Crowdlending platforms enable businesses and individuals to obtain financing directly from a pool of individual investors, often offering faster approval and more flexible terms compared to traditional bank loans. Unlike banks, which typically require extensive credit checks and collateral, crowdlending leverages peer-to-peer networks to facilitate access to capital with varying interest rates based on borrower risk profiles. Explore further to understand the key differences and benefits of crowdlending versus conventional bank financing.

Why it is important

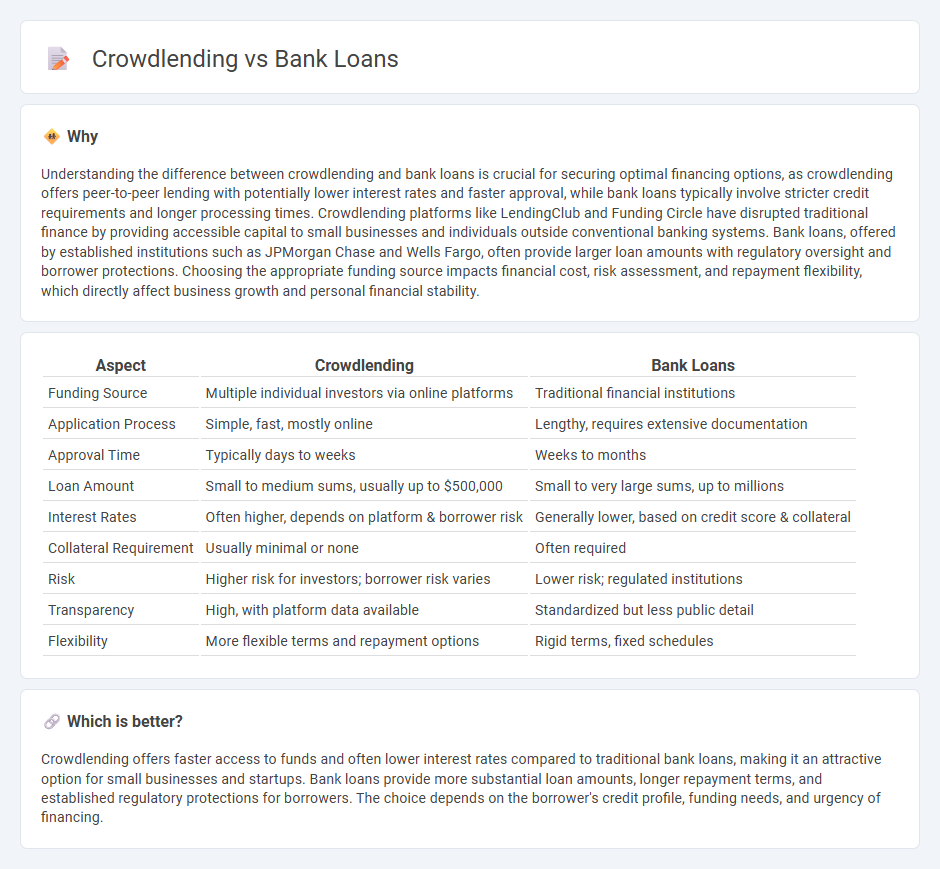

Understanding the difference between crowdlending and bank loans is crucial for securing optimal financing options, as crowdlending offers peer-to-peer lending with potentially lower interest rates and faster approval, while bank loans typically involve stricter credit requirements and longer processing times. Crowdlending platforms like LendingClub and Funding Circle have disrupted traditional finance by providing accessible capital to small businesses and individuals outside conventional banking systems. Bank loans, offered by established institutions such as JPMorgan Chase and Wells Fargo, often provide larger loan amounts with regulatory oversight and borrower protections. Choosing the appropriate funding source impacts financial cost, risk assessment, and repayment flexibility, which directly affect business growth and personal financial stability.

Comparison Table

| Aspect | Crowdlending | Bank Loans |

|---|---|---|

| Funding Source | Multiple individual investors via online platforms | Traditional financial institutions |

| Application Process | Simple, fast, mostly online | Lengthy, requires extensive documentation |

| Approval Time | Typically days to weeks | Weeks to months |

| Loan Amount | Small to medium sums, usually up to $500,000 | Small to very large sums, up to millions |

| Interest Rates | Often higher, depends on platform & borrower risk | Generally lower, based on credit score & collateral |

| Collateral Requirement | Usually minimal or none | Often required |

| Risk | Higher risk for investors; borrower risk varies | Lower risk; regulated institutions |

| Transparency | High, with platform data available | Standardized but less public detail |

| Flexibility | More flexible terms and repayment options | Rigid terms, fixed schedules |

Which is better?

Crowdlending offers faster access to funds and often lower interest rates compared to traditional bank loans, making it an attractive option for small businesses and startups. Bank loans provide more substantial loan amounts, longer repayment terms, and established regulatory protections for borrowers. The choice depends on the borrower's credit profile, funding needs, and urgency of financing.

Connection

Crowdlending and bank loans are connected through their function as alternative financing methods that facilitate capital access for individuals and businesses. Both involve the provision of funds with agreed-upon repayment terms and interest rates, yet crowdlending leverages peer-to-peer platforms enabling direct loans from investors, whereas bank loans are issued by financial institutions following traditional credit assessments. The rise of crowdlending has influenced banks to adapt by integrating digital lending technologies to streamline loan approval processes and expand credit accessibility.

Key Terms

Interest Rate

Bank loans typically offer fixed or variable interest rates ranging from 3% to 10% depending on creditworthiness and loan type, often accompanied by strict eligibility criteria. Crowdlending platforms feature competitive interest rates, generally between 5% and 15%, reflecting higher risk and shorter loan terms, while providing greater accessibility to borrowers. Explore the detailed comparison of interest rates and conditions to make an informed financing decision.

Risk Assessment

Bank loans undergo rigorous risk assessment involving credit scores, financial history, and collateral evaluation to minimize default risks for lenders. Crowdlending platforms assess risk by analyzing borrower profiles, project viability, and market trends but often involve higher risk due to less stringent credit requirements and diversified investor participation. Discover more about the comparative risk frameworks and decision-making in bank loans versus crowdlending.

Funding Source

Bank loans are traditionally funded by financial institutions that pool deposits and reserves, offering structured repayment plans and interest rates regulated by banking authorities. Crowdlending sources capital directly from individual investors via online platforms, enabling peer-to-peer lending with variable rates influenced by market demand and borrower profiles. Explore further to understand the implications of these funding sources on loan accessibility and cost.

Source and External Links

Personal loans: See options and apply online - Wells Fargo offers unsecured personal loans from $3,000 to $100,000 with fixed monthly payments and terms up to 84 months, useful for managing debt, home improvements, or large purchases, with a streamlined online application and potential for same-day funding.

Personal loan - U.S. Bank provides unsecured personal loans up to $50,000 for clients, and up to $25,000 for non-clients, which can be used for debt consolidation, home renovations, medical bills, or big purchases, with funds potentially available within hours.

Personal Loans, Unsecured, Fixed Rate | TD Bank Fit Loan - TD Bank offers unsecured personal loans from $2,000 to $50,000 with fixed rates and terms up to 60 months, no application or origination fees, and no prepayment penalties, with funds available as soon as one business day after approval.

dowidth.com

dowidth.com