Risk parity portfolios balance risk exposure across diverse asset classes by allocating capital based on volatility rather than market capitalization, aiming for consistent returns with reduced drawdowns. Tactical asset allocation portfolios actively adjust asset weights in response to market conditions to exploit short-term opportunities and enhance returns. Explore the differences in strategy and risk management to determine which approach aligns with your investment goals.

Why it is important

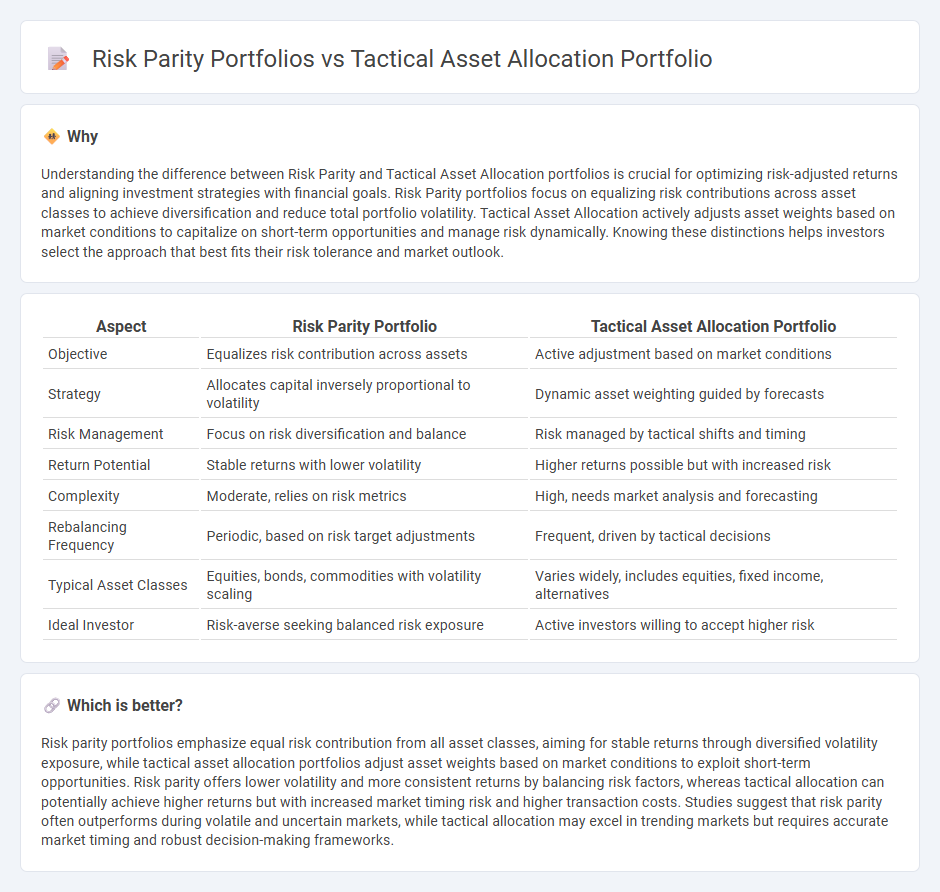

Understanding the difference between Risk Parity and Tactical Asset Allocation portfolios is crucial for optimizing risk-adjusted returns and aligning investment strategies with financial goals. Risk Parity portfolios focus on equalizing risk contributions across asset classes to achieve diversification and reduce total portfolio volatility. Tactical Asset Allocation actively adjusts asset weights based on market conditions to capitalize on short-term opportunities and manage risk dynamically. Knowing these distinctions helps investors select the approach that best fits their risk tolerance and market outlook.

Comparison Table

| Aspect | Risk Parity Portfolio | Tactical Asset Allocation Portfolio |

|---|---|---|

| Objective | Equalizes risk contribution across assets | Active adjustment based on market conditions |

| Strategy | Allocates capital inversely proportional to volatility | Dynamic asset weighting guided by forecasts |

| Risk Management | Focus on risk diversification and balance | Risk managed by tactical shifts and timing |

| Return Potential | Stable returns with lower volatility | Higher returns possible but with increased risk |

| Complexity | Moderate, relies on risk metrics | High, needs market analysis and forecasting |

| Rebalancing Frequency | Periodic, based on risk target adjustments | Frequent, driven by tactical decisions |

| Typical Asset Classes | Equities, bonds, commodities with volatility scaling | Varies widely, includes equities, fixed income, alternatives |

| Ideal Investor | Risk-averse seeking balanced risk exposure | Active investors willing to accept higher risk |

Which is better?

Risk parity portfolios emphasize equal risk contribution from all asset classes, aiming for stable returns through diversified volatility exposure, while tactical asset allocation portfolios adjust asset weights based on market conditions to exploit short-term opportunities. Risk parity offers lower volatility and more consistent returns by balancing risk factors, whereas tactical allocation can potentially achieve higher returns but with increased market timing risk and higher transaction costs. Studies suggest that risk parity often outperforms during volatile and uncertain markets, while tactical allocation may excel in trending markets but requires accurate market timing and robust decision-making frameworks.

Connection

Risk parity portfolios and tactical asset allocation portfolios both aim to optimize diversification and balance risk across asset classes, enhancing portfolio stability. Risk parity focuses on allocating capital based on risk contribution to equalize volatility, while tactical asset allocation adjusts weights dynamically in response to market conditions and economic forecasts. Integrating these strategies allows investors to achieve a risk-balanced baseline with flexibility for opportunistic adjustments, improving risk-adjusted returns.

Key Terms

Market Timing

Tactical asset allocation portfolios actively adjust asset weights based on market forecasts and economic indicators to capitalize on short-term opportunities, aiming to enhance returns through precise market timing. Risk parity portfolios allocate risk evenly across asset classes, emphasizing stability and diversification without relying heavily on market timing predictions. Explore deeper insights into how these strategies approach market timing to optimize portfolio performance.

Leverage

Tactical asset allocation portfolios strategically adjust asset weights based on market forecasts to exploit short-term opportunities, often using leverage to enhance returns and manage risk exposure. Risk parity portfolios emphasize equalizing risk contributions from all asset classes, frequently employing leverage to balance lower-volatility assets with higher-risk components for stable growth. Explore the benefits and trade-offs of leverage in these portfolio strategies to optimize your investment approach.

Risk Budgeting

Tactical asset allocation portfolios dynamically adjust weights to exploit market opportunities, emphasizing risk budgeting by allocating capital based on expected returns and risk forecasts. Risk parity portfolios balance asset classes by equalizing risk contributions, aiming to minimize volatility and enhance diversification across equities, bonds, and commodities. Discover how risk budgeting shapes these strategies and informs optimal portfolio construction.

Source and External Links

Tactical Asset Allocation (TAA) - Overview, Reasons, Example - Tactical asset allocation is an active portfolio strategy that adjusts asset class weights to capitalize on expected stronger performers and mitigate risks based on macroeconomic trends, aiming to enhance returns and reduce portfolio risk.

What is Tactical Asset Allocation? - SmartAsset - Tactical asset allocation involves actively shifting asset allocations in response to market conditions to optimize short-term returns, differing from strategic asset allocation's static targets by dynamically adapting to economic or market signals.

Tactical Asset Allocation - Wikipedia - TAA is a dynamic strategy that adjusts asset allocations either through discretionary judgement or systematic quantitative models to improve risk-adjusted returns by capitalizing on market or sector valuation shifts.

dowidth.com

dowidth.com