Nonfungible token (NFT) fractionalization divides ownership of a digital asset into smaller, tradable units, enhancing liquidity and accessibility in the digital art market. In contrast, art securitization transforms physical art assets into financial securities, allowing investors to buy shares backed by tangible masterpieces. Explore the differences and benefits of these innovative financial models to understand their impact on art investment.

Why it is important

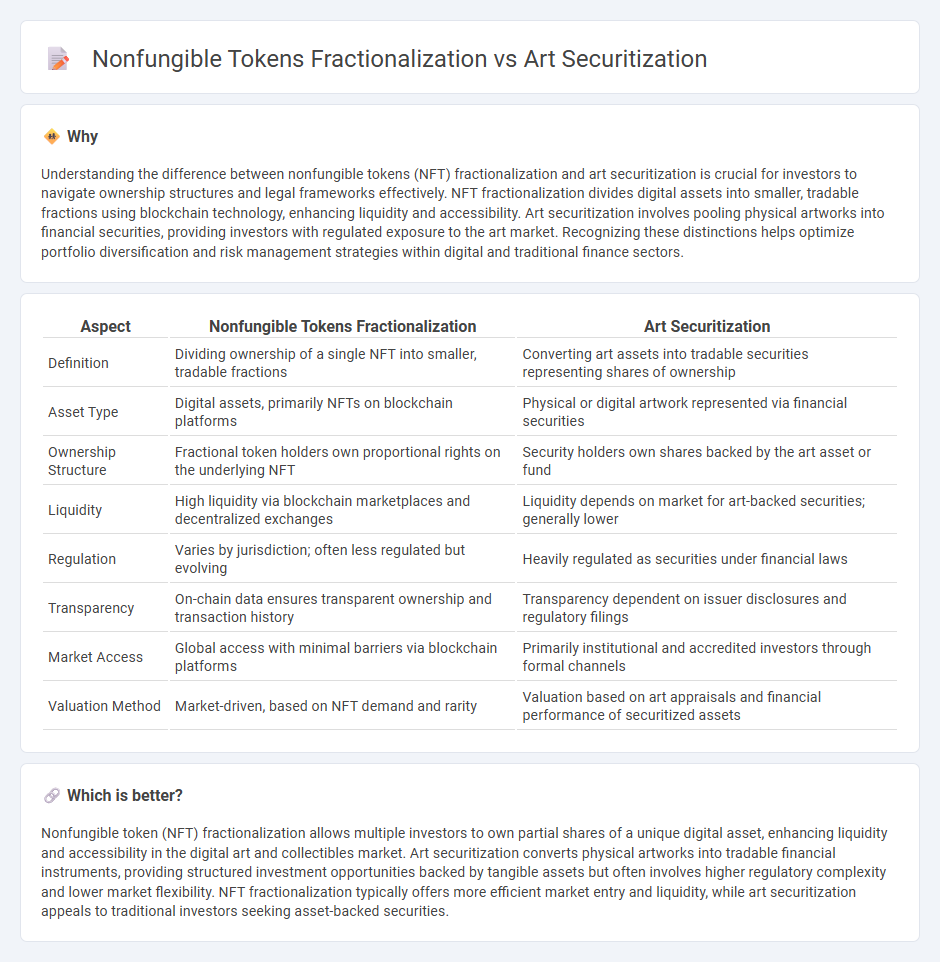

Understanding the difference between nonfungible tokens (NFT) fractionalization and art securitization is crucial for investors to navigate ownership structures and legal frameworks effectively. NFT fractionalization divides digital assets into smaller, tradable fractions using blockchain technology, enhancing liquidity and accessibility. Art securitization involves pooling physical artworks into financial securities, providing investors with regulated exposure to the art market. Recognizing these distinctions helps optimize portfolio diversification and risk management strategies within digital and traditional finance sectors.

