Digital asset custody involves safeguarding cryptocurrencies and blockchain-based tokens using advanced cryptographic techniques and secure hardware, while traditional asset custody focuses on protecting physical or legacy financial instruments like stocks, bonds, and cash through established custodial banks and trust companies. Digital custody solutions emphasize decentralized access control, multi-signature wallets, and cold storage to mitigate cyber risks, whereas traditional custody relies on regulatory compliance, physical vaults, and insured custodial accounts. Explore the evolving landscape of asset protection to understand how innovations in custody are transforming financial security.

Why it is important

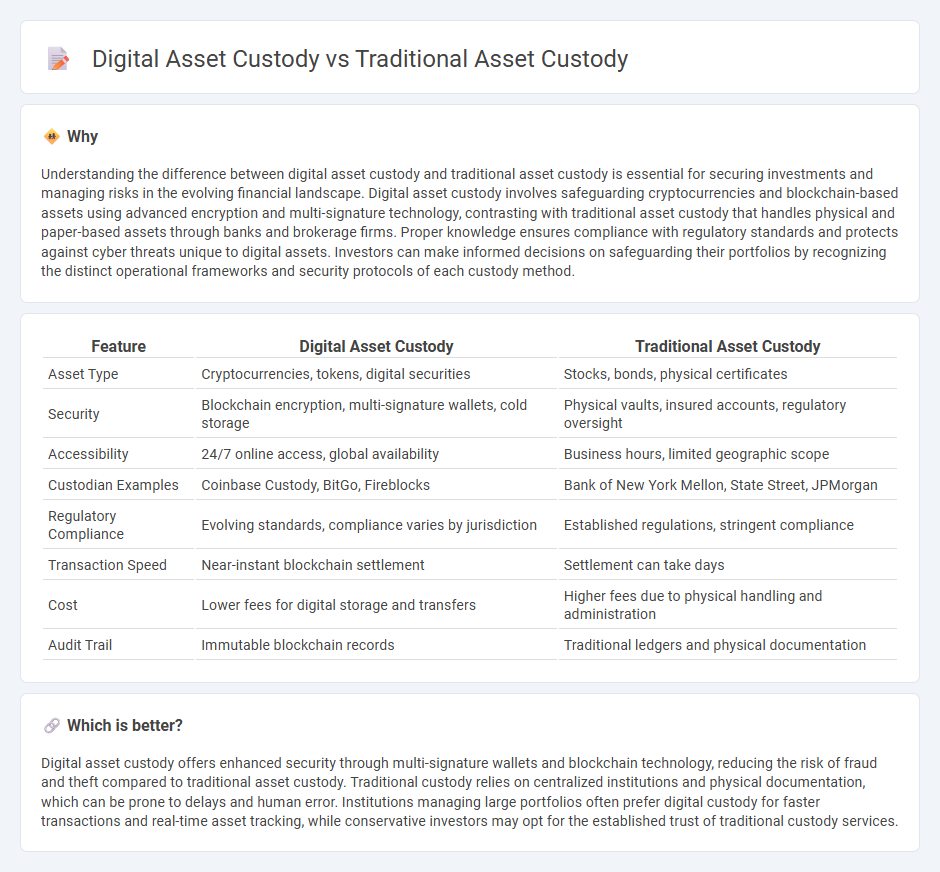

Understanding the difference between digital asset custody and traditional asset custody is essential for securing investments and managing risks in the evolving financial landscape. Digital asset custody involves safeguarding cryptocurrencies and blockchain-based assets using advanced encryption and multi-signature technology, contrasting with traditional asset custody that handles physical and paper-based assets through banks and brokerage firms. Proper knowledge ensures compliance with regulatory standards and protects against cyber threats unique to digital assets. Investors can make informed decisions on safeguarding their portfolios by recognizing the distinct operational frameworks and security protocols of each custody method.

Comparison Table

| Feature | Digital Asset Custody | Traditional Asset Custody |

|---|---|---|

| Asset Type | Cryptocurrencies, tokens, digital securities | Stocks, bonds, physical certificates |

| Security | Blockchain encryption, multi-signature wallets, cold storage | Physical vaults, insured accounts, regulatory oversight |

| Accessibility | 24/7 online access, global availability | Business hours, limited geographic scope |

| Custodian Examples | Coinbase Custody, BitGo, Fireblocks | Bank of New York Mellon, State Street, JPMorgan |

| Regulatory Compliance | Evolving standards, compliance varies by jurisdiction | Established regulations, stringent compliance |

| Transaction Speed | Near-instant blockchain settlement | Settlement can take days |

| Cost | Lower fees for digital storage and transfers | Higher fees due to physical handling and administration |

| Audit Trail | Immutable blockchain records | Traditional ledgers and physical documentation |

Which is better?

Digital asset custody offers enhanced security through multi-signature wallets and blockchain technology, reducing the risk of fraud and theft compared to traditional asset custody. Traditional custody relies on centralized institutions and physical documentation, which can be prone to delays and human error. Institutions managing large portfolios often prefer digital custody for faster transactions and real-time asset tracking, while conservative investors may opt for the established trust of traditional custody services.

Connection

Digital asset custody and traditional asset custody are connected through their core function of safeguarding client assets using secure, regulated infrastructure. Both systems employ advanced encryption techniques and multi-factor authentication to ensure asset protection and compliance with financial regulations. Integration is increasing as financial institutions adopt hybrid custody solutions to manage diverse portfolios combining cryptocurrencies and conventional assets efficiently.

Key Terms

Custodian

Traditional asset custody involves custodians safeguarding physical assets such as stocks, bonds, and real estate, relying on established regulatory frameworks and physical security measures. Digital asset custody focuses on securing cryptocurrencies and blockchain-based assets through advanced cryptographic techniques, multi-signature wallets, and cold storage solutions to prevent cyber threats and unauthorized access. Explore how custodians are evolving to protect both traditional and digital assets in today's financial landscape.

Private Key

Traditional asset custody relies on centralized institutions to safeguard physical or financial assets, whereas digital asset custody centers on securing private keys that grant access to cryptocurrencies. The private key is a critical cryptographic element enabling ownership and transfer of digital assets, necessitating robust security measures like hardware wallets and multi-signature protocols. Explore how private key management transforms asset security and control in the evolving financial landscape.

Settlement

Traditional asset custody relies on centralized intermediaries to ensure secure settlement through established clearinghouses and regulatory oversight, often resulting in longer settlement cycles. Digital asset custody employs blockchain technology to enable near-instantaneous settlement with increased transparency and reduced counterparty risk via smart contracts and decentralized ledgers. Explore the evolving landscape of settlement mechanisms in asset custody to understand the benefits and challenges of each approach.

Source and External Links

Opportunities in digital assets and digital custody - Traditional asset custody emerged from the need to protect investor assets from theft or loss, with banks becoming custodians due to their trusted status, infrastructure, and ability to settle transactions, evolving from paper-based to electronic book-entry securities systems using central securities depositories (CSDs).

Digital Asset Custody: Navigating a Rapidly Evolving ... - Traditionally, investors no longer held direct ownership of their securities but instead held IOUs through intermediaries like banks and brokerages, a system established by UCC Article 8; this shifted custody control away from individuals to financial institutions, affecting real ownership rights.

Digital Asset Custody vs Traditional Global Custody - Traditional custody focuses on safekeeping physical certificates or electronic securities with extensive security and regulatory frameworks, offering services like dividend handling and proxy voting, contrasting with digital asset custody which relies on cryptographic security, smart contracts, and evolving regulations.

dowidth.com

dowidth.com