Altcoin staking involves locking specific cryptocurrencies within a network to earn rewards, enhancing liquidity and supporting blockchain security. Cross-chain bridging facilitates the transfer of assets across different blockchain networks, enabling interoperability and increasing decentralized finance flexibility. Explore the advantages and risks of staking versus bridging to optimize your crypto investment strategy.

Why it is important

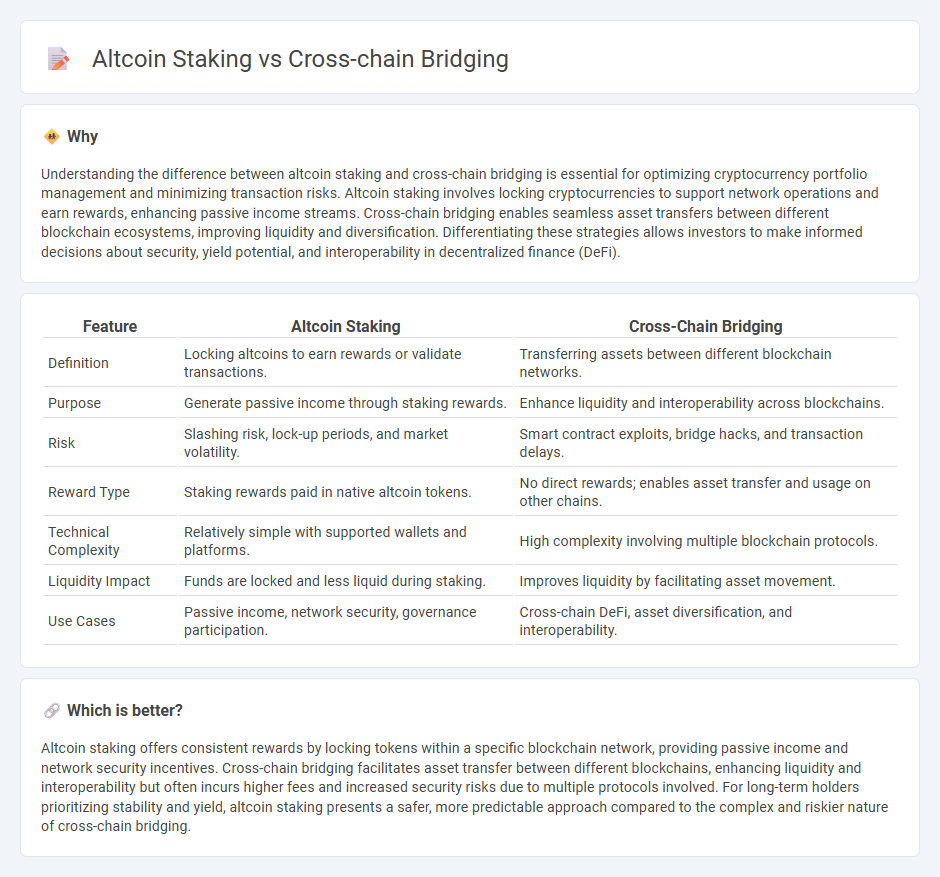

Understanding the difference between altcoin staking and cross-chain bridging is essential for optimizing cryptocurrency portfolio management and minimizing transaction risks. Altcoin staking involves locking cryptocurrencies to support network operations and earn rewards, enhancing passive income streams. Cross-chain bridging enables seamless asset transfers between different blockchain ecosystems, improving liquidity and diversification. Differentiating these strategies allows investors to make informed decisions about security, yield potential, and interoperability in decentralized finance (DeFi).

Comparison Table

| Feature | Altcoin Staking | Cross-Chain Bridging |

|---|---|---|

| Definition | Locking altcoins to earn rewards or validate transactions. | Transferring assets between different blockchain networks. |

| Purpose | Generate passive income through staking rewards. | Enhance liquidity and interoperability across blockchains. |

| Risk | Slashing risk, lock-up periods, and market volatility. | Smart contract exploits, bridge hacks, and transaction delays. |

| Reward Type | Staking rewards paid in native altcoin tokens. | No direct rewards; enables asset transfer and usage on other chains. |

| Technical Complexity | Relatively simple with supported wallets and platforms. | High complexity involving multiple blockchain protocols. |

| Liquidity Impact | Funds are locked and less liquid during staking. | Improves liquidity by facilitating asset movement. |

| Use Cases | Passive income, network security, governance participation. | Cross-chain DeFi, asset diversification, and interoperability. |

Which is better?

Altcoin staking offers consistent rewards by locking tokens within a specific blockchain network, providing passive income and network security incentives. Cross-chain bridging facilitates asset transfer between different blockchains, enhancing liquidity and interoperability but often incurs higher fees and increased security risks due to multiple protocols involved. For long-term holders prioritizing stability and yield, altcoin staking presents a safer, more predictable approach compared to the complex and riskier nature of cross-chain bridging.

Connection

Altcoin staking enhances blockchain network security by locking tokens to validate transactions, while cross-chain bridging enables asset transfers between different blockchains, increasing liquidity and interoperability. Staking rewards often rely on the seamless movement of tokens across chains facilitated by bridges, allowing users to maximize yield opportunities in decentralized finance (DeFi). Integrating cross-chain bridging with altcoin staking protocols drives wider adoption and flexibility in the crypto ecosystem, optimizing capital efficiency.

Key Terms

Interoperability

Cross-chain bridging enhances interoperability by enabling seamless asset transfers across distinct blockchain networks, facilitating diversified portfolio management and liquidity access. Altcoin staking supports network security and consensus within specific blockchain ecosystems but often lacks cross-chain asset fluidity. Explore the comparative benefits of interoperability in cross-chain bridging versus altcoin staking for optimized blockchain engagement.

Yield

Cross-chain bridging enables users to transfer assets seamlessly between different blockchain networks, increasing opportunities for yield generation through diversified liquidity pools. Altcoin staking offers passive income by locking tokens in a blockchain network to support its operations, often providing attractive annual percentage yields (APYs) depending on the token's demand and network incentives. Explore detailed comparisons of cross-chain bridging yields and altcoin staking benefits to optimize your crypto portfolio returns.

Smart Contracts

Cross-chain bridging leverages smart contracts to enable seamless asset transfers between different blockchain networks, enhancing interoperability and liquidity. Altcoin staking uses smart contracts to lock tokens securely, providing network security and earning rewards. Discover how smart contracts power these innovations and transform decentralized finance.

Source and External Links

Introduction to Cross-Chain Bridges - Chainalysis - Cross-chain bridges enable secure sharing of data and assets across different blockchains, enhancing interoperability, expanding DeFi opportunities, enabling multi-chain decentralized applications, and providing users with greater flexibility to use the best blockchain features for their needs.

What Is A Cross Chain Bridge? | Chainlink - Cross-chain bridges are decentralized applications that transfer assets between blockchains using mechanisms such as lock-and-mint, burn-and-mint, or lock-and-unlock, and can include programmable token bridges that execute smart contract functions on the destination chain.

7 Best Cross-Chain Bridges Powering Interoperability in DeFi - Crypto bridges facilitate interoperability by enabling transfer of assets, smart contracts, and information between different blockchains, creating wrapped tokens for cross-chain swaps and empowering DeFi users and developers to leverage features across multiple blockchain ecosystems.

dowidth.com

dowidth.com