Finfluencers harness social media platforms to deliver accessible, real-time financial advice and investment tips to a broad audience, leveraging trends and user engagement data. Private bankers offer personalized wealth management services, focusing on customized strategies for high-net-worth clients through direct, confidential consultations. Explore the differences to determine which financial guidance suits your goals best.

Why it is important

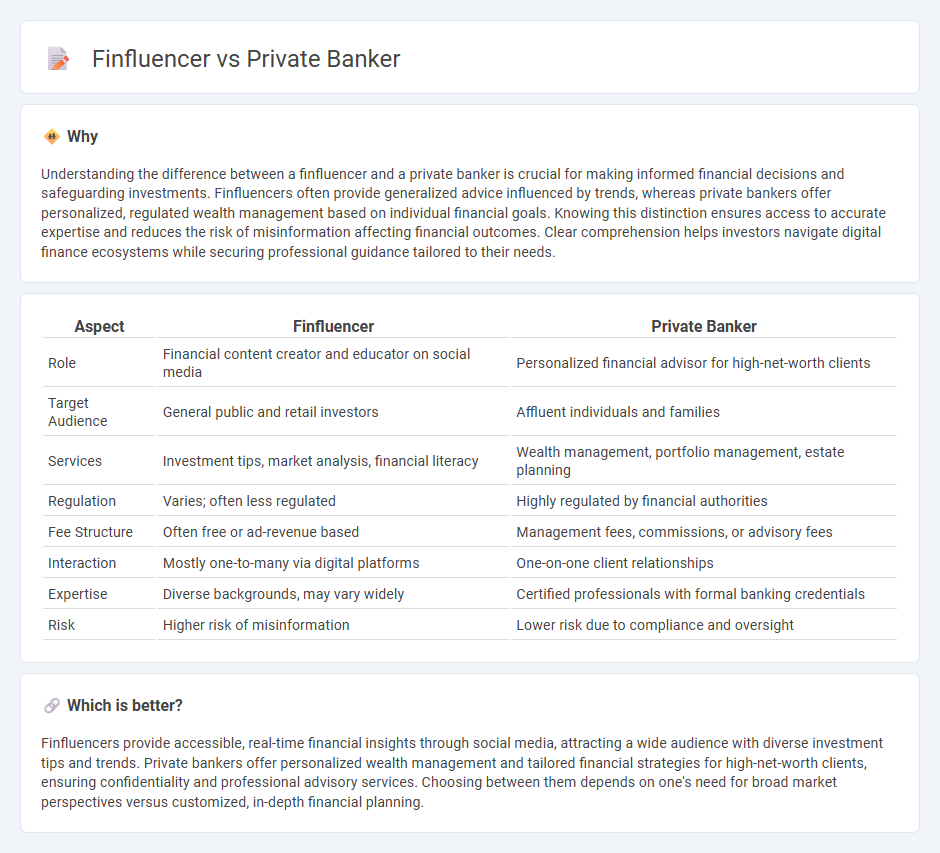

Understanding the difference between a finfluencer and a private banker is crucial for making informed financial decisions and safeguarding investments. Finfluencers often provide generalized advice influenced by trends, whereas private bankers offer personalized, regulated wealth management based on individual financial goals. Knowing this distinction ensures access to accurate expertise and reduces the risk of misinformation affecting financial outcomes. Clear comprehension helps investors navigate digital finance ecosystems while securing professional guidance tailored to their needs.

Comparison Table

| Aspect | Finfluencer | Private Banker |

|---|---|---|

| Role | Financial content creator and educator on social media | Personalized financial advisor for high-net-worth clients |

| Target Audience | General public and retail investors | Affluent individuals and families |

| Services | Investment tips, market analysis, financial literacy | Wealth management, portfolio management, estate planning |

| Regulation | Varies; often less regulated | Highly regulated by financial authorities |

| Fee Structure | Often free or ad-revenue based | Management fees, commissions, or advisory fees |

| Interaction | Mostly one-to-many via digital platforms | One-on-one client relationships |

| Expertise | Diverse backgrounds, may vary widely | Certified professionals with formal banking credentials |

| Risk | Higher risk of misinformation | Lower risk due to compliance and oversight |

Which is better?

Finfluencers provide accessible, real-time financial insights through social media, attracting a wide audience with diverse investment tips and trends. Private bankers offer personalized wealth management and tailored financial strategies for high-net-worth clients, ensuring confidentiality and professional advisory services. Choosing between them depends on one's need for broad market perspectives versus customized, in-depth financial planning.

Connection

Finfluencers leverage social media platforms to educate and influence retail investors with insights on wealth management, investment strategies, and financial products that align closely with private bankers' personalized advisory services. Private bankers use their deep expertise and client-specific financial data to offer tailored solutions, while finfluencers amplify financial literacy and market trends, creating a symbiotic relationship that enhances client engagement and informed decision-making. Both roles focus on optimizing portfolio growth, risk management, and long-term financial planning, bridging traditional banking with modern digital influence.

Key Terms

Assets Under Management (AUM)

Private bankers manage significantly higher Assets Under Management (AUM), typically ranging from millions to billions of dollars, providing personalized wealth management and investment strategies for high-net-worth clients. Finfluencers, while influential in the financial space, generally oversee minimal or no direct AUM, focusing instead on content creation and financial education to a broad audience. Discover more about the contrasting roles and financial impacts of private bankers versus finfluencers.

Fiduciary Duty

Private bankers adhere strictly to fiduciary duty, prioritizing clients' best interests through personalized financial strategies and confidential wealth management services. Finfluencers provide broad financial advice primarily via social media platforms without guaranteed fiduciary responsibility, emphasizing trends and investor engagement over individualized care. Explore the distinct roles and responsibilities of private bankers versus finfluencers to understand their impact on your financial decisions.

Social Media Reach

Private bankers typically have a niche clientele with personalized financial strategies, focusing on trust and confidentiality, while finfluencers leverage social media platforms to reach millions by sharing accessible financial tips and market updates instantly. The average finfluencer commands a broader audience across Instagram, TikTok, and YouTube, generating higher engagement rates and viral potential compared to the limited but deeper connections maintained by private bankers. Explore the evolving dynamics of financial communication and influence in the digital era to learn more.

Source and External Links

What Is a Private Banker? Should You Have One? - NerdWallet - A private banker offers specialized banking services such as investments, trusts, and loans to high-net-worth individuals, providing concierge-like financial services often within a dedicated private banking division.

Private Banking | Independent Bank - A private banker acts as a dedicated financial partner and trusted advisor, providing personalized financial planning, tailored lending, and priority service to clients who meet specific asset or income requirements.

Citi Private Bank: Private banking services for Global Citizens - Citi Private Bank serves wealthy individuals and families globally with customized private banking services that include wealth preservation, growth strategies, and access to sophisticated resources worldwide.

dowidth.com

dowidth.com