Shadow banking consists of non-bank financial intermediaries that provide lending and credit services outside traditional banking regulations, often involving higher risks and less transparency. Microfinance institutions focus on providing small loans, savings, and financial services to low-income individuals or small businesses, promoting financial inclusion and economic development. Explore the key differences and impacts of shadow banking and microfinance institutions on global finance.

Why it is important

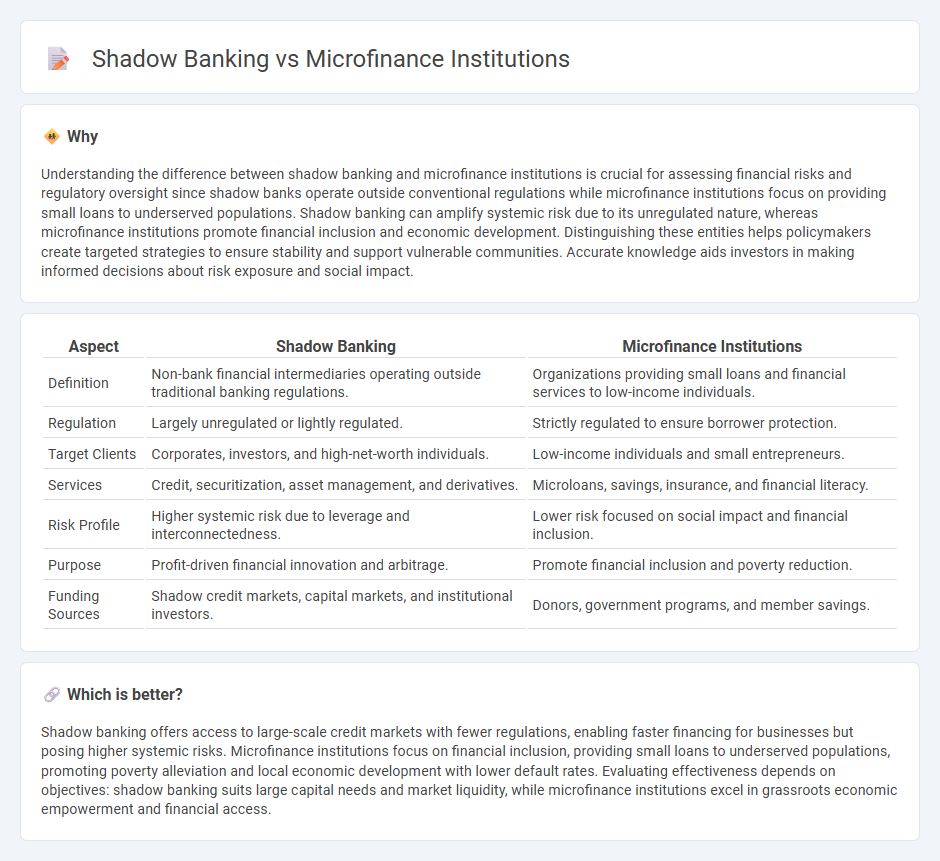

Understanding the difference between shadow banking and microfinance institutions is crucial for assessing financial risks and regulatory oversight since shadow banks operate outside conventional regulations while microfinance institutions focus on providing small loans to underserved populations. Shadow banking can amplify systemic risk due to its unregulated nature, whereas microfinance institutions promote financial inclusion and economic development. Distinguishing these entities helps policymakers create targeted strategies to ensure stability and support vulnerable communities. Accurate knowledge aids investors in making informed decisions about risk exposure and social impact.

Comparison Table

| Aspect | Shadow Banking | Microfinance Institutions |

|---|---|---|

| Definition | Non-bank financial intermediaries operating outside traditional banking regulations. | Organizations providing small loans and financial services to low-income individuals. |

| Regulation | Largely unregulated or lightly regulated. | Strictly regulated to ensure borrower protection. |

| Target Clients | Corporates, investors, and high-net-worth individuals. | Low-income individuals and small entrepreneurs. |

| Services | Credit, securitization, asset management, and derivatives. | Microloans, savings, insurance, and financial literacy. |

| Risk Profile | Higher systemic risk due to leverage and interconnectedness. | Lower risk focused on social impact and financial inclusion. |

| Purpose | Profit-driven financial innovation and arbitrage. | Promote financial inclusion and poverty reduction. |

| Funding Sources | Shadow credit markets, capital markets, and institutional investors. | Donors, government programs, and member savings. |

Which is better?

Shadow banking offers access to large-scale credit markets with fewer regulations, enabling faster financing for businesses but posing higher systemic risks. Microfinance institutions focus on financial inclusion, providing small loans to underserved populations, promoting poverty alleviation and local economic development with lower default rates. Evaluating effectiveness depends on objectives: shadow banking suits large capital needs and market liquidity, while microfinance institutions excel in grassroots economic empowerment and financial access.

Connection

Shadow banking and microfinance institutions are connected through their roles in providing alternative credit sources outside traditional banking systems, often targeting underserved or unbanked populations. Both entities operate with less regulation, allowing quicker access to funds but increased risk exposure. This intertwined dynamic supports financial inclusion while also raising concerns about transparency and systemic stability.

Key Terms

Financial Inclusion

Microfinance institutions (MFIs) primarily target underserved populations with small loans, savings, and financial literacy programs to promote financial inclusion and poverty alleviation. Shadow banking involves non-bank financial intermediaries that provide credit outside traditional banking regulations, often lacking transparency and regulatory oversight, which can limit access for marginalized groups. Explore how these two sectors impact financial inclusion strategies and their roles in economic development.

Regulatory Oversight

Microfinance institutions operate under strict regulatory oversight designed to protect low-income borrowers and promote financial inclusion, while shadow banking entities often function with limited or no regulation, posing higher systemic risks. Regulatory frameworks for microfinance enforce transparency, lending limits, and consumer protection mechanisms, contrasting sharply with the opaque practices of shadow banks. Explore the complexities of these regulatory differences to understand their impact on financial stability.

Credit Risk

Microfinance institutions primarily serve low-income individuals with small loans, managing credit risk through stringent borrower evaluation and local relationship-based lending, reducing default rates. Shadow banking involves non-bank financial intermediaries engaging in high-risk lending activities with less regulatory oversight, which heightens credit risk due to opaque practices and leverage. Explore detailed insights into credit risk management strategies across microfinance institutions and shadow banking entities.

Source and External Links

Kiva Microfinance 101 - Provides an overview of microfinance, including its purpose and impact on communities worldwide.

Nuts and Bolts of Microfinance - Offers insights into the vision, mission, and objectives of microfinance, focusing on resource management and financial efficiency.

MFIN INDIA - Works towards the robust development of the microfinance sector in India, focusing on strengthening the ecosystem and promoting responsible lending practices.

dowidth.com

dowidth.com