Buy now pay later (BNPL) integration offers consumers flexible, short-term financing directly at the point of sale, often with interest-free periods, enhancing purchasing power and boosting sales conversion rates. Installment loan integration provides longer-term repayment options with fixed interest rates, appealing to borrowers seeking predictable budgeting and larger loan amounts. Explore the key differences and benefits of BNPL versus installment loans to determine the best financial solution for your business or personal needs.

Why it is important

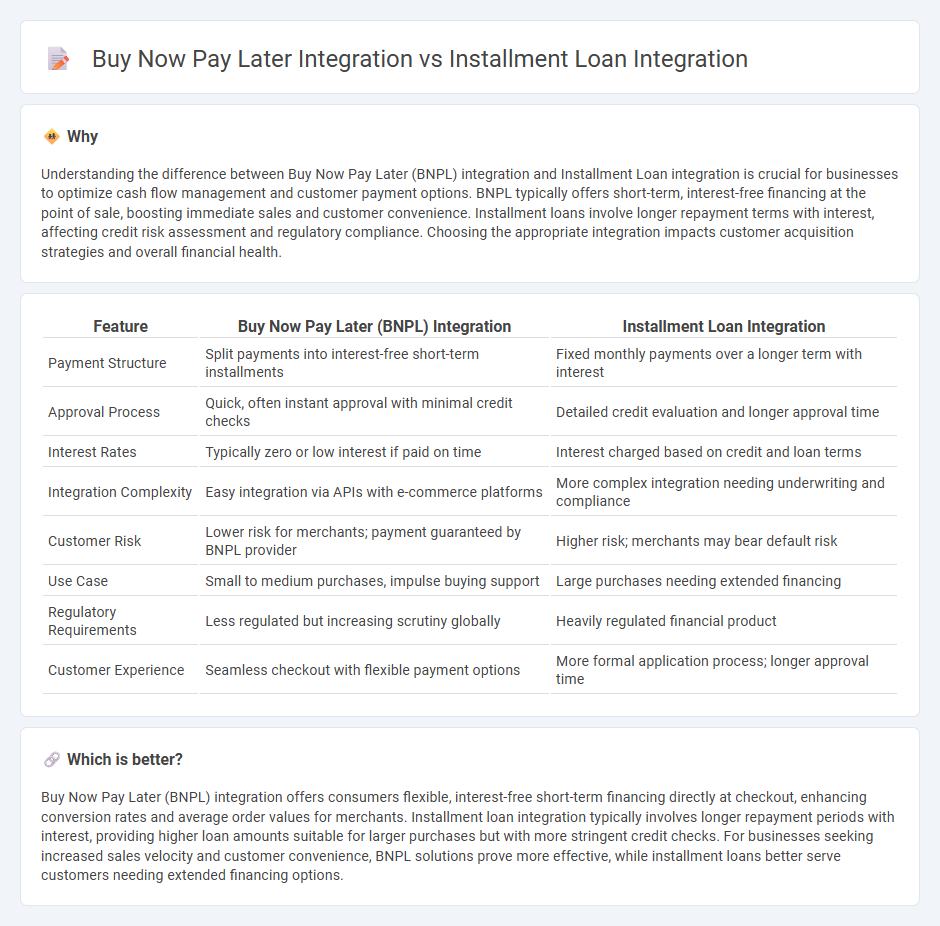

Understanding the difference between Buy Now Pay Later (BNPL) integration and Installment Loan integration is crucial for businesses to optimize cash flow management and customer payment options. BNPL typically offers short-term, interest-free financing at the point of sale, boosting immediate sales and customer convenience. Installment loans involve longer repayment terms with interest, affecting credit risk assessment and regulatory compliance. Choosing the appropriate integration impacts customer acquisition strategies and overall financial health.

Comparison Table

| Feature | Buy Now Pay Later (BNPL) Integration | Installment Loan Integration |

|---|---|---|

| Payment Structure | Split payments into interest-free short-term installments | Fixed monthly payments over a longer term with interest |

| Approval Process | Quick, often instant approval with minimal credit checks | Detailed credit evaluation and longer approval time |

| Interest Rates | Typically zero or low interest if paid on time | Interest charged based on credit and loan terms |

| Integration Complexity | Easy integration via APIs with e-commerce platforms | More complex integration needing underwriting and compliance |

| Customer Risk | Lower risk for merchants; payment guaranteed by BNPL provider | Higher risk; merchants may bear default risk |

| Use Case | Small to medium purchases, impulse buying support | Large purchases needing extended financing |

| Regulatory Requirements | Less regulated but increasing scrutiny globally | Heavily regulated financial product |

| Customer Experience | Seamless checkout with flexible payment options | More formal application process; longer approval time |

Which is better?

Buy Now Pay Later (BNPL) integration offers consumers flexible, interest-free short-term financing directly at checkout, enhancing conversion rates and average order values for merchants. Installment loan integration typically involves longer repayment periods with interest, providing higher loan amounts suitable for larger purchases but with more stringent credit checks. For businesses seeking increased sales velocity and customer convenience, BNPL solutions prove more effective, while installment loans better serve customers needing extended financing options.

Connection

Buy Now Pay Later (BNPL) integration and installment loan integration are connected through their shared goal of providing flexible payment options to consumers, enhancing purchasing power and boosting sales for merchants. Both financing solutions leverage real-time credit assessments and seamless API connectivity to streamline approval processes and improve user experience. Implementing these integrations allows financial institutions and retailers to diversify credit offerings, manage risk effectively, and increase customer retention.

Key Terms

Credit Assessment

Installment loan integration relies on comprehensive credit assessment techniques, including detailed credit scoring, income verification, and debt-to-income ratio analysis to ensure borrower creditworthiness over extended repayment periods. Buy Now Pay Later (BNPL) integration typically employs streamlined or real-time risk evaluation, often based on alternative data and limited credit checks, aiming for quick approval and minimal friction at the point of sale. Explore detailed credit assessment methods and their impact on lending integration to optimize customer experience and risk management.

Repayment Schedule

Installment loan integration offers a structured repayment schedule with fixed monthly payments over a set term, providing clarity and predictability for borrowers. Buy Now Pay Later (BNPL) integration typically features shorter repayment periods with multiple smaller, interest-free installments, aimed at enhancing purchase flexibility. Explore the differences in repayment schedules to determine which financing option best suits your business needs.

Interest Rate Structure

Installment loan integration typically features fixed or variable interest rates spread over a defined repayment period, allowing borrowers to manage predictable monthly payments. Buy now pay later integration often offers interest-free periods followed by higher rates if balances are not settled on time, influencing consumer behavior and merchant transaction costs. Explore the detailed implications of interest rate structures on your payment strategy to optimize customer experience and financial outcomes.

Source and External Links

Installment Lending | Installment Loan Management Software - Infinity Software offers customizable and automated installment loan management software with features like one-click underwriting, digital signing, and digital borrower experience across devices to streamline lending operations and payment schedules.

Installment Loan Software: API-First Lending Platform - LoanPro provides an API-first platform enabling the configuration, deployment, and servicing of diverse installment loan programs with flexible payment schedules, automated communication, and comprehensive loan recasting tools tailored to different borrower types.

Installment Loan Servicing Software - TIMVERO delivers a loan servicing platform with seamless integration for digital and brick-and-mortar lenders, focusing on advanced risk assessment, real-time monitoring, personalized repayment plans, compliance, and digital onboarding automation to enhance installment loan operations.

dowidth.com

dowidth.com