Decentralized over-the-counter (OTC) trading enables direct peer-to-peer transactions without intermediaries, offering enhanced privacy and customizable deal terms compared to traditional exchanges. Electronic communication networks (ECNs) automate order matching in centralized platforms, ensuring greater transparency, liquidity, and speed for participants. Explore comprehensive insights to understand which trading method best fits your financial strategy.

Why it is important

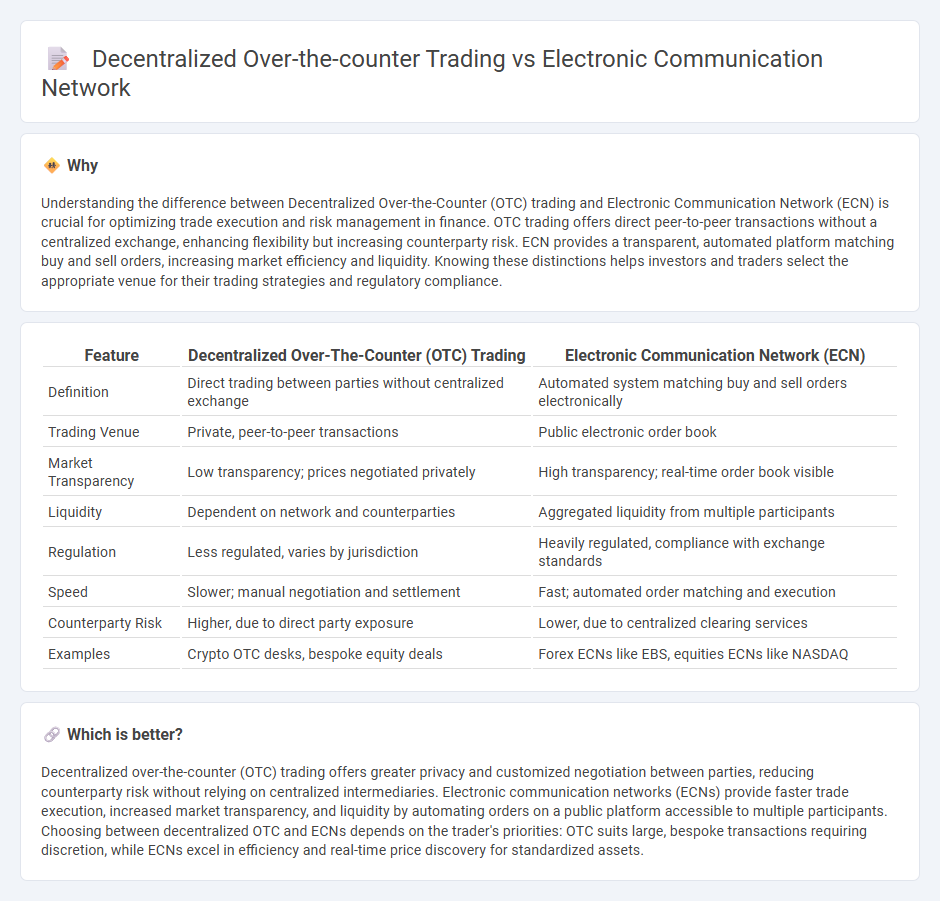

Understanding the difference between Decentralized Over-the-Counter (OTC) trading and Electronic Communication Network (ECN) is crucial for optimizing trade execution and risk management in finance. OTC trading offers direct peer-to-peer transactions without a centralized exchange, enhancing flexibility but increasing counterparty risk. ECN provides a transparent, automated platform matching buy and sell orders, increasing market efficiency and liquidity. Knowing these distinctions helps investors and traders select the appropriate venue for their trading strategies and regulatory compliance.

Comparison Table

| Feature | Decentralized Over-The-Counter (OTC) Trading | Electronic Communication Network (ECN) |

|---|---|---|

| Definition | Direct trading between parties without centralized exchange | Automated system matching buy and sell orders electronically |

| Trading Venue | Private, peer-to-peer transactions | Public electronic order book |

| Market Transparency | Low transparency; prices negotiated privately | High transparency; real-time order book visible |

| Liquidity | Dependent on network and counterparties | Aggregated liquidity from multiple participants |

| Regulation | Less regulated, varies by jurisdiction | Heavily regulated, compliance with exchange standards |

| Speed | Slower; manual negotiation and settlement | Fast; automated order matching and execution |

| Counterparty Risk | Higher, due to direct party exposure | Lower, due to centralized clearing services |

| Examples | Crypto OTC desks, bespoke equity deals | Forex ECNs like EBS, equities ECNs like NASDAQ |

Which is better?

Decentralized over-the-counter (OTC) trading offers greater privacy and customized negotiation between parties, reducing counterparty risk without relying on centralized intermediaries. Electronic communication networks (ECNs) provide faster trade execution, increased market transparency, and liquidity by automating orders on a public platform accessible to multiple participants. Choosing between decentralized OTC and ECNs depends on the trader's priorities: OTC suits large, bespoke transactions requiring discretion, while ECNs excel in efficiency and real-time price discovery for standardized assets.

Connection

Decentralized over-the-counter (OTC) trading and Electronic Communication Networks (ECNs) are connected through their roles in facilitating direct, transparent, and efficient transactions outside traditional centralized exchanges. ECNs provide a digital platform that matches buyers and sellers in real-time, enhancing liquidity and price discovery for OTC markets. This integration reduces counterparty risk and operational costs, fostering greater accessibility and scalability in decentralized financial markets.

Key Terms

Order Matching

Electronic communication networks (ECNs) automate order matching by directly linking buyers and sellers in real-time to facilitate transparent and efficient trades, often within regulated exchanges. Decentralized over-the-counter (OTC) trading relies on peer-to-peer negotiations without centralized order books or automated matching, leading to less transparency but greater privacy and flexibility in trade execution. Explore the distinct mechanisms and advantages of ECNs and decentralized OTC trading to better understand their impact on market liquidity and price discovery.

Liquidity

Electronic communication networks (ECNs) provide centralized platforms for matching buy and sell orders, enhancing liquidity by aggregating a wide pool of participants transparent pricing and faster execution. Decentralized over-the-counter (OTC) trading operates through direct peer-to-peer transactions without intermediaries, which can result in less transparent but often deeper liquidity for tailored large-volume trades. Explore the differences in liquidity dynamics and strategic advantages of ECNs versus decentralized OTC trading to optimize your investment approach.

Counterparty

Electronic Communication Networks (ECNs) facilitate automated, transparent trading of financial instruments by matching buyers and sellers directly within a centralized digital platform, minimizing counterparty risk through immediate trade execution and clearing. In contrast, decentralized over-the-counter (OTC) trading occurs directly between counterparties without a centralized intermediary, which increases counterparty risk due to the reliance on trust and bilateral credit agreements. Explore the distinctions in counterparty risk management between ECNs and decentralized OTC markets to enhance your trading strategies.

Source and External Links

Electronic communication network - An ECN is a computerized network that facilitates trading of financial products like stocks and currencies outside traditional exchanges by matching buy and sell limit orders electronically and charging very small fees, increasing competition and liquidity in markets.

What is an electronic communication network (ECN)? - ECNs are alternative trading systems enabling direct, automated trading between buyers and sellers, often in OTC markets, differing from traditional exchanges by settlement methods and order book management.

Electronic Communication Network (ECN) Definition: Day ... - ECNs are automated electronic systems that eliminate intermediaries by connecting brokers and individual traders directly, executing limit orders and facilitating trades in stocks and currencies at low transaction costs.

dowidth.com

dowidth.com