Shadow banking comprises financial intermediaries and activities operating outside traditional banking regulations, providing credit and liquidity without direct depositor funds. Off-balance sheet activities involve financial transactions or obligations not recorded on a company's balance sheet, often used to manage risk or improve financial metrics. Explore the nuanced differences and impacts of shadow banking and off-balance sheet activities on financial markets and regulatory frameworks.

Why it is important

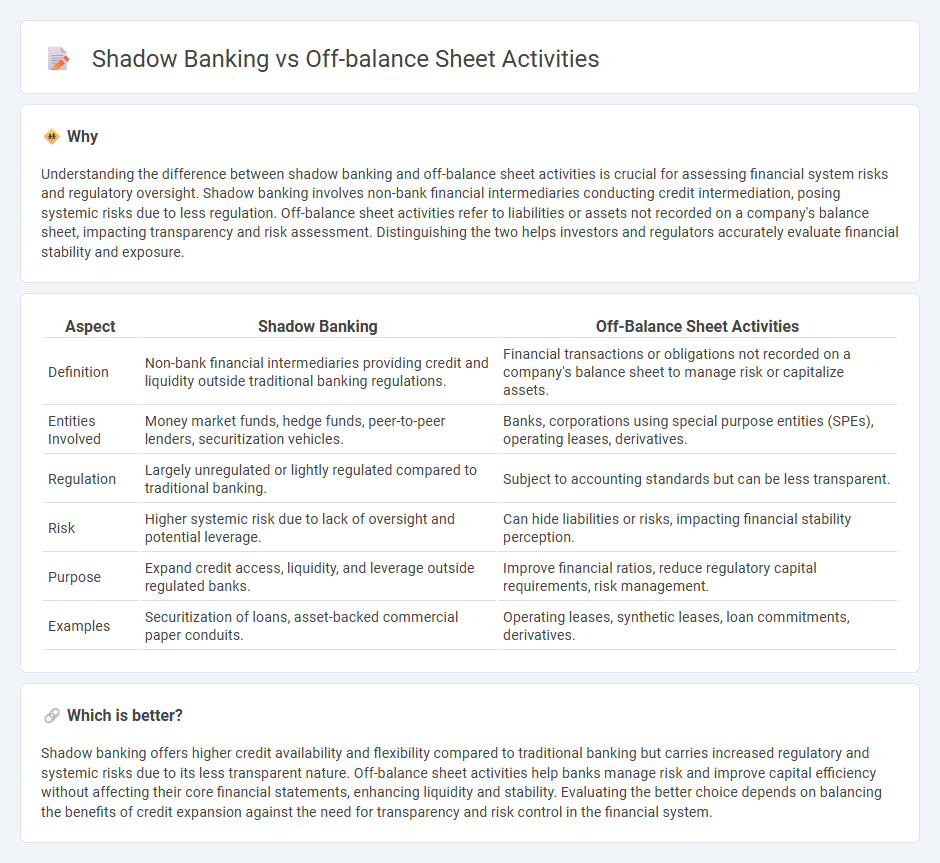

Understanding the difference between shadow banking and off-balance sheet activities is crucial for assessing financial system risks and regulatory oversight. Shadow banking involves non-bank financial intermediaries conducting credit intermediation, posing systemic risks due to less regulation. Off-balance sheet activities refer to liabilities or assets not recorded on a company's balance sheet, impacting transparency and risk assessment. Distinguishing the two helps investors and regulators accurately evaluate financial stability and exposure.

Comparison Table

| Aspect | Shadow Banking | Off-Balance Sheet Activities |

|---|---|---|

| Definition | Non-bank financial intermediaries providing credit and liquidity outside traditional banking regulations. | Financial transactions or obligations not recorded on a company's balance sheet to manage risk or capitalize assets. |

| Entities Involved | Money market funds, hedge funds, peer-to-peer lenders, securitization vehicles. | Banks, corporations using special purpose entities (SPEs), operating leases, derivatives. |

| Regulation | Largely unregulated or lightly regulated compared to traditional banking. | Subject to accounting standards but can be less transparent. |

| Risk | Higher systemic risk due to lack of oversight and potential leverage. | Can hide liabilities or risks, impacting financial stability perception. |

| Purpose | Expand credit access, liquidity, and leverage outside regulated banks. | Improve financial ratios, reduce regulatory capital requirements, risk management. |

| Examples | Securitization of loans, asset-backed commercial paper conduits. | Operating leases, synthetic leases, loan commitments, derivatives. |

Which is better?

Shadow banking offers higher credit availability and flexibility compared to traditional banking but carries increased regulatory and systemic risks due to its less transparent nature. Off-balance sheet activities help banks manage risk and improve capital efficiency without affecting their core financial statements, enhancing liquidity and stability. Evaluating the better choice depends on balancing the benefits of credit expansion against the need for transparency and risk control in the financial system.

Connection

Shadow banking involves financial intermediaries operating outside traditional banking regulations, often using off-balance sheet activities to manage risks and enhance returns. Off-balance sheet activities, such as securitization and special purpose vehicles (SPVs), enable shadow banks to move assets and liabilities off their balance sheets, reducing regulatory capital requirements and increasing leverage. This connection allows shadow banks to expand credit creation while circumventing regulatory scrutiny, contributing to systemic financial risks.

Key Terms

Off-Balance Sheet Activities:

Off-balance sheet activities involve financial transactions and obligations not recorded on a company's balance sheet, such as operating leases, joint ventures, and securitized assets, which help manage risk and regulatory capital requirements. These activities differ from shadow banking, which includes non-bank financial intermediaries engaging in credit intermediation outside traditional regulatory frameworks. Explore the distinctions and implications of off-balance sheet activities to understand their impact on financial transparency and risk management.

Securitization

Off-balance sheet activities involve financial transactions, such as securitization, that do not appear on a company's balance sheet, allowing risk transfer and regulatory capital relief. Shadow banking encompasses non-bank financial intermediaries, including securitization vehicles, which facilitate credit creation outside traditional banking regulations. Discover key insights into how securitization operates within these frameworks and its impact on financial markets.

Loan Commitments

Loan commitments in off-balance sheet activities represent contractual promises by banks to extend credit, which do not appear on the balance sheet until drawn upon, affecting risk exposure and capital requirements. Shadow banking involves non-bank financial intermediaries engaging in loan-like activities, often through loan commitments, that operate outside traditional regulatory frameworks, potentially increasing systemic risk. Explore deeper insights into how these loan commitments reshape financial risk and regulatory challenges.

Source and External Links

Off-Balance Sheet Activity - NCSU Financial Mathematics - Off-balance sheet activities are financial arrangements--such as derivatives, loan commitments, or contingent exposures--that are not recorded on a company's balance sheet but may still pose potential risks.

Section 3.8 Off-Balance Sheet Activities - FDIC - These activities include items like loan commitments, letters of credit, and revolving underwriting facilities, which institutions must report in line with regulatory requirements but do not appear as assets or liabilities on the balance sheet.

Off-Balance-Sheet Activities Section 3300.1 - Federal Reserve Board - Off-balance-sheet items encompass a diverse range of instruments and services--such as standby letters of credit, derivatives, and advisory services--that generate fee income and involve risks not directly reflected in traditional financial statements.

dowidth.com

dowidth.com