Carbon trading markets focus on reducing greenhouse gas emissions by allowing companies to buy and sell carbon credits generated from various projects, promoting cost-effective pollution control. Blue carbon credits specifically originate from ocean and coastal ecosystem conservation efforts, such as mangroves and seagrasses, which sequester carbon while supporting biodiversity and climate resilience. Explore how these two financial mechanisms differ in impact and investment potential to better understand sustainable finance strategies.

Why it is important

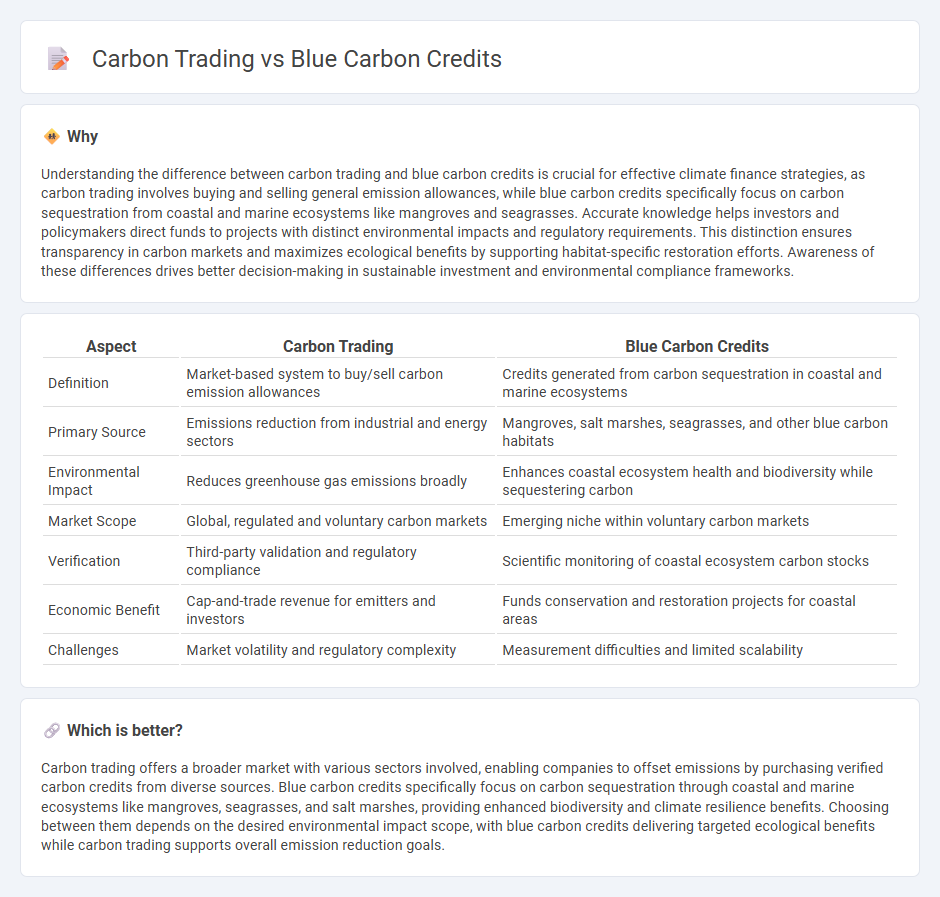

Understanding the difference between carbon trading and blue carbon credits is crucial for effective climate finance strategies, as carbon trading involves buying and selling general emission allowances, while blue carbon credits specifically focus on carbon sequestration from coastal and marine ecosystems like mangroves and seagrasses. Accurate knowledge helps investors and policymakers direct funds to projects with distinct environmental impacts and regulatory requirements. This distinction ensures transparency in carbon markets and maximizes ecological benefits by supporting habitat-specific restoration efforts. Awareness of these differences drives better decision-making in sustainable investment and environmental compliance frameworks.

