Tokenized treasury bills offer blockchain-based ownership of government debt with enhanced liquidity and transparency compared to traditional financial instruments. Exchange-traded funds (ETFs) provide diversified exposure to various asset classes through shares traded on stock exchanges, combining flexibility with cost efficiency. Explore the differences and benefits of tokenized treasury bills and ETFs to optimize your investment portfolio.

Why it is important

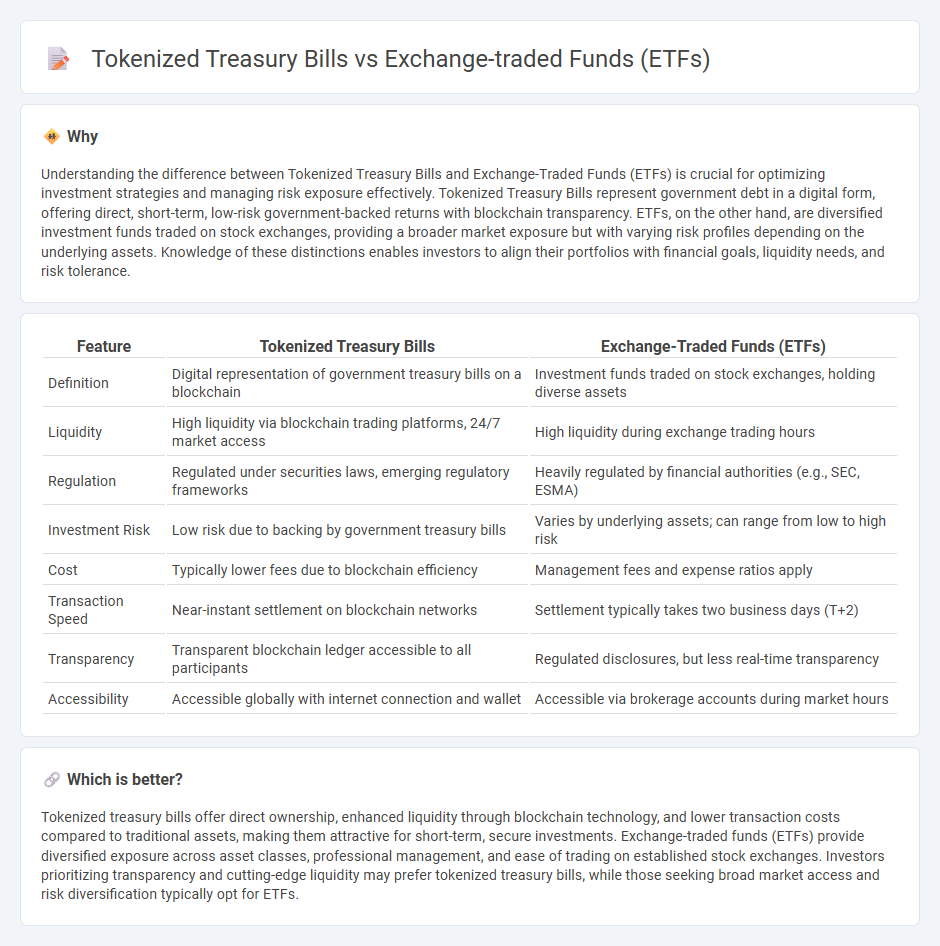

Understanding the difference between Tokenized Treasury Bills and Exchange-Traded Funds (ETFs) is crucial for optimizing investment strategies and managing risk exposure effectively. Tokenized Treasury Bills represent government debt in a digital form, offering direct, short-term, low-risk government-backed returns with blockchain transparency. ETFs, on the other hand, are diversified investment funds traded on stock exchanges, providing a broader market exposure but with varying risk profiles depending on the underlying assets. Knowledge of these distinctions enables investors to align their portfolios with financial goals, liquidity needs, and risk tolerance.

