Laddered bond ETFs distribute investments across multiple bonds with staggered maturities, enhancing liquidity and reducing interest rate risk, while fixed-maturity bond funds hold bonds that mature on a specific date, offering predictable returns and clearer income streams. Both investment strategies provide tailored approaches to managing bond portfolios, suited for different risk tolerances and income planning goals. Explore the distinctions and benefits of laddered bond ETFs versus fixed-maturity bond funds to optimize your fixed income investments.

Why it is important

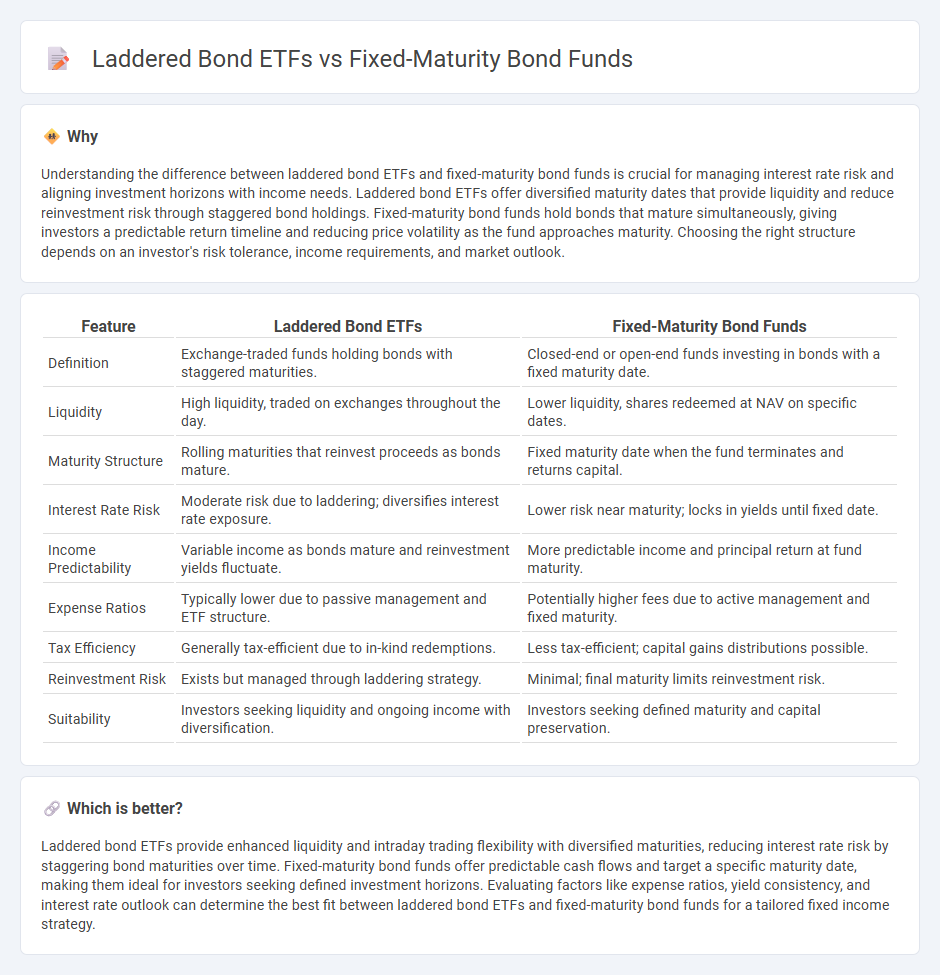

Understanding the difference between laddered bond ETFs and fixed-maturity bond funds is crucial for managing interest rate risk and aligning investment horizons with income needs. Laddered bond ETFs offer diversified maturity dates that provide liquidity and reduce reinvestment risk through staggered bond holdings. Fixed-maturity bond funds hold bonds that mature simultaneously, giving investors a predictable return timeline and reducing price volatility as the fund approaches maturity. Choosing the right structure depends on an investor's risk tolerance, income requirements, and market outlook.

