Bucket investing segments assets into different time-framed portfolios to manage risk and ensure liquidity, whereas goal-based investing tailors strategies specifically to individual financial objectives, focusing on personalized outcome achievement. Bucket investing offers structured time horizons for spending needs, while goal-based investing prioritizes aligning investments with distinct life goals such as retirement or education funding. Explore deeper insights into how each strategy can optimize your financial planning and investment success.

Why it is important

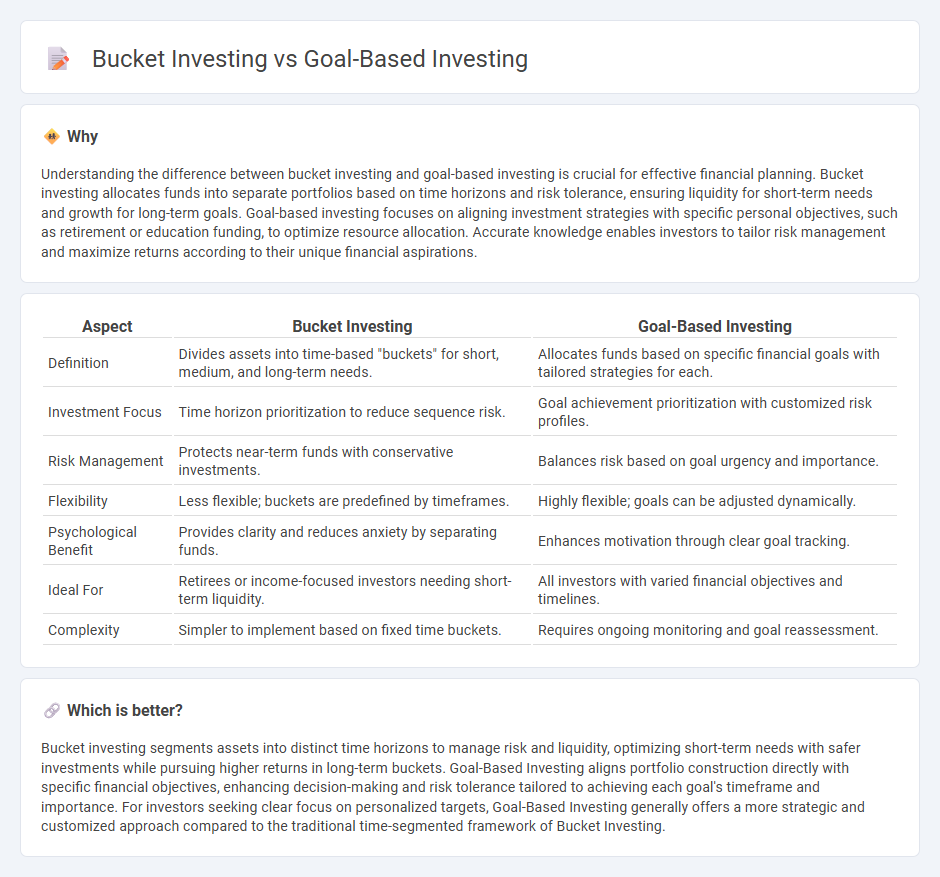

Understanding the difference between bucket investing and goal-based investing is crucial for effective financial planning. Bucket investing allocates funds into separate portfolios based on time horizons and risk tolerance, ensuring liquidity for short-term needs and growth for long-term goals. Goal-based investing focuses on aligning investment strategies with specific personal objectives, such as retirement or education funding, to optimize resource allocation. Accurate knowledge enables investors to tailor risk management and maximize returns according to their unique financial aspirations.

Comparison Table

| Aspect | Bucket Investing | Goal-Based Investing |

|---|---|---|

| Definition | Divides assets into time-based "buckets" for short, medium, and long-term needs. | Allocates funds based on specific financial goals with tailored strategies for each. |

| Investment Focus | Time horizon prioritization to reduce sequence risk. | Goal achievement prioritization with customized risk profiles. |

| Risk Management | Protects near-term funds with conservative investments. | Balances risk based on goal urgency and importance. |

| Flexibility | Less flexible; buckets are predefined by timeframes. | Highly flexible; goals can be adjusted dynamically. |

| Psychological Benefit | Provides clarity and reduces anxiety by separating funds. | Enhances motivation through clear goal tracking. |

| Ideal For | Retirees or income-focused investors needing short-term liquidity. | All investors with varied financial objectives and timelines. |

| Complexity | Simpler to implement based on fixed time buckets. | Requires ongoing monitoring and goal reassessment. |

Which is better?

Bucket investing segments assets into distinct time horizons to manage risk and liquidity, optimizing short-term needs with safer investments while pursuing higher returns in long-term buckets. Goal-Based Investing aligns portfolio construction directly with specific financial objectives, enhancing decision-making and risk tolerance tailored to achieving each goal's timeframe and importance. For investors seeking clear focus on personalized targets, Goal-Based Investing generally offers a more strategic and customized approach compared to the traditional time-segmented framework of Bucket Investing.

Connection

Bucket investing and goal-based investing are connected through their shared focus on aligning investment strategies with specific financial objectives and time horizons. Bucket investing segments assets into different "buckets" based on liquidity and risk tolerance to meet short-, medium-, and long-term goals, which mirrors the tailored approach of goal-based investing that prioritizes investment allocation based on individual financial milestones. Both methodologies emphasize personalized portfolio construction to optimize returns while managing risk according to distinct financial goals.

Key Terms

Risk Profiling

Goal-based investing tailors portfolios to individual risk tolerance, time horizons, and financial objectives to optimize returns aligned with specific goals. Bucket investing segments assets into distinct categories based on time frames and risk levels, often leading to rigid allocation that may not fully reflect changing investor risk profiles. Explore how risk profiling influences portfolio construction strategies to determine the best approach for your financial goals.

Time Horizon

Goal-based investing tailors asset allocation to specific financial objectives and their unique time horizons, emphasizing personalized risk management and targeted returns. Bucket investing segments assets into different "buckets" based on time intervals, typically short, medium, and long-term, to manage liquidity and market volatility effectively. Explore how aligning investment strategies with your time horizon can enhance portfolio performance and financial goal achievement.

Asset Allocation

Goal-based investing prioritizes aligning asset allocation with specific financial objectives, adjusting risk levels according to each goal's timeline and importance. Bucket investing segments portfolios into time-based buckets with distinct asset allocations to meet short-, medium-, and long-term needs separately. Explore how tailored asset allocation strategies can enhance your investment outcomes by learning more about these approaches.

Source and External Links

Goal-based investing - Wikipedia - Goal-based investing (GBI) is an approach that focuses on funding specific financial goals within a set time frame by optimizing an investment mix to minimize the chance of failing to meet minimum wealth targets, prioritizing goals by importance and integrating financial planning with investment management for efficient goal funding.

Goal-Based Investment Planning: Crafting Your Financial Future With Purpose - Goal-based investment planning aligns investment strategies directly with personalized life objectives, emphasizing precise goal definition, tailored investment approaches, dynamic risk management, and continuous adaptation to help individuals achieve measurable financial milestones.

How Goal-Based Investing Motivates Investors - Morningstar - Goal-based investing motivates investors by helping them articulate meaningful, personal financial goals, providing a clear purpose for investing that increases discipline, patience, and client wealth, while making progress measurable and emotionally rewarding.

dowidth.com

dowidth.com