Yield farming leverages decentralized finance (DeFi) protocols to earn rewards by providing liquidity, often involving staking tokens in liquidity pools. Arbitrage exploits price discrepancies of the same asset across different markets or exchanges to generate risk-free profit. Explore the nuances between yield farming and arbitrage to optimize your investment strategy.

Why it is important

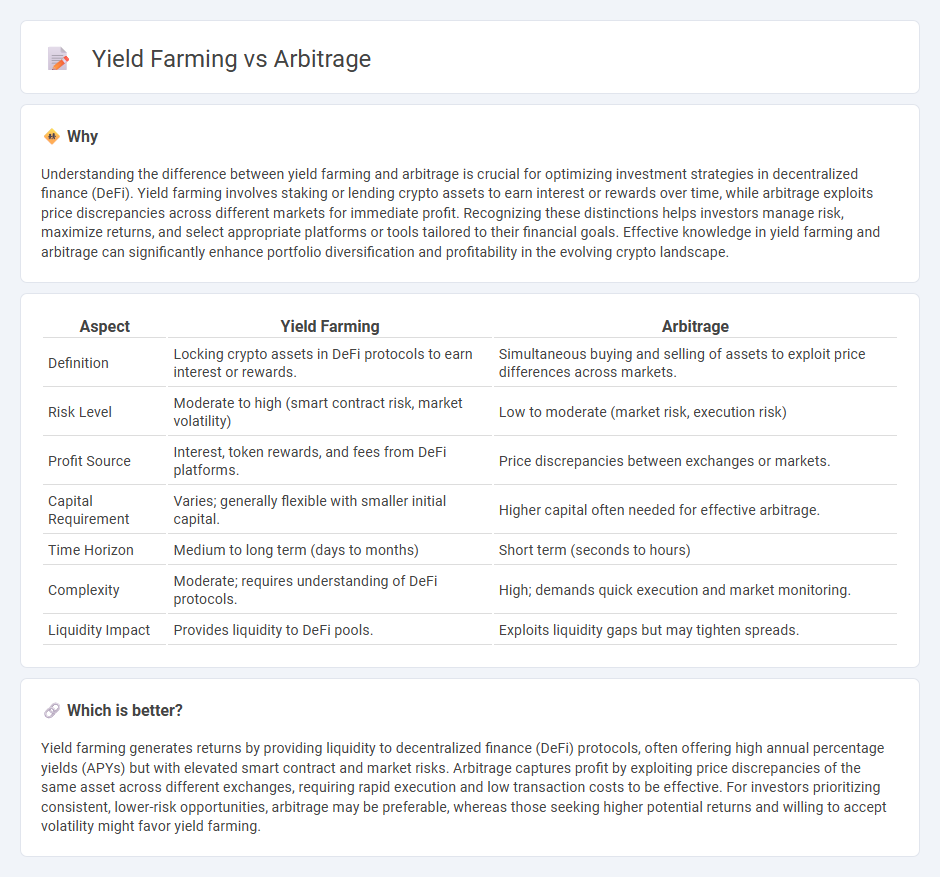

Understanding the difference between yield farming and arbitrage is crucial for optimizing investment strategies in decentralized finance (DeFi). Yield farming involves staking or lending crypto assets to earn interest or rewards over time, while arbitrage exploits price discrepancies across different markets for immediate profit. Recognizing these distinctions helps investors manage risk, maximize returns, and select appropriate platforms or tools tailored to their financial goals. Effective knowledge in yield farming and arbitrage can significantly enhance portfolio diversification and profitability in the evolving crypto landscape.

Comparison Table

| Aspect | Yield Farming | Arbitrage |

|---|---|---|

| Definition | Locking crypto assets in DeFi protocols to earn interest or rewards. | Simultaneous buying and selling of assets to exploit price differences across markets. |

| Risk Level | Moderate to high (smart contract risk, market volatility) | Low to moderate (market risk, execution risk) |

| Profit Source | Interest, token rewards, and fees from DeFi platforms. | Price discrepancies between exchanges or markets. |

| Capital Requirement | Varies; generally flexible with smaller initial capital. | Higher capital often needed for effective arbitrage. |

| Time Horizon | Medium to long term (days to months) | Short term (seconds to hours) |

| Complexity | Moderate; requires understanding of DeFi protocols. | High; demands quick execution and market monitoring. |

| Liquidity Impact | Provides liquidity to DeFi pools. | Exploits liquidity gaps but may tighten spreads. |

Which is better?

Yield farming generates returns by providing liquidity to decentralized finance (DeFi) protocols, often offering high annual percentage yields (APYs) but with elevated smart contract and market risks. Arbitrage captures profit by exploiting price discrepancies of the same asset across different exchanges, requiring rapid execution and low transaction costs to be effective. For investors prioritizing consistent, lower-risk opportunities, arbitrage may be preferable, whereas those seeking higher potential returns and willing to accept volatility might favor yield farming.

Connection

Yield farming and arbitrage intersect in decentralized finance (DeFi) by exploiting price discrepancies across multiple liquidity pools to maximize returns. Arbitrageurs capitalize on these inefficiencies by swiftly buying low on one platform and selling high on another, indirectly boosting yield farming profitability through increased token valuations and liquidity rewards. This synergistic relationship drives higher capital efficiency and rewards for participants engaging in both strategies.

Key Terms

Price Discrepancy

Arbitrage exploits price discrepancies of the same asset across different markets, enabling traders to buy low in one exchange and sell high in another for guaranteed profit. Yield farming, focused on optimizing returns by providing liquidity to decentralized finance platforms, depends on interest rates and reward tokens rather than direct price differences. Explore the mechanics of arbitrage and yield farming to maximize your crypto investment strategy.

Risk-Free Profit

Arbitrage exploits price differences across markets to secure risk-free profit by simultaneously buying low and selling high without exposure to price volatility. Yield farming involves staking or lending crypto assets in DeFi protocols to earn rewards but carries risks like smart contract vulnerabilities and impermanent loss. Explore detailed strategies and risk assessments to maximize your returns confidently.

Liquidity Provision

Arbitrage in liquidity provision involves exploiting price differences across decentralized exchanges (DEXs) to generate risk-free profits, while yield farming focuses on locking tokens in liquidity pools to earn interest, fees, or rewards over time. Liquidity providers in yield farming contribute assets to pools on platforms like Uniswap or SushiSwap, earning rewards proportional to their share of the pool, whereas arbitrageurs constantly monitor market inefficiencies for immediate gains. Explore the nuances and strategies behind liquidity-based arbitrage and yield farming to optimize your decentralized finance (DeFi) investments.

Source and External Links

Arbitrage - Arbitrage is the practice of exploiting price differences of the same or similar assets across different markets to generate risk-free or low-risk profit, often by simultaneously buying low and selling high in different places.

What Is Arbitrage? 3 Strategies to Know - Arbitrage is an investment strategy involving simultaneous purchase and sale of an asset in separate markets to profit from price discrepancies, with types including pure arbitrage, merger arbitrage, and convertible arbitrage.

Arbitrage (film) - "Arbitrage" is a 2012 American crime drama film about a troubled hedge fund manager trying to complete the sale of his trading empire while dealing with personal and professional crises.

dowidth.com

dowidth.com