Comparison Table

| Feature | Laddered Bond ETFs | Fixed-Maturity Bond Funds |

|---|---|---|

| Definition | Exchange-traded funds holding bonds with staggered maturities. | Closed-end or open-end funds investing in bonds with a fixed maturity date. |

| Liquidity | High liquidity, traded on exchanges throughout the day. | Lower liquidity, shares redeemed at NAV on specific dates. |

| Maturity Structure | Rolling maturities that reinvest proceeds as bonds mature. | Fixed maturity date when the fund terminates and returns capital. |

| Interest Rate Risk | Moderate risk due to laddering; diversifies interest rate exposure. | Lower risk near maturity; locks in yields until fixed date. |

| Income Predictability | Variable income as bonds mature and reinvestment yields fluctuate. | More predictable income and principal return at fund maturity. |

| Expense Ratios | Typically lower due to passive management and ETF structure. | Potentially higher fees due to active management and fixed maturity. |

| Tax Efficiency | Generally tax-efficient due to in-kind redemptions. | Less tax-efficient; capital gains distributions possible. |

| Reinvestment Risk | Exists but managed through laddering strategy. | Minimal; final maturity limits reinvestment risk. |

| Suitability | Investors seeking liquidity and ongoing income with diversification. | Investors seeking defined maturity and capital preservation. |

Which is better?

Laddered bond ETFs provide enhanced liquidity and intraday trading flexibility with diversified maturities, reducing interest rate risk by staggering bond maturities over time. Fixed-maturity bond funds offer predictable cash flows and target a specific maturity date, making them ideal for investors seeking defined investment horizons. Evaluating factors like expense ratios, yield consistency, and interest rate outlook can determine the best fit between laddered bond ETFs and fixed-maturity bond funds for a tailored fixed income strategy.

Connection

Laddered bond ETFs and fixed-maturity bond funds both employ structured investment strategies that manage bonds across staggered maturities to optimize yield and minimize interest rate risk. Laddered bond ETFs continuously trade bonds with varying maturities, providing liquidity and diversification, while fixed-maturity bond funds hold bonds to a specified maturity date, offering predictable cash flows and reduced reinvestment risk. These strategies align by targeting stable income generation and interest rate risk management through disciplined maturity scheduling.

Key Terms

Interest Rate Risk

Fixed-maturity bond funds offer predictable maturity dates, reducing interest rate risk by minimizing price volatility as bonds approach maturity. Laddered bond ETFs diversify maturities across a range, smoothing the impact of rate changes through staggered reinvestments at varying yields. Explore how these strategies manage interest rate risk to align with your investment goals.

Liquidity

Fixed-maturity bond funds offer predictable redemption dates and can provide enhanced liquidity during fixed intervals, while laddered bond ETFs enable continuous trading on exchanges, providing investors with daily liquidity and price transparency. Investors seeking a balance of cash flow predictability and market liquidity often compare these structures based on their trading flexibility and interest rate risk management. Explore more detailed comparisons and strategies to optimize fixed-income portfolio liquidity.

Principal Repayment Schedule

Fixed-Maturity Bond Funds offer a predetermined principal repayment schedule where the maturity date of the fund aligns with the bonds it holds, providing investors with a clear timeline for principal return. Laddered bond ETFs, in contrast, achieve a staggered principal repayment by holding bonds with varying maturities, which mitigates reinvestment risk and enhances liquidity. Discover more about how these strategic approaches impact portfolio stability and income consistency.

Source and External Links

TDAM | ETFs - Target Maturity Bonds - TD Bank - Fixed-maturity bond funds invest primarily in investment-grade corporate bonds with a defined maturity date, offering regular income, capital preservation, and reduced short-term volatility while providing the liquidity and transparency benefits of ETFs.

Fixed maturity bond portfolios: An effective combination - These funds have a finite life (typically 3-5 years) providing investors predictable return of capital, yield protection, and declining duration risk as the fund approaches maturity.

BulletShares(r) fixed income ETFs - Invesco - Fixed maturity bond ETFs like BulletShares offer targeted exposure to bonds with specific maturities to create bond ladders, providing stability and potential protection from rising interest rates by gradually reducing duration risk over time.

dowidth.com

dowidth.com