Laddered bond ETFs provide a diversified portfolio with staggered maturities, reducing interest rate risk and ensuring steady income over time. High-yield bond ETFs offer higher returns by investing in lower-rated corporate bonds but come with increased credit risk and price volatility. Explore the key differences and find the best fit for your investment strategy.

Why it is important

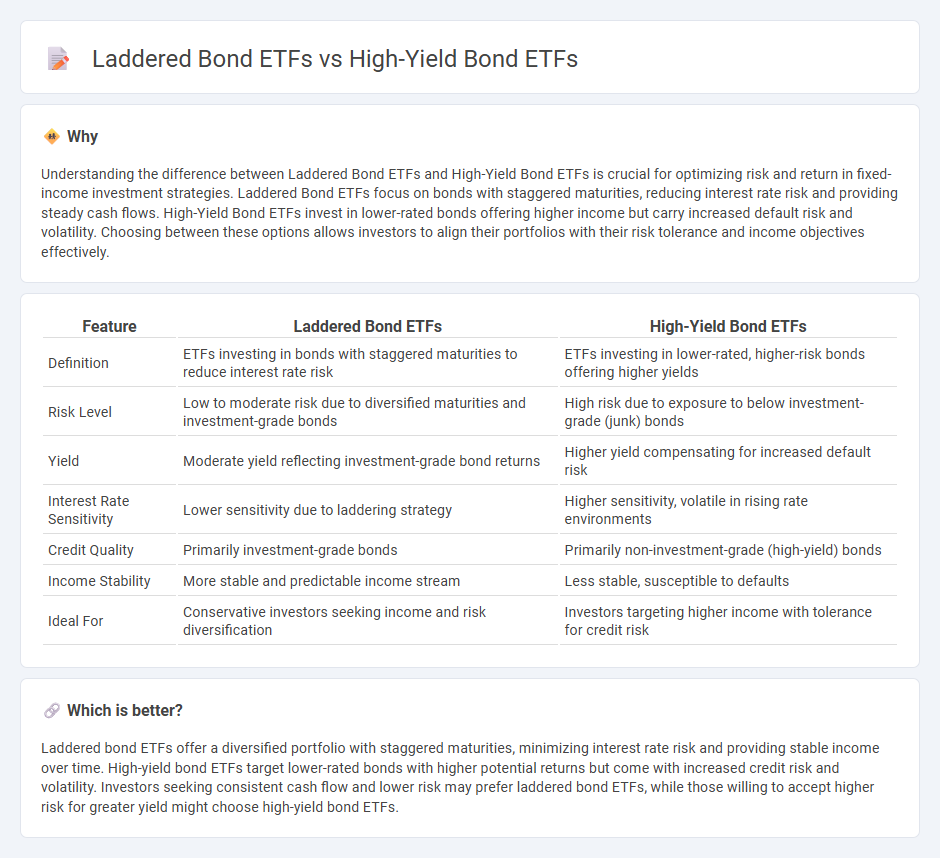

Understanding the difference between Laddered Bond ETFs and High-Yield Bond ETFs is crucial for optimizing risk and return in fixed-income investment strategies. Laddered Bond ETFs focus on bonds with staggered maturities, reducing interest rate risk and providing steady cash flows. High-Yield Bond ETFs invest in lower-rated bonds offering higher income but carry increased default risk and volatility. Choosing between these options allows investors to align their portfolios with their risk tolerance and income objectives effectively.

Comparison Table

| Feature | Laddered Bond ETFs | High-Yield Bond ETFs |

|---|---|---|

| Definition | ETFs investing in bonds with staggered maturities to reduce interest rate risk | ETFs investing in lower-rated, higher-risk bonds offering higher yields |

| Risk Level | Low to moderate risk due to diversified maturities and investment-grade bonds | High risk due to exposure to below investment-grade (junk) bonds |

| Yield | Moderate yield reflecting investment-grade bond returns | Higher yield compensating for increased default risk |

| Interest Rate Sensitivity | Lower sensitivity due to laddering strategy | Higher sensitivity, volatile in rising rate environments |

| Credit Quality | Primarily investment-grade bonds | Primarily non-investment-grade (high-yield) bonds |

| Income Stability | More stable and predictable income stream | Less stable, susceptible to defaults |

| Ideal For | Conservative investors seeking income and risk diversification | Investors targeting higher income with tolerance for credit risk |

Which is better?

Laddered bond ETFs offer a diversified portfolio with staggered maturities, minimizing interest rate risk and providing stable income over time. High-yield bond ETFs target lower-rated bonds with higher potential returns but come with increased credit risk and volatility. Investors seeking consistent cash flow and lower risk may prefer laddered bond ETFs, while those willing to accept higher risk for greater yield might choose high-yield bond ETFs.

Connection

Laddered bond ETFs and high-yield bond ETFs both serve distinct roles in fixed-income investment strategies, with laddered bond ETFs focusing on staggered maturities to manage interest rate risk, while high-yield bond ETFs target lower-rated bonds offering higher returns at increased credit risk. Investors often combine laddered bond ETFs with high-yield bond ETFs to balance income stability and growth potential, benefiting from portfolio diversification across credit qualities and maturities. This strategic blend enhances yield optimization while mitigating volatility inherent in high-yield debt markets.

Key Terms

Credit Risk

High-yield bond ETFs invest primarily in below-investment-grade bonds, exposing investors to elevated credit risk but offering higher potential yields compared to laddered bond ETFs, which hold bonds with staggered maturities to reduce interest rate risk and typically feature investment-grade credits. Credit risk in high-yield bond ETFs is heightened by increased default probabilities, whereas laddered bond ETFs mitigate credit exposure through diversification and maturity distribution. Explore how these differences impact portfolio stability and yield by diving deeper into credit risk profiles of bond ETF strategies.

Yield-to-Maturity

High-yield bond ETFs typically offer higher yield-to-maturity (YTM) due to exposure to lower credit quality bonds, reflecting increased default risk and volatility. Laddered bond ETFs, constructed by staggering bond maturities, provide more stable YTM with reduced interest rate risk and smoother income streams. Explore how yield-to-maturity dynamics influence portfolio strategy by learning more about these ETF types.

Interest Rate Sensitivity

High-yield bond ETFs typically exhibit greater interest rate sensitivity due to their lower credit quality and longer durations compared to laddered bond ETFs, which spread maturity dates to reduce risk. Laddered bond ETFs offer more stable income streams by balancing reinvestment risk and interest rate exposure, making them suitable for investors seeking moderate volatility. Explore our detailed analysis to understand which bond ETF strategy aligns best with your investment goals.

Source and External Links

Check the Right Boxes with High-Yield Bond ETFs | AB - Highlights low-cost high-yield bond ETFs like AB Short Duration High Yield ETF (SYFI) and AB High Yield ETF (HYFI), focusing on high income and less volatility than traditional approaches with dynamic management and strong liquidity.

High Yield Bonds ETFs - ETF Database - Provides a wide database of high yield bond ETFs investing in junk bonds and senior loans, detailing popular ETFs such as iShares 0-5 Year High Yield Corporate Bond ETF (SHYG) and SPDR Bloomberg Short Term High Yield Bond ETF (SJNK) with performance and fee metrics.

High-Yield Bond ETFs | Xtrackers by DWS - Offers a suite of six high-yield bond ETFs targeting different credit and interest rate risk levels, providing investors with diverse options for exposure to the high-yield bond market.

dowidth.com

dowidth.com