Tokenized treasuries represent government debt digitally, offering transparent ownership and streamlined trading on blockchain platforms. Asset-backed tokens, however, are digital representations of tangible assets like real estate or commodities, providing investors with fractional ownership and liquidity. Explore the differences and benefits of these innovative financial instruments to enhance your investment strategy.

Why it is important

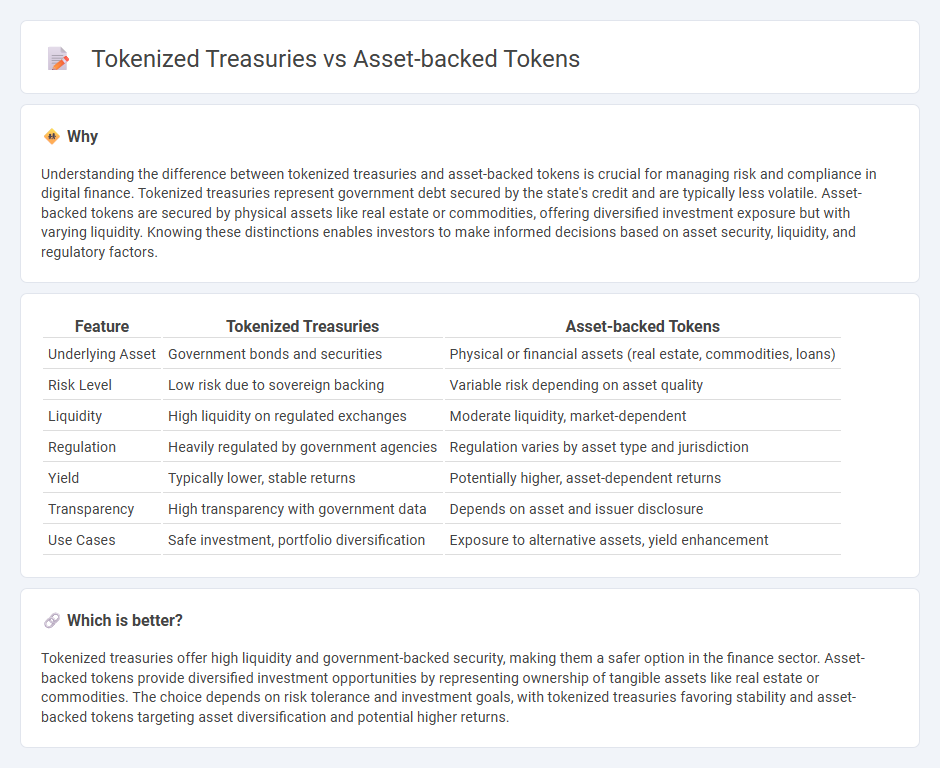

Understanding the difference between tokenized treasuries and asset-backed tokens is crucial for managing risk and compliance in digital finance. Tokenized treasuries represent government debt secured by the state's credit and are typically less volatile. Asset-backed tokens are secured by physical assets like real estate or commodities, offering diversified investment exposure but with varying liquidity. Knowing these distinctions enables investors to make informed decisions based on asset security, liquidity, and regulatory factors.

Comparison Table

| Feature | Tokenized Treasuries | Asset-backed Tokens |

|---|---|---|

| Underlying Asset | Government bonds and securities | Physical or financial assets (real estate, commodities, loans) |

| Risk Level | Low risk due to sovereign backing | Variable risk depending on asset quality |

| Liquidity | High liquidity on regulated exchanges | Moderate liquidity, market-dependent |

| Regulation | Heavily regulated by government agencies | Regulation varies by asset type and jurisdiction |

| Yield | Typically lower, stable returns | Potentially higher, asset-dependent returns |

| Transparency | High transparency with government data | Depends on asset and issuer disclosure |

| Use Cases | Safe investment, portfolio diversification | Exposure to alternative assets, yield enhancement |

Which is better?

Tokenized treasuries offer high liquidity and government-backed security, making them a safer option in the finance sector. Asset-backed tokens provide diversified investment opportunities by representing ownership of tangible assets like real estate or commodities. The choice depends on risk tolerance and investment goals, with tokenized treasuries favoring stability and asset-backed tokens targeting asset diversification and potential higher returns.

Connection

Tokenized treasuries represent fractional ownership of government debt securities on a blockchain, enabling enhanced liquidity and transparency. Asset-backed tokens derive their value from underlying financial assets, including tokenized treasuries, ensuring stability and investor confidence. This connection fosters efficient trading, reduced settlement times, and expanded access to traditional financial markets through decentralized platforms.

Key Terms

Collateralization

Asset-backed tokens derive their value directly from specific tangible assets such as real estate, commodities, or receivables, ensuring a clear link between the token and the underlying collateral. Tokenized treasuries represent digital claims on government securities, backed by sovereign debt and offering a different risk profile based on the issuing government's creditworthiness. Explore further to understand how collateralization impacts liquidity, security, and market adoption in these innovative digital financial instruments.

Liquidity

Asset-backed tokens provide enhanced liquidity by representing tangible assets such as real estate or commodities, enabling fractional ownership and faster transfers through blockchain technology. Tokenized treasuries, backed by government securities, offer highly liquid and low-risk investment options with streamlined settlement processes on digital platforms. Discover more about how these tokenization methods revolutionize liquidity management in modern finance.

Yield

Asset-backed tokens represent digital assets secured by tangible items like real estate or commodities, offering yield through asset appreciation and income generation. Tokenized treasuries, on the other hand, provide yield primarily through interest payments backed by government securities, ensuring lower risk and stable returns. Explore the nuances between these yield sources to enhance your investment strategy.

Source and External Links

Asset-Backed Tokens: Characteristics, Hierarchy, How They Work, Functionality and Use Cases - Asset-backed tokens are cryptocurrencies backed by physical or digital assets, representing fractional ownership on blockchain platforms and ensuring value stability through collateralization and redemption mechanisms.

Asset-Backed Tokens Definition - Asset-backed tokens are digital claims on real-world assets like gold, real estate, or commodities, allowing token holders to benefit from asset appreciation and providing a more stable cryptocurrency option.

What is an Asset Backed Token (ABT) - ABTs are cryptographic assets pegged to underlying reserves such as real estate or precious metals, often subject to regulatory compliance and designed to maintain stable value similar to stablecoins.

dowidth.com

dowidth.com