Zero-day options expire on the same day they are traded, offering traders the opportunity for rapid gains or losses within a single trading session. American options allow holders to exercise the option at any point before expiration, providing greater flexibility in managing positions. Explore the unique characteristics and strategies behind zero-day and American options to enhance your trading approach.

Why it is important

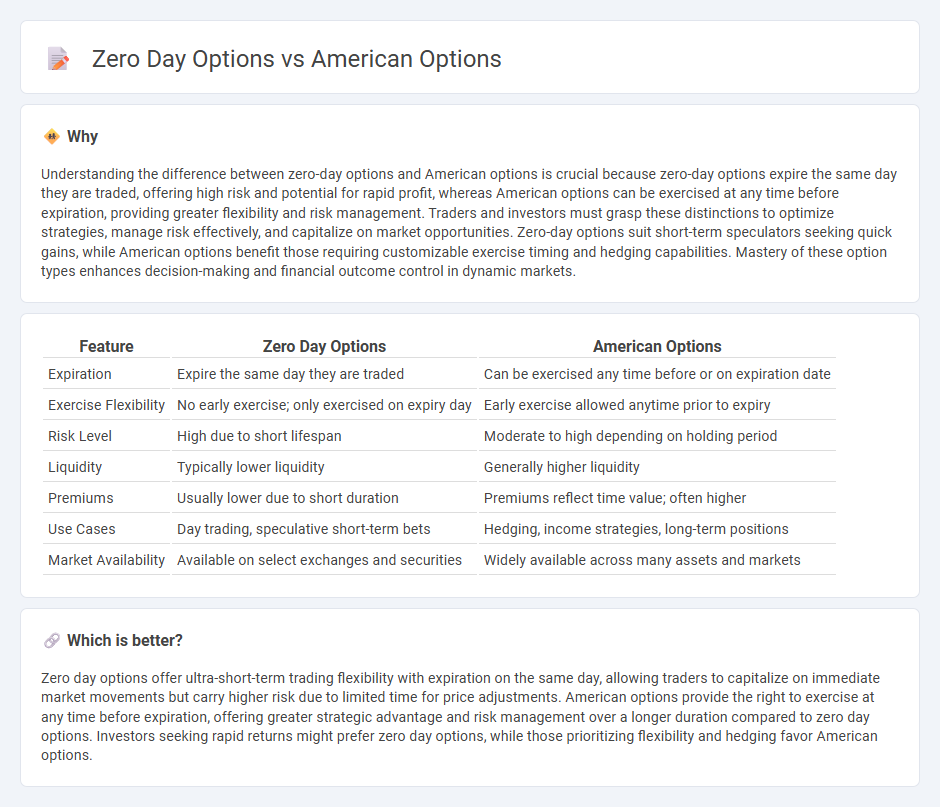

Understanding the difference between zero-day options and American options is crucial because zero-day options expire the same day they are traded, offering high risk and potential for rapid profit, whereas American options can be exercised at any time before expiration, providing greater flexibility and risk management. Traders and investors must grasp these distinctions to optimize strategies, manage risk effectively, and capitalize on market opportunities. Zero-day options suit short-term speculators seeking quick gains, while American options benefit those requiring customizable exercise timing and hedging capabilities. Mastery of these option types enhances decision-making and financial outcome control in dynamic markets.

Comparison Table

| Feature | Zero Day Options | American Options |

|---|---|---|

| Expiration | Expire the same day they are traded | Can be exercised any time before or on expiration date |

| Exercise Flexibility | No early exercise; only exercised on expiry day | Early exercise allowed anytime prior to expiry |

| Risk Level | High due to short lifespan | Moderate to high depending on holding period |

| Liquidity | Typically lower liquidity | Generally higher liquidity |

| Premiums | Usually lower due to short duration | Premiums reflect time value; often higher |

| Use Cases | Day trading, speculative short-term bets | Hedging, income strategies, long-term positions |

| Market Availability | Available on select exchanges and securities | Widely available across many assets and markets |

Which is better?

Zero day options offer ultra-short-term trading flexibility with expiration on the same day, allowing traders to capitalize on immediate market movements but carry higher risk due to limited time for price adjustments. American options provide the right to exercise at any time before expiration, offering greater strategic advantage and risk management over a longer duration compared to zero day options. Investors seeking rapid returns might prefer zero day options, while those prioritizing flexibility and hedging favor American options.

Connection

Zero day options represent contracts that expire on the day they are traded, offering traders high-risk, high-reward opportunities within extremely short timeframes. American options grant holders the right to exercise their options at any point up to and including the expiration date, providing flexibility in managing positions. When zero day options are American-style, traders can capitalize on intraday market movements by exercising the option anytime before market close, blending immediacy with strategic timing.

Key Terms

Expiration Date

American options allow exercise at any time before or on the expiration date, providing flexibility for early decision-making and risk management. Zero day options expire on the same day they are traded, creating high volatility and rapid time decay, which appeals to traders seeking short-term profits. Explore detailed strategies and risks associated with these options to optimize your trading approach.

Premium

American options typically have higher premiums than zero day options due to their longer expiration periods and greater flexibility for early exercise. Zero day options, expiring on the same day they are traded, often feature lower premiums reflecting limited time value and heightened time decay. Explore the detailed premium structures of both option types to enhance your trading strategy.

Exercise Style

American options allow holders to exercise their rights at any time up to expiration, providing flexibility and the ability to respond to market movements. Zero day options, which expire on the same day they are traded, require precise timing and rapid decision-making due to their extremely short lifespan. Explore further to understand how exercise styles impact trading strategies and risk management.

Source and External Links

American Options: Definition, How It Works, Types, Advantages - Strike - American options are contracts allowing the holder to exercise the right to buy or sell an underlying asset at any time before or on the expiration date, with two main types: American Call and American Put options, offering more flexibility than European options which can only be exercised at expiration.

Option style - Wikipedia - The fundamental difference between American and European options is that American options can be exercised any time before expiration, while European options can only be exercised at expiration; American options are common for stocks and equity options and expire monthly on a specified schedule.

Math 181 Lecture 18 American Options (Hull 7.4, 7.5) - American options can be exercised any time up to expiration with the exercise time chosen to maximize value; interestingly, early exercise of American call options on non-dividend stocks is generally suboptimal due to the value of retaining the strike price payment.

dowidth.com

dowidth.com