ESG integration involves incorporating environmental, social, and governance criteria into investment decisions to enhance long-term financial performance and risk management. Green bonds are fixed-income securities specifically earmarked to fund projects with positive environmental benefits, such as renewable energy or sustainable infrastructure. Explore how ESG integration contrasts with green bonds to optimize sustainable investment strategies.

Why it is important

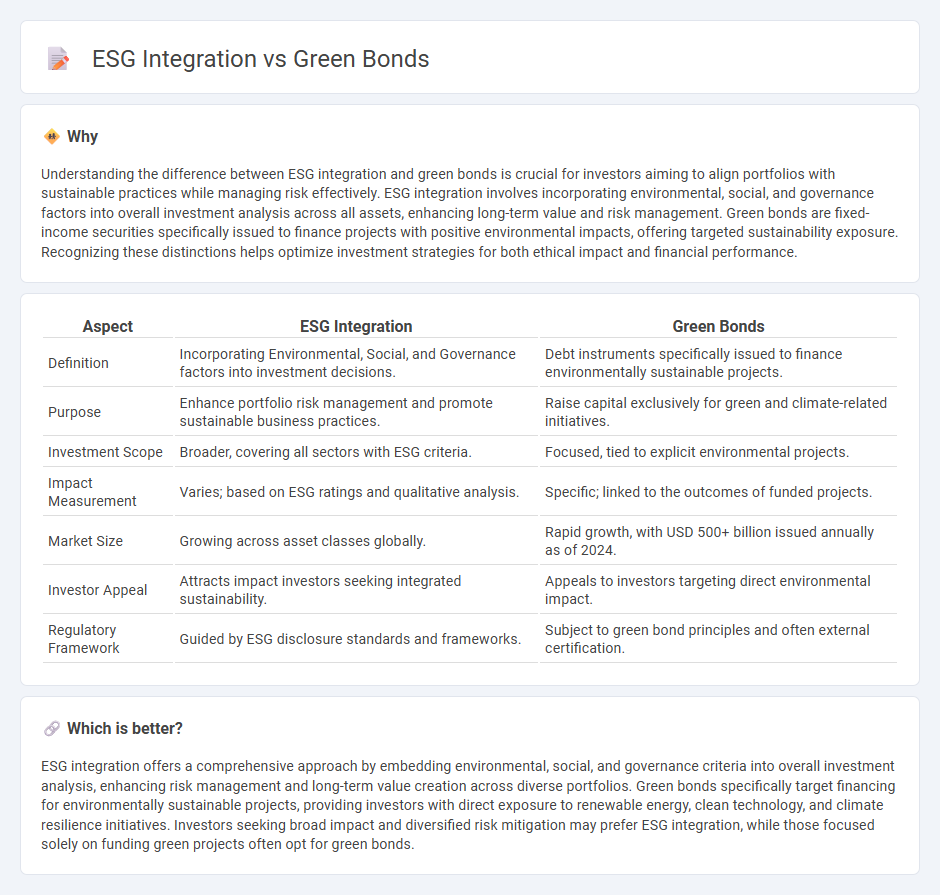

Understanding the difference between ESG integration and green bonds is crucial for investors aiming to align portfolios with sustainable practices while managing risk effectively. ESG integration involves incorporating environmental, social, and governance factors into overall investment analysis across all assets, enhancing long-term value and risk management. Green bonds are fixed-income securities specifically issued to finance projects with positive environmental impacts, offering targeted sustainability exposure. Recognizing these distinctions helps optimize investment strategies for both ethical impact and financial performance.

Comparison Table

| Aspect | ESG Integration | Green Bonds |

|---|---|---|

| Definition | Incorporating Environmental, Social, and Governance factors into investment decisions. | Debt instruments specifically issued to finance environmentally sustainable projects. |

| Purpose | Enhance portfolio risk management and promote sustainable business practices. | Raise capital exclusively for green and climate-related initiatives. |

| Investment Scope | Broader, covering all sectors with ESG criteria. | Focused, tied to explicit environmental projects. |

| Impact Measurement | Varies; based on ESG ratings and qualitative analysis. | Specific; linked to the outcomes of funded projects. |

| Market Size | Growing across asset classes globally. | Rapid growth, with USD 500+ billion issued annually as of 2024. |

| Investor Appeal | Attracts impact investors seeking integrated sustainability. | Appeals to investors targeting direct environmental impact. |

| Regulatory Framework | Guided by ESG disclosure standards and frameworks. | Subject to green bond principles and often external certification. |

Which is better?

ESG integration offers a comprehensive approach by embedding environmental, social, and governance criteria into overall investment analysis, enhancing risk management and long-term value creation across diverse portfolios. Green bonds specifically target financing for environmentally sustainable projects, providing investors with direct exposure to renewable energy, clean technology, and climate resilience initiatives. Investors seeking broad impact and diversified risk mitigation may prefer ESG integration, while those focused solely on funding green projects often opt for green bonds.

Connection

ESG integration in finance involves assessing environmental, social, and governance factors to identify sustainable investment opportunities, directly supporting the issuance and growth of Green Bonds. Green Bonds specifically finance projects with positive environmental impacts, aligning investor portfolios with ESG criteria while driving capital towards renewable energy, clean transportation, and climate resilience initiatives. The synergy between ESG integration and Green Bonds enhances risk management and promotes long-term value creation in sustainable finance markets.

Key Terms

Sustainable Finance

Green bonds are debt instruments specifically earmarked to finance environmentally sustainable projects, playing a crucial role in sustainable finance by directing capital towards green initiatives such as renewable energy and climate resilience. ESG integration involves incorporating environmental, social, and governance criteria into investment analysis and decision-making processes to achieve long-term value and risk mitigation. Explore more to understand how these approaches shape the future of responsible investing.

Impact Measurement

Green Bonds specifically finance projects with environmental benefits, such as renewable energy or pollution reduction, providing clear, measurable impact through allocated funds. ESG integration evaluates a company's entire environmental, social, and governance practices, focusing on overall sustainability performance and risk management rather than specific project outcomes. Explore how impact measurement varies between these approaches to enhance sustainable investment strategies.

Risk Assessment

Green bonds specifically finance environmentally sustainable projects, allowing investors to target climate-related risk mitigation directly. ESG integration incorporates environmental, social, and governance factors into broader risk assessment frameworks to identify material risks across entire portfolios. Explore how combining these strategies can enhance your risk management approach.

Source and External Links

Green bond - Wikipedia - A green bond is a fixed-income financial instrument used specifically to fund projects with positive environmental benefits such as renewable energy, energy efficiency, and pollution control, enabling investors to meet ESG goals by financing climate-related projects.

What are Green Bonds and what projects do they finance? - Iberdrola - Green bonds are debt instruments issued by public or private entities committed to funding sustainable and socially responsible environmental projects like renewable energy and clean transportation, aiming to support Sustainable Development Goals, especially affordable energy and climate action.

Green Bond Principles (GBP) - ICMA - The Green Bond Principles provide voluntary guidelines promoting transparency, disclosure, and integrity in issuing green bonds, supporting financing of environmentally sustainable projects that advance a net-zero emissions economy, with emphasis on clear reporting and tracking of proceeds.

dowidth.com

dowidth.com