Altcoin staking involves locking up cryptocurrencies like Ethereum or Cardano to support blockchain operations and earn rewards, often yielding higher but more volatile returns. Stablecoin farming focuses on lending or providing liquidity with assets like USDC or DAI, offering steady, lower-risk income through interest and rewards on decentralized finance platforms. Explore deeper insights into the benefits and risks of altcoin staking versus stablecoin farming to optimize your crypto investment strategy.

Why it is important

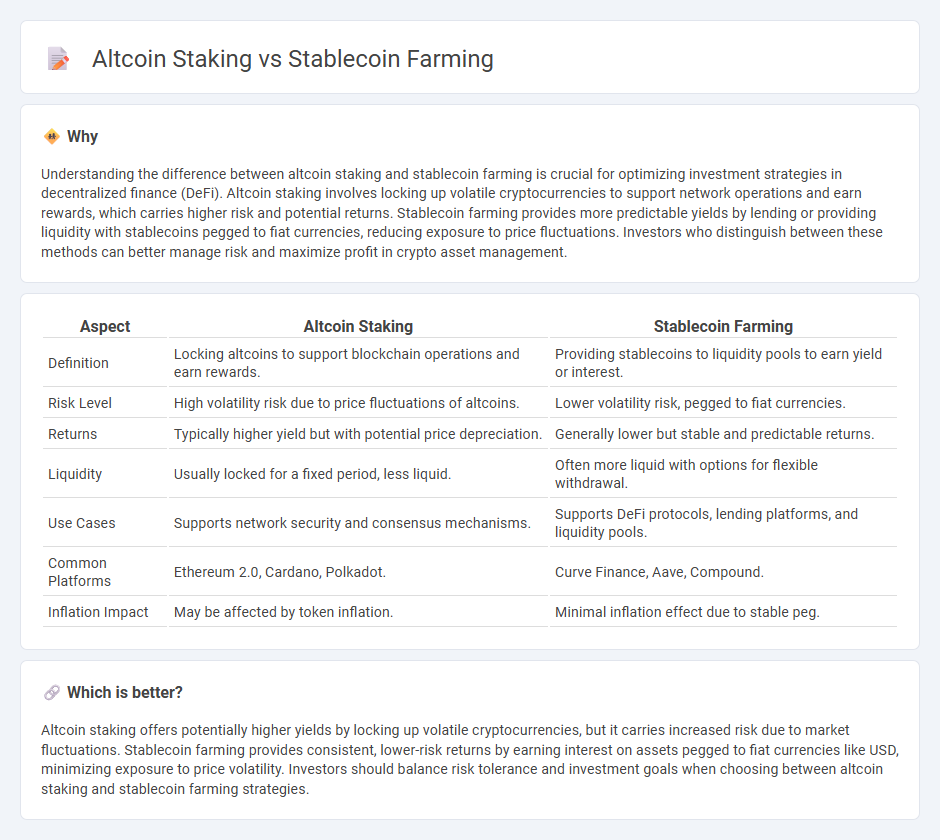

Understanding the difference between altcoin staking and stablecoin farming is crucial for optimizing investment strategies in decentralized finance (DeFi). Altcoin staking involves locking up volatile cryptocurrencies to support network operations and earn rewards, which carries higher risk and potential returns. Stablecoin farming provides more predictable yields by lending or providing liquidity with stablecoins pegged to fiat currencies, reducing exposure to price fluctuations. Investors who distinguish between these methods can better manage risk and maximize profit in crypto asset management.

Comparison Table

| Aspect | Altcoin Staking | Stablecoin Farming |

|---|---|---|

| Definition | Locking altcoins to support blockchain operations and earn rewards. | Providing stablecoins to liquidity pools to earn yield or interest. |

| Risk Level | High volatility risk due to price fluctuations of altcoins. | Lower volatility risk, pegged to fiat currencies. |

| Returns | Typically higher yield but with potential price depreciation. | Generally lower but stable and predictable returns. |

| Liquidity | Usually locked for a fixed period, less liquid. | Often more liquid with options for flexible withdrawal. |

| Use Cases | Supports network security and consensus mechanisms. | Supports DeFi protocols, lending platforms, and liquidity pools. |

| Common Platforms | Ethereum 2.0, Cardano, Polkadot. | Curve Finance, Aave, Compound. |

| Inflation Impact | May be affected by token inflation. | Minimal inflation effect due to stable peg. |

Which is better?

Altcoin staking offers potentially higher yields by locking up volatile cryptocurrencies, but it carries increased risk due to market fluctuations. Stablecoin farming provides consistent, lower-risk returns by earning interest on assets pegged to fiat currencies like USD, minimizing exposure to price volatility. Investors should balance risk tolerance and investment goals when choosing between altcoin staking and stablecoin farming strategies.

Connection

Altcoin staking involves locking up cryptocurrency tokens to support blockchain operations and earn rewards, which can provide liquidity that stablecoin farming utilizes for yield generation. Stablecoin farming leverages these liquidity pools, often funded by staked altcoins, to offer low-volatility returns through decentralized finance protocols. Both practices enhance capital efficiency by integrating staked assets into stablecoin liquidity mechanisms, driving DeFi growth.

Key Terms

Yield

Stablecoin farming offers consistent yields by providing liquidity to decentralized finance (DeFi) protocols with low volatility assets such as USDT or USDC. Altcoin staking typically yields higher returns but carries increased risk due to market price fluctuations and token-specific factors, making it suitable for investors seeking growth potential. Explore detailed comparisons to choose the optimal strategy for maximizing your yield in crypto investments.

Volatility

Stablecoin farming minimizes exposure to market volatility by providing consistent returns through interest or yield farming on stablecoins pegged to fiat currencies, ensuring capital preservation. Altcoin staking involves locking up tokens of volatile cryptocurrencies, which can offer higher rewards but with significant price fluctuation risk that impacts overall profitability. Discover the strategies behind stablecoin farming and altcoin staking to optimize your crypto portfolio against volatility.

Liquidity

Stablecoin farming offers consistent yields by providing liquidity in decentralized finance (DeFi) platforms, leveraging low volatility assets like USDC or DAI to minimize risk exposure. Altcoin staking involves locking up native tokens of blockchain networks to secure operations and earn rewards, but it carries higher volatility and potential liquidity constraints compared to stablecoins. Explore detailed insights on optimizing liquidity strategies between stablecoin farming and altcoin staking for better DeFi portfolio management.

Source and External Links

The Best 8 Stablecoin Yield Farming Strategies - Flagship.FYI - Covers eight stablecoin yield farming opportunities in DeFi, highlighting methods like Ethena USDe's synthetic dollar backed by stETH collateral and staking strategies that offer yields around 10%, along with risk considerations such as collateral value changes and funding rates.

Farming Stablecoin Yields on Beefy - Bankless - Discusses how stablecoin yield farming provides attractive APYs typically over 20% without impermanent loss risks, serving as a safer hedge against market downturns compared to more volatile crypto yield farming strategies.

Is stablecoin yield farming a good investment? - DeFi Community - Explains that stablecoin yield farming minimizes impermanent loss due to price stabilization by pegging to fiat, making it a reliable way to generate profits while reducing volatility risks common with other cryptocurrencies.

dowidth.com

dowidth.com