Regenerative finance focuses on restoring and enhancing natural ecosystems through investments that promote sustainability and long-term environmental health. Ethical finance prioritizes social and moral values, ensuring that financial decisions support human rights, fairness, and transparency. Explore the key distinctions between regenerative and ethical finance to understand their unique impacts on the future of responsible investing.

Why it is important

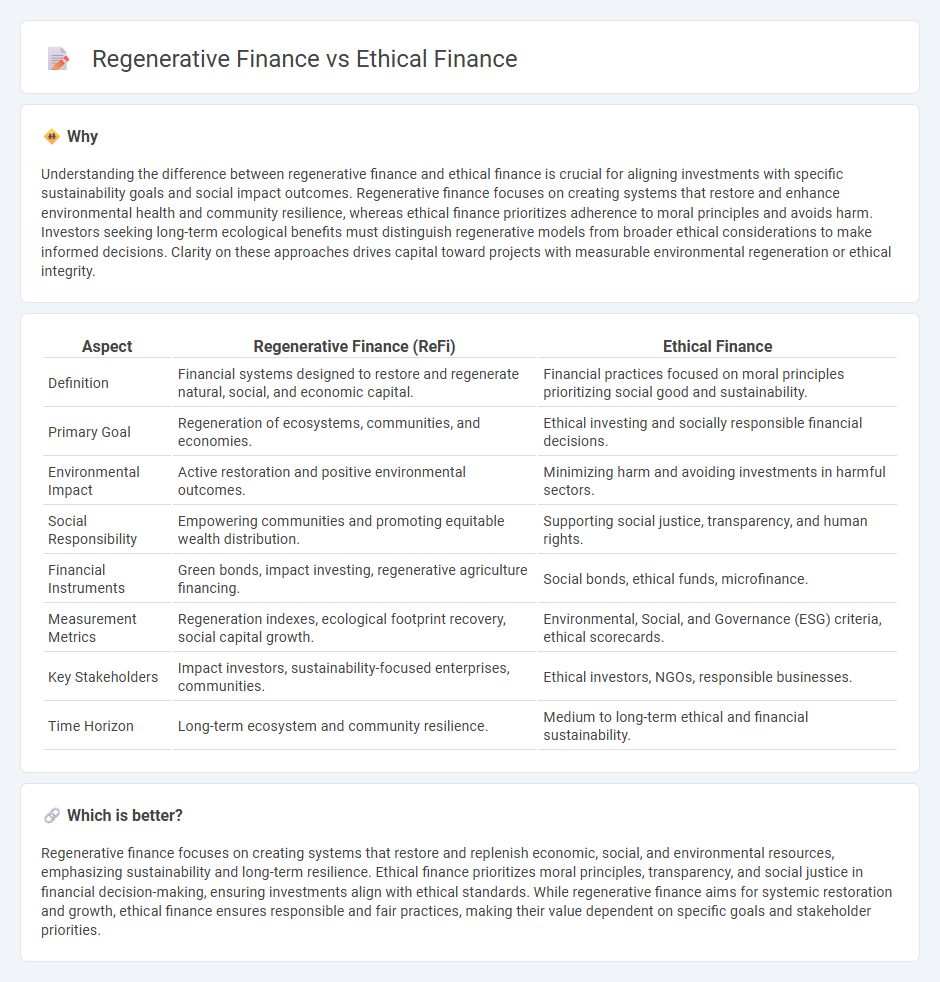

Understanding the difference between regenerative finance and ethical finance is crucial for aligning investments with specific sustainability goals and social impact outcomes. Regenerative finance focuses on creating systems that restore and enhance environmental health and community resilience, whereas ethical finance prioritizes adherence to moral principles and avoids harm. Investors seeking long-term ecological benefits must distinguish regenerative models from broader ethical considerations to make informed decisions. Clarity on these approaches drives capital toward projects with measurable environmental regeneration or ethical integrity.

Comparison Table

| Aspect | Regenerative Finance (ReFi) | Ethical Finance |

|---|---|---|

| Definition | Financial systems designed to restore and regenerate natural, social, and economic capital. | Financial practices focused on moral principles prioritizing social good and sustainability. |

| Primary Goal | Regeneration of ecosystems, communities, and economies. | Ethical investing and socially responsible financial decisions. |

| Environmental Impact | Active restoration and positive environmental outcomes. | Minimizing harm and avoiding investments in harmful sectors. |

| Social Responsibility | Empowering communities and promoting equitable wealth distribution. | Supporting social justice, transparency, and human rights. |

| Financial Instruments | Green bonds, impact investing, regenerative agriculture financing. | Social bonds, ethical funds, microfinance. |

| Measurement Metrics | Regeneration indexes, ecological footprint recovery, social capital growth. | Environmental, Social, and Governance (ESG) criteria, ethical scorecards. |

| Key Stakeholders | Impact investors, sustainability-focused enterprises, communities. | Ethical investors, NGOs, responsible businesses. |

| Time Horizon | Long-term ecosystem and community resilience. | Medium to long-term ethical and financial sustainability. |

Which is better?

Regenerative finance focuses on creating systems that restore and replenish economic, social, and environmental resources, emphasizing sustainability and long-term resilience. Ethical finance prioritizes moral principles, transparency, and social justice in financial decision-making, ensuring investments align with ethical standards. While regenerative finance aims for systemic restoration and growth, ethical finance ensures responsible and fair practices, making their value dependent on specific goals and stakeholder priorities.

Connection

Regenerative finance and ethical finance intersect through their shared commitment to sustainability and social impact, prioritizing investments that foster environmental restoration and community well-being. Both approaches emphasize transparency, responsible resource allocation, and long-term value creation over short-term profits. By integrating principles of ecological health and social justice, they redefine traditional financial models to support a more equitable and resilient economy.

Key Terms

Social Responsibility

Ethical finance emphasizes transparent investment practices that prioritize social responsibility, ensuring capital supports fair labor, human rights, and community well-being. Regenerative finance goes beyond by actively restoring social and ecological systems, fostering long-term resilience and equitable resource distribution. Discover how these financial models transform social impact by exploring their core principles and applications.

Sustainability

Ethical finance prioritizes responsible investment by avoiding harm and promoting social justice, while regenerative finance actively restores ecosystems and fosters long-term environmental health through innovative financial mechanisms. Both approaches emphasize sustainability but differ in impact scope: ethical finance mitigates negative effects, whereas regenerative finance creates positive ecological outcomes. Explore how these financial models can transform your sustainable investment strategy.

Impact Investing

Ethical finance prioritizes responsible investment practices by avoiding harm and promoting social and environmental good, while regenerative finance actively seeks to restore and enhance ecosystems and communities through positive impact. Impact investing bridges both approaches by channeling capital into projects that generate measurable social or environmental benefits alongside financial returns. Discover how impact investing integrates ethical principles and regenerative goals to reshape the future of finance.

Source and External Links

Ethical Finance vs. Traditional Finance: Unravelling the ... - Ethical finance prioritizes transparency, responsibility, and sustainability by investing in social and environmental good, contrasting with traditional finance that mainly focuses on profit maximization.

Ethical Finance - FEBEA - European Federation of Ethical and ... - Ethical finance directs money toward social economy projects that promote social inclusion, sustainable development, and economic solidarity, aiming to benefit communities and excluded groups from traditional banking.

Supporting a sustainable society through ethical finance - Ethical finance balances financial returns with social and environmental impact goals like financial inclusion, poverty reduction, and sustainability, with ethical banks often outperforming conventional ones financially.

dowidth.com

dowidth.com