Shadow banking encompasses non-bank financial intermediaries providing credit and liquidity outside traditional banking regulations, often involving entities like hedge funds, money market funds, and structured investment vehicles. Retail banking, in contrast, involves banks offering direct financial services to individual consumers, including savings accounts, loans, and payment services, regulated by central banks and financial authorities. Explore the key differences and implications between shadow banking and retail banking to understand their roles in the financial ecosystem.

Why it is important

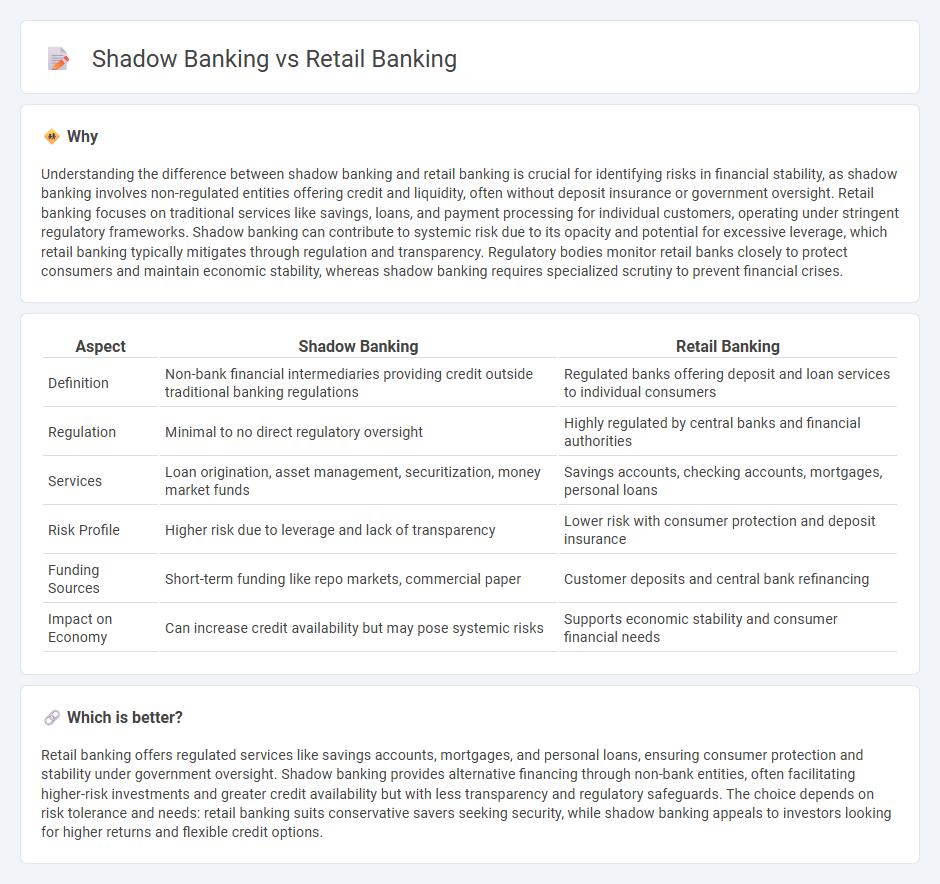

Understanding the difference between shadow banking and retail banking is crucial for identifying risks in financial stability, as shadow banking involves non-regulated entities offering credit and liquidity, often without deposit insurance or government oversight. Retail banking focuses on traditional services like savings, loans, and payment processing for individual customers, operating under stringent regulatory frameworks. Shadow banking can contribute to systemic risk due to its opacity and potential for excessive leverage, which retail banking typically mitigates through regulation and transparency. Regulatory bodies monitor retail banks closely to protect consumers and maintain economic stability, whereas shadow banking requires specialized scrutiny to prevent financial crises.

Comparison Table

| Aspect | Shadow Banking | Retail Banking |

|---|---|---|

| Definition | Non-bank financial intermediaries providing credit outside traditional banking regulations | Regulated banks offering deposit and loan services to individual consumers |

| Regulation | Minimal to no direct regulatory oversight | Highly regulated by central banks and financial authorities |

| Services | Loan origination, asset management, securitization, money market funds | Savings accounts, checking accounts, mortgages, personal loans |

| Risk Profile | Higher risk due to leverage and lack of transparency | Lower risk with consumer protection and deposit insurance |

| Funding Sources | Short-term funding like repo markets, commercial paper | Customer deposits and central bank refinancing |

| Impact on Economy | Can increase credit availability but may pose systemic risks | Supports economic stability and consumer financial needs |

Which is better?

Retail banking offers regulated services like savings accounts, mortgages, and personal loans, ensuring consumer protection and stability under government oversight. Shadow banking provides alternative financing through non-bank entities, often facilitating higher-risk investments and greater credit availability but with less transparency and regulatory safeguards. The choice depends on risk tolerance and needs: retail banking suits conservative savers seeking security, while shadow banking appeals to investors looking for higher returns and flexible credit options.

Connection

Shadow banking and retail banking are interconnected through credit extension and financial services, where shadow banking provides alternative lending channels outside traditional regulatory frameworks. Retail banks often engage with shadow banking entities for liquidity management and risk distribution, impacting overall credit availability and financial stability. The interaction influences monetary policy transmission and creates systemic risk concerns in the global financial ecosystem.

Key Terms

**Retail Banking:**

Retail banking primarily serves individual consumers and small businesses through services such as savings and checking accounts, mortgages, personal loans, and credit cards, offering regulated financial products with consumer protection. This sector operates through physical branches, online platforms, and ATMs, ensuring accessibility and convenience while maintaining deposit insurance and compliance with banking regulations. Explore the differences from shadow banking to better understand the full financial ecosystem.

Deposits

Retail banking primarily relies on customer deposits as a stable source of funding for loan issuance and financial services, regulated by central banks to ensure deposit safety and liquidity. Shadow banking operates outside traditional regulatory frameworks, using short-term funding instruments like repurchase agreements and commercial paper instead of traditional deposits, increasing systemic risk due to a lack of deposit insurance. Explore how these distinctions impact financial stability and consumer protection.

Loans

Retail banking provides loans directly to consumers, including mortgages, personal loans, and auto financing, regulated by government agencies to ensure transparency and consumer protection. Shadow banking involves non-bank financial intermediaries offering credit outside traditional banking regulations, often through complex instruments like securitized loans, posing higher risks due to less oversight. Explore the key differences in loan structures and risk profiles between retail and shadow banking to better understand their impacts on the financial system.

Source and External Links

Retail banking - Wikipedia - Retail banking, also known as consumer or personal banking, provides banking services to individual customers rather than corporations, offering products like checking and savings accounts, mortgages, personal loans, debit and credit cards, and certificates of deposit.

The Role of Retail Banking in the U.S. Banking Industry - Retail banking focuses on consumer deposits (checking, savings, CDs) and loans (credit cards, mortgages, auto loans), which provide banks with stable funding and generate fee income, with checking accounts serving as a key product to retain and cross-sell to customers.

What Is Retail Banking? - The Forage - Retail banking caters to individuals and small businesses by offering financial products such as checking and savings accounts, debit and credit cards, mortgages, and personal loans, and retail bankers often provide personal financial assistance and community-based banking services.

dowidth.com

dowidth.com