Bucket investing segments portfolios into cash, income, and growth buckets to match time horizons and risk tolerance, focusing on stable income and liquidity. Tactical asset allocation dynamically adjusts portfolio weights based on market conditions and economic forecasts, aiming to capitalize on short-term opportunities and enhance returns. Explore the differences in strategy performance and suitability for your financial goals.

Why it is important

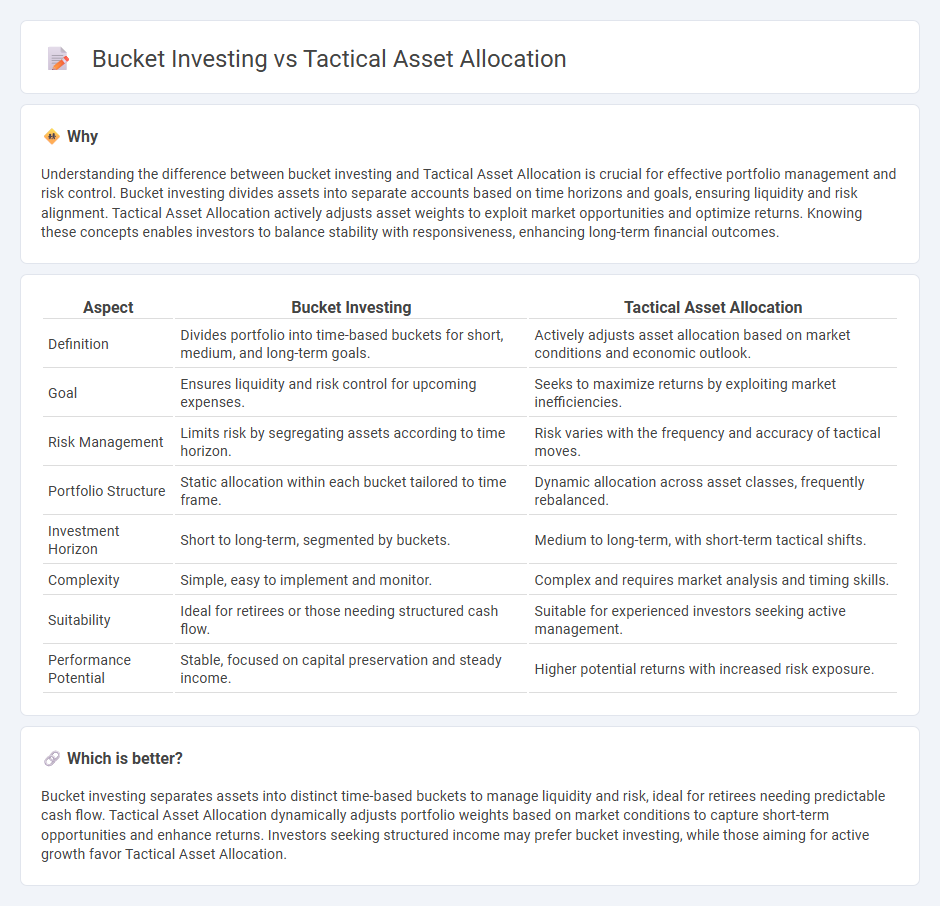

Understanding the difference between bucket investing and Tactical Asset Allocation is crucial for effective portfolio management and risk control. Bucket investing divides assets into separate accounts based on time horizons and goals, ensuring liquidity and risk alignment. Tactical Asset Allocation actively adjusts asset weights to exploit market opportunities and optimize returns. Knowing these concepts enables investors to balance stability with responsiveness, enhancing long-term financial outcomes.

Comparison Table

| Aspect | Bucket Investing | Tactical Asset Allocation |

|---|---|---|

| Definition | Divides portfolio into time-based buckets for short, medium, and long-term goals. | Actively adjusts asset allocation based on market conditions and economic outlook. |

| Goal | Ensures liquidity and risk control for upcoming expenses. | Seeks to maximize returns by exploiting market inefficiencies. |

| Risk Management | Limits risk by segregating assets according to time horizon. | Risk varies with the frequency and accuracy of tactical moves. |

| Portfolio Structure | Static allocation within each bucket tailored to time frame. | Dynamic allocation across asset classes, frequently rebalanced. |

| Investment Horizon | Short to long-term, segmented by buckets. | Medium to long-term, with short-term tactical shifts. |

| Complexity | Simple, easy to implement and monitor. | Complex and requires market analysis and timing skills. |

| Suitability | Ideal for retirees or those needing structured cash flow. | Suitable for experienced investors seeking active management. |

| Performance Potential | Stable, focused on capital preservation and steady income. | Higher potential returns with increased risk exposure. |

Which is better?

Bucket investing separates assets into distinct time-based buckets to manage liquidity and risk, ideal for retirees needing predictable cash flow. Tactical Asset Allocation dynamically adjusts portfolio weights based on market conditions to capture short-term opportunities and enhance returns. Investors seeking structured income may prefer bucket investing, while those aiming for active growth favor Tactical Asset Allocation.

Connection

Bucket investing complements Tactical Asset Allocation by structuring portfolios into distinct segments aligned with specific time horizons and risk profiles. Tactical Asset Allocation dynamically adjusts asset weights within these buckets to exploit short-term market opportunities while maintaining long-term investment goals. This integrated approach enhances portfolio diversification, risk management, and potential returns through systematic rebalancing and strategic market response.

Key Terms

Rebalancing

Tactical Asset Allocation (TAA) actively adjusts portfolio weights based on market forecasts, enhancing returns but requiring frequent rebalancing to capture short-term opportunities. Bucket investing segments assets by time horizon with a focus on liquidity and risk tolerance, resulting in less frequent rebalancing primarily driven by withdrawal needs rather than market signals. Explore more about how these distinct rebalancing strategies impact portfolio performance and investor goals.

Risk segmentation

Tactical Asset Allocation adjusts portfolio weights based on market forecasts to optimize risk-return balance, while bucket investing segments assets into different "buckets" aligned with time horizons and liquidity needs to manage risk. Tactical Asset Allocation offers dynamic risk control but requires active management and market insight, whereas bucket investing provides a structured, time-based risk segmentation fostering psychological comfort and spending discipline. Explore detailed strategies and risk profiles to determine the best approach for your financial goals.

Time horizon

Tactical asset allocation adjusts investment weights based on short- to medium-term market forecasts, aiming to optimize returns within flexible time horizons typically ranging from months to a few years. Bucket investing segments assets into distinct "buckets" aligned with specific time horizons, such as short-term income, medium-term growth, and long-term wealth preservation, enhancing liquidity and risk management per period. Explore further to understand how aligning these strategies with your investment time horizon can improve portfolio outcomes.

Source and External Links

Tactical Asset Allocation (TAA) - Tactical asset allocation is an active portfolio management strategy that shifts asset classes to capitalize on expected better performance and adjust to macroeconomic events, aiming to enhance returns and reduce risks by dynamically reallocating assets.

What is Tactical Asset Allocation? - Tactical asset allocation involves actively adjusting portfolio allocations based on market conditions to capture short-term opportunities, differing from strategic asset allocation by allowing flexible shifts responding to economic trends and market cycles.

Tactical asset allocation - Tactical asset allocation is a dynamic investment strategy that actively adjusts portfolio asset mix either discretionarily or systematically to improve risk-adjusted returns by exploiting market valuation or momentum anomalies across asset classes.

dowidth.com

dowidth.com