Comparison Table

| Aspect | Nonfungible Tokens Fractionalization | Art Securitization |

|---|---|---|

| Definition | Dividing ownership of a single NFT into smaller, tradable fractions | Converting art assets into tradable securities representing shares of ownership |

| Asset Type | Digital assets, primarily NFTs on blockchain platforms | Physical or digital artwork represented via financial securities |

| Ownership Structure | Fractional token holders own proportional rights on the underlying NFT | Security holders own shares backed by the art asset or fund |

| Liquidity | High liquidity via blockchain marketplaces and decentralized exchanges | Liquidity depends on market for art-backed securities; generally lower |

| Regulation | Varies by jurisdiction; often less regulated but evolving | Heavily regulated as securities under financial laws |

| Transparency | On-chain data ensures transparent ownership and transaction history | Transparency dependent on issuer disclosures and regulatory filings |

| Market Access | Global access with minimal barriers via blockchain platforms | Primarily institutional and accredited investors through formal channels |

| Valuation Method | Market-driven, based on NFT demand and rarity | Valuation based on art appraisals and financial performance of securitized assets |

Which is better?

Nonfungible token (NFT) fractionalization allows multiple investors to own partial shares of a unique digital asset, enhancing liquidity and accessibility in the digital art and collectibles market. Art securitization converts physical artworks into tradable financial instruments, providing structured investment opportunities backed by tangible assets but often involves higher regulatory complexity and lower market flexibility. NFT fractionalization typically offers more efficient market entry and liquidity, while art securitization appeals to traditional investors seeking asset-backed securities.

Connection

Nonfungible tokens (NFTs) fractionalization allows multiple investors to own shares of a high-value digital asset, increasing liquidity and market accessibility in finance. Art securitization transforms physical artworks into financial securities by tokenizing ownership, enabling fractional investment and trading. Both processes leverage blockchain technology to democratize asset ownership and enhance capital flow within the art and digital asset markets.

Key Terms

Asset-backed securities

Art securitization involves pooling valuable artworks to create asset-backed securities (ABS) that offer investors fractional ownership and income streams derived from the appreciation or sale of the collection. Nonfungible tokens (NFTs) fractionalization divides a unique digital NFT into smaller, tradable shares, enabling fractional ownership but differs from ABS as it is blockchain-based and not typically linked to traditional financial instruments. Explore the distinctions and potential benefits of art securitization versus NFT fractionalization for innovative investment opportunities.

Smart contracts

Art securitization leverages blockchain-based smart contracts to tokenize ownership rights, enabling fractional investment in high-value artworks with automated dividend distribution and transparent transfer of ownership. Nonfungible tokens (NFTs) fractionalization uses smart contracts to split a unique digital asset into smaller, tradable fractions, enhancing liquidity and market accessibility while preserving the original token's metadata and provenance. Explore the nuances of how smart contracts drive efficiency and trust in these innovative art investment mechanisms.

Provenance

Art securitization transforms physical artworks into tradable securities, enabling fractional ownership with clear legal frameworks, whereas nonfungible tokens (NFTs) fractionalization uses blockchain technology to divide digital art into verifiable shares secured by smart contracts. Provenance in securitization relies on traditional certification and transaction histories, while NFT fractionalization offers transparent, immutable provenance recorded on decentralized ledgers, reducing fraud risks. Explore how these distinct provenance methods impact art investment strategies and market trust.

Source and External Links

Part 1 - Art Securitisation: what is, the mechanics, and why it matters - Art securitisation transforms artworks or collections into financial securities, allowing investors to buy shares and own a fraction of artworks without large capital commitment, involving appraisal, bundling, and expert selection processes.

NOT JUST ANOTHER CRYPTO SCHEME: WHAT MAKES ART ... - Art securitization platforms, like Masterworks, enable fractional ownership and trading of artwork shares on secondary markets, making high-value art accessible to smaller investors and increasing transparency and liquidity in the art market.

Art-Backed Debt Investing Gains Popularity Among Private Clients - Sotheby's launched a $700 million securitization program pooling art-secured loans into asset-backed notes, demonstrating increasing institutional demand and transforming art into a more liquid and credible asset class.

dowidth.com

dowidth.com