Quantamental investing merges quantitative data analysis with fundamental research to identify high-growth opportunities, outperforming traditional index investing that tracks market averages through broad-based funds such as S&P 500 ETFs. This hybrid strategy leverages algorithms to analyze financial statements, market trends, and economic indicators for smarter stock selection. Explore how integrating these approaches can optimize portfolio performance and mitigate risks effectively.

Why it is important

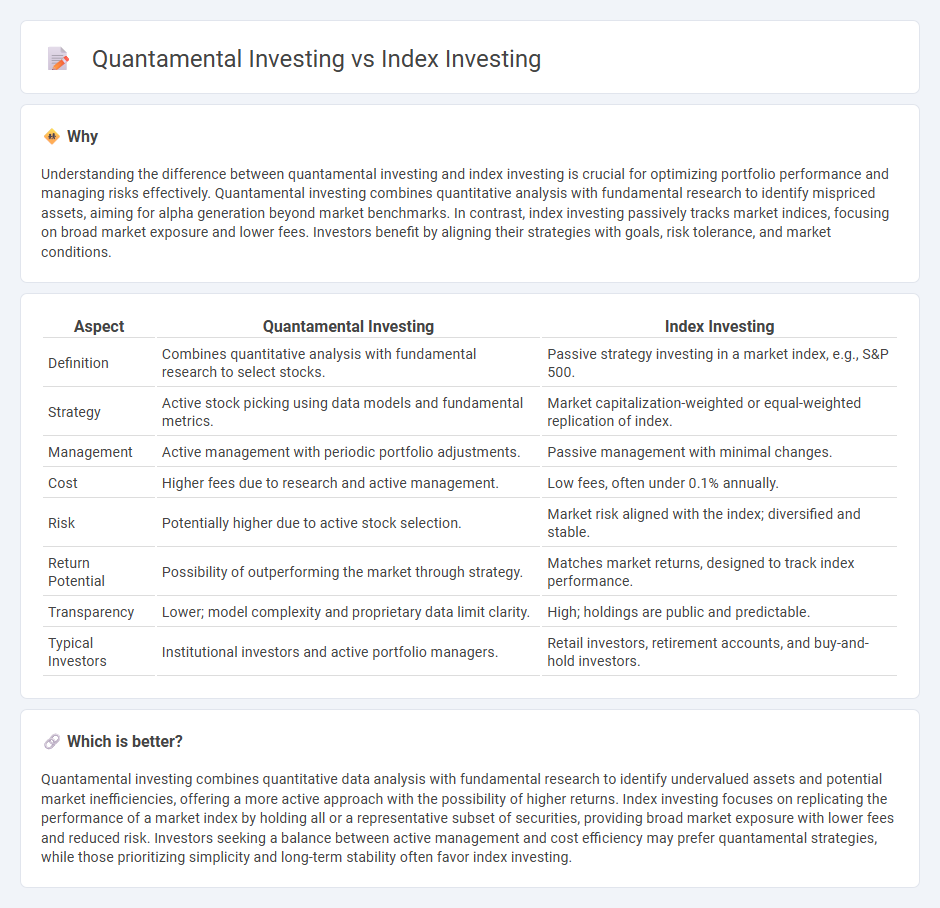

Understanding the difference between quantamental investing and index investing is crucial for optimizing portfolio performance and managing risks effectively. Quantamental investing combines quantitative analysis with fundamental research to identify mispriced assets, aiming for alpha generation beyond market benchmarks. In contrast, index investing passively tracks market indices, focusing on broad market exposure and lower fees. Investors benefit by aligning their strategies with goals, risk tolerance, and market conditions.

Comparison Table

| Aspect | Quantamental Investing | Index Investing |

|---|---|---|

| Definition | Combines quantitative analysis with fundamental research to select stocks. | Passive strategy investing in a market index, e.g., S&P 500. |

| Strategy | Active stock picking using data models and fundamental metrics. | Market capitalization-weighted or equal-weighted replication of index. |

| Management | Active management with periodic portfolio adjustments. | Passive management with minimal changes. |

| Cost | Higher fees due to research and active management. | Low fees, often under 0.1% annually. |

| Risk | Potentially higher due to active stock selection. | Market risk aligned with the index; diversified and stable. |

| Return Potential | Possibility of outperforming the market through strategy. | Matches market returns, designed to track index performance. |

| Transparency | Lower; model complexity and proprietary data limit clarity. | High; holdings are public and predictable. |

| Typical Investors | Institutional investors and active portfolio managers. | Retail investors, retirement accounts, and buy-and-hold investors. |

Which is better?

Quantamental investing combines quantitative data analysis with fundamental research to identify undervalued assets and potential market inefficiencies, offering a more active approach with the possibility of higher returns. Index investing focuses on replicating the performance of a market index by holding all or a representative subset of securities, providing broad market exposure with lower fees and reduced risk. Investors seeking a balance between active management and cost efficiency may prefer quantamental strategies, while those prioritizing simplicity and long-term stability often favor index investing.

Connection

Quantamental investing combines quantitative models with fundamental analysis to select stocks, leveraging data-driven insights and financial metrics for optimal portfolio construction. Index investing, which tracks market benchmarks like the S&P 500, serves as a baseline or comparison for quantamental strategies aiming to outperform passive returns. Both approaches rely on systematic data evaluation, but quantamental investing enhances index investing by incorporating deeper financial analysis to identify undervalued or high-growth opportunities.

Key Terms

**Index Investing:**

Index investing involves replicating the performance of a market index like the S&P 500 by holding a diversified portfolio of its constituent stocks, offering broad market exposure with low fees and minimal trading. This passive strategy reduces the risks associated with individual stock selection and market timing, making it ideal for long-term investors seeking consistent, steady growth. Explore more to understand how index investing can align with your financial goals and risk tolerance.

Passive Management

Index investing primarily focuses on passive management by tracking market indexes like the S&P 500 to replicate their performance and minimize costs. Quantamental investing combines quantitative analysis and fundamental research to enhance decision-making while maintaining elements of passive management. Explore deeper insights to understand which strategy aligns best with your investment goals.

Benchmark Index

Index investing emphasizes replicating the performance of a benchmark index, such as the S&P 500 or the MSCI World Index, by holding a diversified portfolio of its constituent securities. Quantamental investing combines quantitative models with fundamental analysis to select stocks, aiming to outperform the benchmark index through data-driven and qualitative insights. Explore how these strategies differ in tracking or beating benchmark indexes to optimize your investment approach.

Source and External Links

Index Funds - An index fund is a mutual fund or ETF designed to track the performance of a specific market index like the S&P 500, offering an indirect way to invest in a broad market segment by replicating its returns.

What is an index fund and how does it work? - Index funds pool money from many investors to mimic an index like the S&P 500, allowing investors to gain diversified exposure to many stocks with relatively low cost and less effort than buying individual stocks.

What is an index fund? - Vanguard - Index investing offers a straightforward, low-cost way to gain broad market exposure by tracking benchmarks, and Vanguard pioneered this approach with the first retail index fund in 1976, now offering extensive fund options for diversified portfolios.

dowidth.com

dowidth.com