Revenue-based financing offers flexible capital repayment tied to a company's revenue, avoiding equity dilution and preserving ownership control. Venture capital involves obtaining significant funding in exchange for equity, often bringing strategic guidance but requiring relinquishment of some control. Explore the advantages and considerations of each financing option to determine the best fit for your business growth.

Why it is important

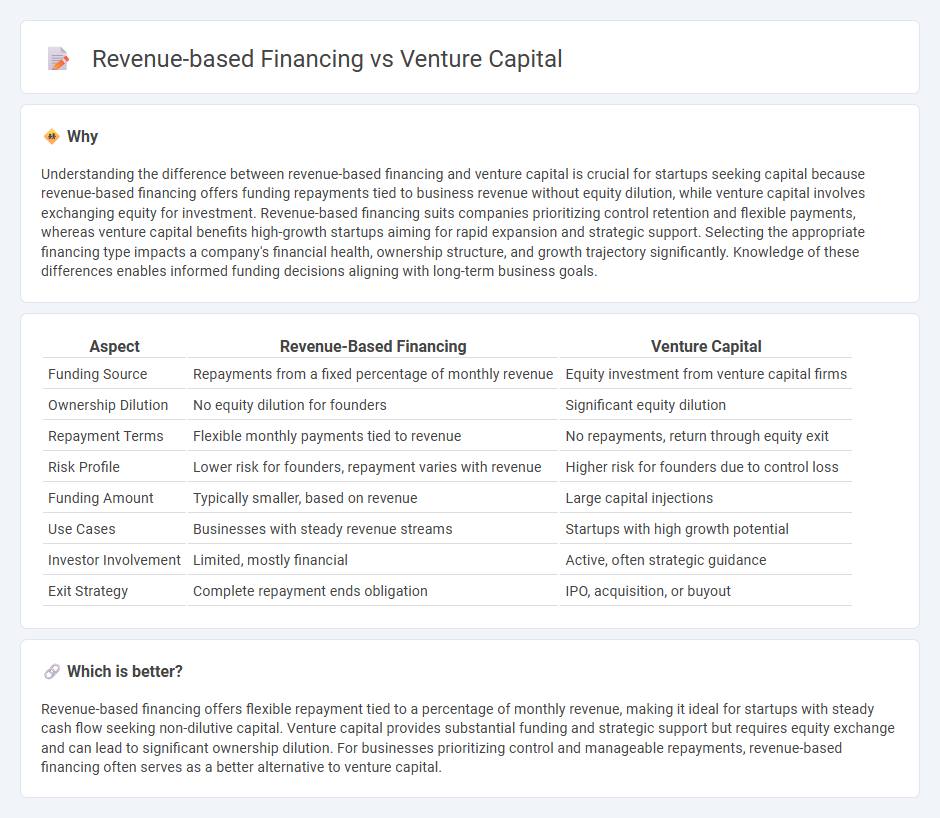

Understanding the difference between revenue-based financing and venture capital is crucial for startups seeking capital because revenue-based financing offers funding repayments tied to business revenue without equity dilution, while venture capital involves exchanging equity for investment. Revenue-based financing suits companies prioritizing control retention and flexible payments, whereas venture capital benefits high-growth startups aiming for rapid expansion and strategic support. Selecting the appropriate financing type impacts a company's financial health, ownership structure, and growth trajectory significantly. Knowledge of these differences enables informed funding decisions aligning with long-term business goals.

Comparison Table

| Aspect | Revenue-Based Financing | Venture Capital |

|---|---|---|

| Funding Source | Repayments from a fixed percentage of monthly revenue | Equity investment from venture capital firms |

| Ownership Dilution | No equity dilution for founders | Significant equity dilution |

| Repayment Terms | Flexible monthly payments tied to revenue | No repayments, return through equity exit |

| Risk Profile | Lower risk for founders, repayment varies with revenue | Higher risk for founders due to control loss |

| Funding Amount | Typically smaller, based on revenue | Large capital injections |

| Use Cases | Businesses with steady revenue streams | Startups with high growth potential |

| Investor Involvement | Limited, mostly financial | Active, often strategic guidance |

| Exit Strategy | Complete repayment ends obligation | IPO, acquisition, or buyout |

Which is better?

Revenue-based financing offers flexible repayment tied to a percentage of monthly revenue, making it ideal for startups with steady cash flow seeking non-dilutive capital. Venture capital provides substantial funding and strategic support but requires equity exchange and can lead to significant ownership dilution. For businesses prioritizing control and manageable repayments, revenue-based financing often serves as a better alternative to venture capital.

Connection

Revenue-based financing and venture capital are interconnected through their roles in providing capital to growing businesses, with revenue-based financing offering flexible repayment tied to monthly revenues and venture capital delivering equity investment for long-term growth. Both financing methods support startups and scale-ups but differ in risk exposure, ownership dilution, and return expectations. Businesses often evaluate these options based on growth trajectory, cash flow stability, and willingness to share equity to optimize capital structure and funding strategy.

Key Terms

Equity

Venture capital provides equity funding where investors acquire ownership stakes in startups, seeking high returns through company growth and eventual exit events. Revenue-based financing offers capital in exchange for a fixed percentage of future revenues, avoiding equity dilution and preserving founder control. Explore deeper insights into equity implications and funding strategies to determine the best fit for your business.

Repayment Structure

Venture capital involves equity financing where investors receive ownership stakes and returns through company growth, while revenue-based financing requires regular repayments as a percentage of monthly revenue without diluting ownership. Repayment in revenue-based financing fluctuates with business performance, providing flexibility compared to fixed equity commitments in venture capital. Explore more to understand which repayment structure aligns best with your funding needs.

Ownership Dilution

Venture capital typically involves significant ownership dilution as investors exchange funding for equity stakes, influencing company control and future decision-making. Revenue-based financing offers an alternative by providing capital in exchange for a percentage of ongoing revenues, avoiding equity dilution and maintaining founder ownership. Explore how these financing options impact business growth and ownership structures to make informed funding decisions.

Source and External Links

What is Venture Capital? - Venture capital is a form of financing provided by institutional investors to high-growth, innovative startups in exchange for equity, offering not just funding but strategic guidance and partnership over a long investment horizon.

Fund your business | U.S. Small Business Administration - Venture capital targets early-stage, high-potential companies, investing in equity rather than debt, typically involving active investor involvement and partial company control in return for capital.

What is venture capital? - Silicon Valley Bank - Venture capital is a high-risk, high-reward private equity investment in startups and early-stage firms, aiming for substantial returns through eventual acquisitions or IPOs, despite the likelihood of many investments failing.

dowidth.com

dowidth.com