Comparison Table

| Aspect | Carbon Trading | Blue Carbon Credits |

|---|---|---|

| Definition | Market-based system to buy/sell carbon emission allowances | Credits generated from carbon sequestration in coastal and marine ecosystems |

| Primary Source | Emissions reduction from industrial and energy sectors | Mangroves, salt marshes, seagrasses, and other blue carbon habitats |

| Environmental Impact | Reduces greenhouse gas emissions broadly | Enhances coastal ecosystem health and biodiversity while sequestering carbon |

| Market Scope | Global, regulated and voluntary carbon markets | Emerging niche within voluntary carbon markets |

| Verification | Third-party validation and regulatory compliance | Scientific monitoring of coastal ecosystem carbon stocks |

| Economic Benefit | Cap-and-trade revenue for emitters and investors | Funds conservation and restoration projects for coastal areas |

| Challenges | Market volatility and regulatory complexity | Measurement difficulties and limited scalability |

Which is better?

Carbon trading offers a broader market with various sectors involved, enabling companies to offset emissions by purchasing verified carbon credits from diverse sources. Blue carbon credits specifically focus on carbon sequestration through coastal and marine ecosystems like mangroves, seagrasses, and salt marshes, providing enhanced biodiversity and climate resilience benefits. Choosing between them depends on the desired environmental impact scope, with blue carbon credits delivering targeted ecological benefits while carbon trading supports overall emission reduction goals.

Connection

Carbon trading markets integrate blue carbon credits as a crucial component for offsetting carbon emissions by preserving and restoring coastal ecosystems such as mangroves, seagrasses, and salt marshes. These blue carbon credits are quantified based on the carbon sequestration potential of these marine and coastal habitats, providing a valuable asset in global carbon markets to meet emission reduction targets. The linkage enhances financial incentives for protecting blue carbon ecosystems, thereby supporting climate change mitigation and biodiversity conservation simultaneously.

Key Terms

Carbon Sequestration

Blue carbon credits specifically reward carbon sequestration achieved through coastal and marine ecosystems such as mangroves, seagrasses, and salt marshes, which capture and store significant amounts of CO2. Carbon trading encompasses a broader market where companies buy and sell permits or credits representing general emission reductions across various sectors, not exclusively tied to natural carbon sinks. Explore how blue carbon credits uniquely bolster climate resilience by preserving vital marine habitats and combating climate change through targeted sequestration strategies.

Offset Verification

Blue carbon credits specifically represent the carbon sequestration benefits from coastal and marine ecosystems like mangroves, seagrasses, and salt marshes, highlighting their unique role in reducing greenhouse gases. Carbon trading encompasses a broader market where verified emissions reductions or removals, including blue carbon credits, are bought and sold to meet regulatory or voluntary climate goals. Explore our detailed guide to understand offset verification processes ensuring transparency and effectiveness in both blue carbon and wider carbon markets.

Market Mechanisms

Blue carbon credits represent a specialized market mechanism that incentivizes the preservation and restoration of coastal and marine ecosystems such as mangroves, seagrasses, and salt marshes, which sequester significant amounts of carbon. Carbon trading encompasses a broader market-based approach allowing entities to buy and sell carbon emission allowances or credits across various sectors to meet regulatory or voluntary climate goals. Explore further to understand how these mechanisms integrate and differ within the global carbon markets.

Source and External Links

How the VCM can turn the tide for blue carbon - Discusses the increasing supply of blue carbon credits and their pricing, highlighting a significant increase in 2022 due to large-scale projects like Delta Blue Carbon.

What Are Blue Carbon Credits, and How Do They Work? - Explains how blue carbon credits work by focusing on ocean and coastal ecosystems to offset carbon emissions through restoration and conservation projects.

Blue carbon: a growing climate finance solution - Highlights the growing interest in blue carbon as a climate finance solution, emphasizing its potential for coastal restoration and carbon storage.

dowidth.com

dowidth.com