Flash loan attacks exploit vulnerabilities in decentralized finance (DeFi) protocols through instant, uncollateralized loans to manipulate assets and execute profitable trades. Rug pulls occur when developers abruptly withdraw liquidity or funds from a project, leaving investors with worthless tokens. Explore the differences between these schemes to safeguard your investments effectively.

Why it is important

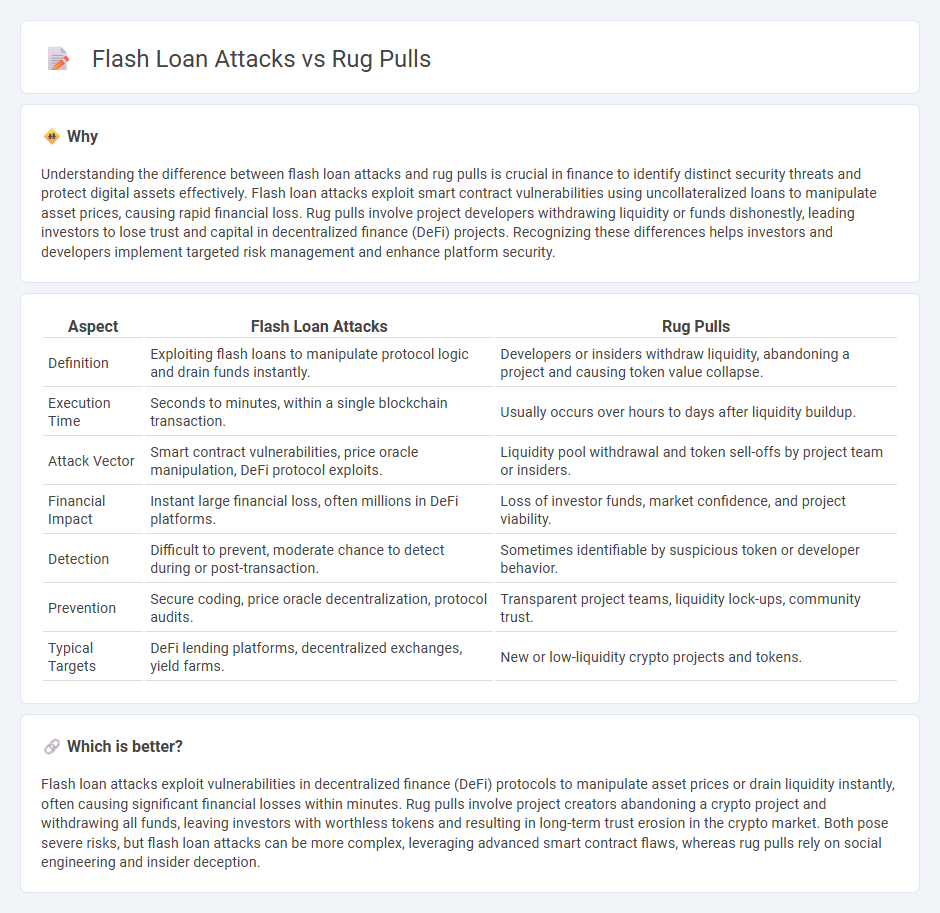

Understanding the difference between flash loan attacks and rug pulls is crucial in finance to identify distinct security threats and protect digital assets effectively. Flash loan attacks exploit smart contract vulnerabilities using uncollateralized loans to manipulate asset prices, causing rapid financial loss. Rug pulls involve project developers withdrawing liquidity or funds dishonestly, leading investors to lose trust and capital in decentralized finance (DeFi) projects. Recognizing these differences helps investors and developers implement targeted risk management and enhance platform security.

