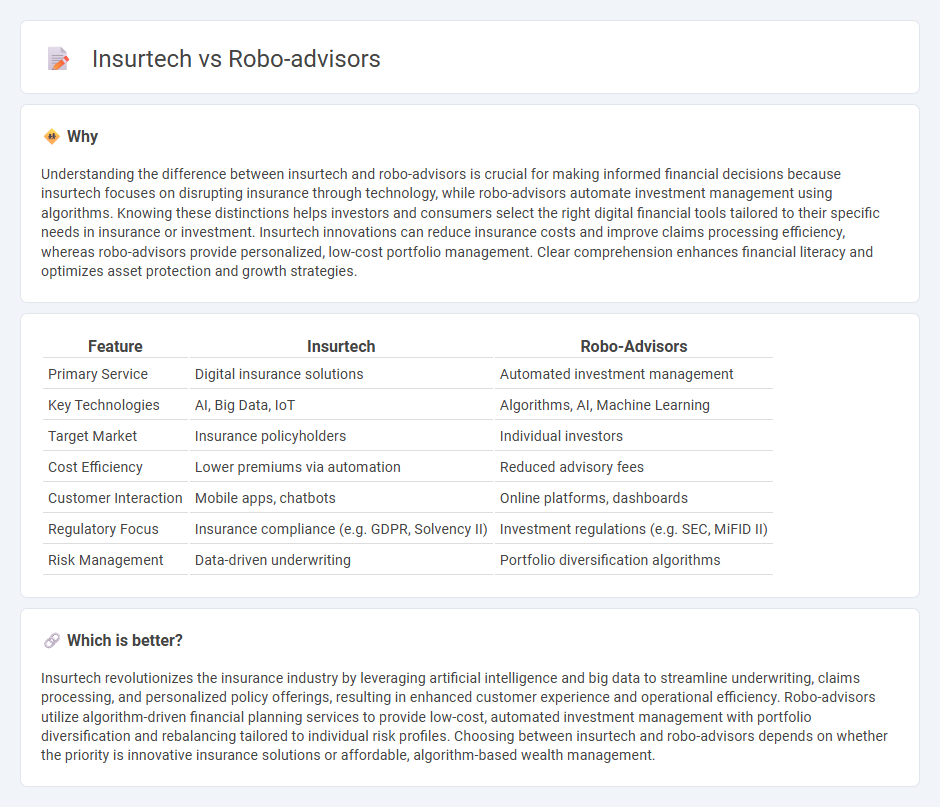

Understanding the difference between insurtech and robo-advisors is crucial for making informed financial decisions because insurtech focuses on disrupting insurance through technology, while robo-advisors automate investment management using algorithms. Knowing these distinctions helps investors and consumers select the right digital financial tools tailored to their specific needs in insurance or investment. Insurtech innovations can reduce insurance costs and improve claims processing efficiency, whereas robo-advisors provide personalized, low-cost portfolio management. Clear comprehension enhances financial literacy and optimizes asset protection and growth strategies.

Comparison Table

| Feature | Insurtech | Robo-Advisors |

|---|---|---|

| Primary Service | Digital insurance solutions | Automated investment management |

| Key Technologies | AI, Big Data, IoT | Algorithms, AI, Machine Learning |

| Target Market | Insurance policyholders | Individual investors |

| Cost Efficiency | Lower premiums via automation | Reduced advisory fees |

| Customer Interaction | Mobile apps, chatbots | Online platforms, dashboards |

| Regulatory Focus | Insurance compliance (e.g. GDPR, Solvency II) | Investment regulations (e.g. SEC, MiFID II) |

| Risk Management | Data-driven underwriting | Portfolio diversification algorithms |

Which is better?

Insurtech revolutionizes the insurance industry by leveraging artificial intelligence and big data to streamline underwriting, claims processing, and personalized policy offerings, resulting in enhanced customer experience and operational efficiency. Robo-advisors utilize algorithm-driven financial planning services to provide low-cost, automated investment management with portfolio diversification and rebalancing tailored to individual risk profiles. Choosing between insurtech and robo-advisors depends on whether the priority is innovative insurance solutions or affordable, algorithm-based wealth management.

Connection

Insurtech and robo-advisors are connected through their shared use of artificial intelligence and data analytics to optimize financial services. Insurtech leverages AI to enhance insurance underwriting, claims processing, and risk assessment, while robo-advisors apply similar technologies to automate investment management and portfolio allocation. Both sectors drive efficiency and personalized financial solutions, transforming how consumers access and manage insurance and investment products.

Key Terms

Algorithmic Portfolio Management

Robo-advisors utilize algorithmic portfolio management to provide automated, data-driven investment strategies tailored to individual risk profiles and financial goals. Insurtech platforms increasingly integrate similar AI-driven algorithms to optimize insurance product recommendations and risk assessments, enhancing user experience and efficiency. Explore how these technologies revolutionize financial and insurance industries through advanced algorithmic management.

Automated Underwriting

Robo-advisors excel in automated portfolio management by leveraging algorithms to optimize investments, while insurtech utilizes automated underwriting to accelerate risk assessment and policy issuance, enhancing insurance efficiency. Automated underwriting employs machine learning models and real-time data integration to deliver accurate risk evaluation, reducing human error and processing time significantly. Explore the latest advancements in automated underwriting and how they reshape the future of insurance and wealth management.

Risk Assessment

Robo-advisors leverage advanced algorithms and machine learning to deliver personalized investment strategies by analyzing financial data and risk tolerance efficiently. Insurtech platforms prioritize dynamic risk assessment through real-time data analytics, telematics, and AI, enabling precise underwriting and fraud detection in insurance. Explore in-depth comparisons of risk assessment methodologies to understand their distinct impacts on financial and insurance sectors.

Source and External Links

Robo-advisor - Wikipedia - Robo-advisors are digital financial advisers that use algorithms to provide personalized investment management online with minimal human intervention, often focusing on automated asset allocation primarily through exchange-traded funds (ETFs) based on clients' risk tolerance and financial goals.

What is a robo advisor? | Robo advisory services - Fidelity Investments - Robo-advisors automate investing by using technology to create and maintain portfolios tailored to an investor's risk tolerance and goals, offering lower fees than traditional human advisory services while still involving human experts behind the scenes.

Best Robo-Advisors In July 2025 - Bankrate - Robo-advisors provide low-cost, automated portfolio management through algorithms that build diversified ETF portfolios, perform ongoing rebalancing, and can implement tax-loss harvesting, making professional investment management affordable and accessible digitally.

dowidth.com

dowidth.com