Comparison Table

| Feature | Tokenized Treasury Bills | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Definition | Digital representation of government treasury bills on a blockchain | Investment funds traded on stock exchanges, holding diverse assets |

| Liquidity | High liquidity via blockchain trading platforms, 24/7 market access | High liquidity during exchange trading hours |

| Regulation | Regulated under securities laws, emerging regulatory frameworks | Heavily regulated by financial authorities (e.g., SEC, ESMA) |

| Investment Risk | Low risk due to backing by government treasury bills | Varies by underlying assets; can range from low to high risk |

| Cost | Typically lower fees due to blockchain efficiency | Management fees and expense ratios apply |

| Transaction Speed | Near-instant settlement on blockchain networks | Settlement typically takes two business days (T+2) |

| Transparency | Transparent blockchain ledger accessible to all participants | Regulated disclosures, but less real-time transparency |

| Accessibility | Accessible globally with internet connection and wallet | Accessible via brokerage accounts during market hours |

Which is better?

Tokenized treasury bills offer direct ownership, enhanced liquidity through blockchain technology, and lower transaction costs compared to traditional assets, making them attractive for short-term, secure investments. Exchange-traded funds (ETFs) provide diversified exposure across asset classes, professional management, and ease of trading on established stock exchanges. Investors prioritizing transparency and cutting-edge liquidity may prefer tokenized treasury bills, while those seeking broad market access and risk diversification typically opt for ETFs.

Connection

Tokenized treasury bills and exchange-traded funds (ETFs) intersect through blockchain technology, which enhances liquidity and transparency in financial markets. Tokenized treasury bills represent digitized government debt securities on decentralized platforms, enabling fractional ownership and faster settlement. ETFs can incorporate these tokenized assets to diversify portfolios while providing investors with seamless access to government securities within traditional investment vehicles.

Key Terms

Liquidity

Exchange-traded funds (ETFs) offer high liquidity through established stock exchanges, allowing investors to buy and sell shares quickly during trading hours. Tokenized treasury bills provide liquidity via blockchain platforms, enabling 24/7 trading and faster settlement compared to traditional markets. Explore the advantages of each liquidity model to optimize your investment strategy.

Regulatory Framework

Exchange-traded funds (ETFs) operate under well-established regulatory frameworks guided by securities laws and financial authorities like the SEC in the United States, ensuring investor protection, transparency, and market oversight. Tokenized treasury bills leverage blockchain technology but face evolving regulations with varying compliance standards across jurisdictions, often subject to securities law and anti-money laundering requirements. Explore more about the regulatory distinctions and compliance strategies governing ETFs and tokenized treasury bills to make informed investment decisions.

Settlement Mechanism

Exchange-traded funds (ETFs) settle through traditional clearinghouses and depositories, typically requiring two business days (T+2) for the transfer of ownership and funds. Tokenized treasury bills leverage blockchain technology, enabling near-instantaneous settlement by recording ownership on a decentralized ledger, reducing counterparty risk and enhancing transparency. Explore the advantages and operational details of these settlement mechanisms to better understand their impact on liquidity and investment efficiency.

Source and External Links

Exchange-Traded Fund (ETF) - Investor.gov - ETFs are investment products traded on exchanges that pool investors' money to buy stocks, bonds, or other assets and are managed by an SEC-registered adviser; unlike mutual funds, ETF shares trade throughout the day on exchanges and can be more tax-efficient.

What is an ETF (Exchange-Traded Fund)? - Charles Schwab - ETFs combine the trading flexibility of stocks with the diversification of mutual funds, allowing affordable access to a wide range of assets with generally lower costs, intraday trading, and potential tax benefits.

Exchange-Traded Funds and Products | FINRA.org - ETFs are pooled investment products traded on exchanges that can be passively or actively managed, involving authorized participants who facilitate large block share creation and redemption, with distributions of dividends or interest depending on the fund structure.

dowidth.com

dowidth.com