Comparison Table

| Aspect | Flash Loan Attacks | Rug Pulls |

|---|---|---|

| Definition | Exploiting flash loans to manipulate protocol logic and drain funds instantly. | Developers or insiders withdraw liquidity, abandoning a project and causing token value collapse. |

| Execution Time | Seconds to minutes, within a single blockchain transaction. | Usually occurs over hours to days after liquidity buildup. |

| Attack Vector | Smart contract vulnerabilities, price oracle manipulation, DeFi protocol exploits. | Liquidity pool withdrawal and token sell-offs by project team or insiders. |

| Financial Impact | Instant large financial loss, often millions in DeFi platforms. | Loss of investor funds, market confidence, and project viability. |

| Detection | Difficult to prevent, moderate chance to detect during or post-transaction. | Sometimes identifiable by suspicious token or developer behavior. |

| Prevention | Secure coding, price oracle decentralization, protocol audits. | Transparent project teams, liquidity lock-ups, community trust. |

| Typical Targets | DeFi lending platforms, decentralized exchanges, yield farms. | New or low-liquidity crypto projects and tokens. |

Which is better?

Flash loan attacks exploit vulnerabilities in decentralized finance (DeFi) protocols to manipulate asset prices or drain liquidity instantly, often causing significant financial losses within minutes. Rug pulls involve project creators abandoning a crypto project and withdrawing all funds, leaving investors with worthless tokens and resulting in long-term trust erosion in the crypto market. Both pose severe risks, but flash loan attacks can be more complex, leveraging advanced smart contract flaws, whereas rug pulls rely on social engineering and insider deception.

Connection

Flash loan attacks and rug pulls are interconnected through their exploitation of decentralized finance (DeFi) vulnerabilities, particularly in liquidity pools and smart contract weaknesses. Flash loan attacks manipulate asset prices by borrowing large sums without collateral, enabling attackers to execute rug pulls by draining liquidity and abandoning projects. This synergy underscores the importance of robust smart contract audits and real-time monitoring to prevent financial losses in DeFi ecosystems.

Key Terms

Liquidity

Rug pulls exploit liquidity by rapidly removing funds from decentralized liquidity pools, leaving investors with worthless tokens and depleted assets. Flash loan attacks manipulate liquidity through instant, uncollateralized loans to exploit vulnerabilities in smart contracts, causing massive financial losses. Discover more about how these exploit methods impact DeFi liquidity and secure mechanisms.

Smart contracts

Rug pulls exploit vulnerabilities in smart contracts by allowing developers to maliciously withdraw liquidity, resulting in severe financial losses for investors. Flash loan attacks manipulate smart contract logic through instantaneous, uncollateralized loans to execute arbitrage, drain assets, or manipulate token prices. Explore our detailed analysis to understand the mechanisms and security measures of smart contracts against rug pulls and flash loan attacks.

Exploits

Rug pulls involve project developers abruptly withdrawing liquidity or funds, leaving investors with worthless tokens, while flash loan attacks exploit vulnerabilities in DeFi protocols using uncollateralized loans to manipulate smart contracts for profit. Both attack types target weaknesses in decentralized finance but differ in execution methods and impact scale, with rug pulls primarily affecting individual projects and flash loan attacks threatening broader protocol stability. Explore detailed case studies and defensive strategies to understand these exploits more comprehensively.

Source and External Links

What is a rug pull and how to avoid it? - Coinbase - A rug pull is a cryptocurrency scam where developers abandon a project after raising funds, leaving investors with worthless tokens; it comes in forms like liquidity pulls, fake projects, pump and dump schemes, and team exits, with major prevention methods including thorough research, security audits, and community engagement.

Rug Pull Definition | CoinMarketCap - A rug pull is a malicious maneuver in crypto where developers hype and launch a token to attract investments, then suddenly abandon the project taking investors' money, often marked by rapid token price surges and influencer promotion; truly "unruggable" projects limit team-held tokens or renounce ownership.

What Is A Rug Pull? | Bankrate - A rug pull is a scam in crypto or NFTs where developers aggressively promote a project to attract investors before disappearing with their funds, leaving victims with worthless assets, with rising prevalence due to DeFi growth and millions lost worldwide in 2024.

dowidth.com

dowidth.com