Web scraping for stock data involves extracting real-time financial information from websites to analyze market trends and make informed investment decisions. Satellite data analysis leverages high-resolution imagery to assess economic activities, such as crop yields or construction progress, providing alternative insights into market conditions. Explore the advantages of both methods to enhance your financial analytics strategy.

Why it is important

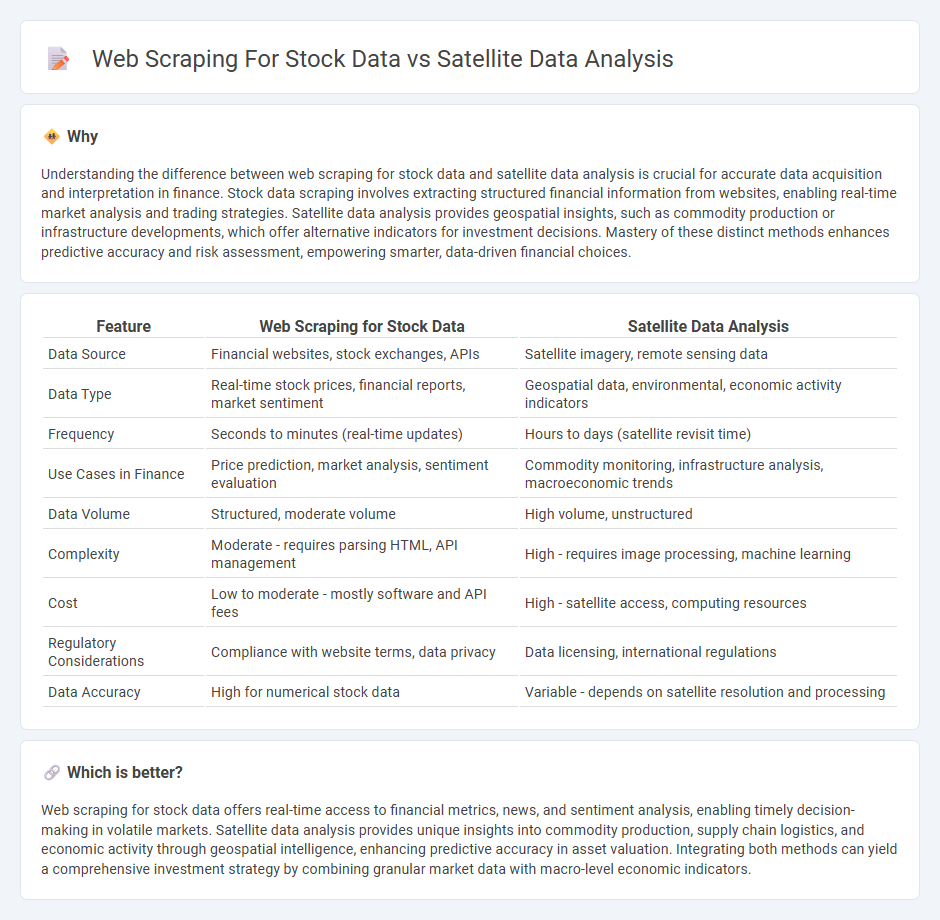

Understanding the difference between web scraping for stock data and satellite data analysis is crucial for accurate data acquisition and interpretation in finance. Stock data scraping involves extracting structured financial information from websites, enabling real-time market analysis and trading strategies. Satellite data analysis provides geospatial insights, such as commodity production or infrastructure developments, which offer alternative indicators for investment decisions. Mastery of these distinct methods enhances predictive accuracy and risk assessment, empowering smarter, data-driven financial choices.

Comparison Table

| Feature | Web Scraping for Stock Data | Satellite Data Analysis |

|---|---|---|

| Data Source | Financial websites, stock exchanges, APIs | Satellite imagery, remote sensing data |

| Data Type | Real-time stock prices, financial reports, market sentiment | Geospatial data, environmental, economic activity indicators |

| Frequency | Seconds to minutes (real-time updates) | Hours to days (satellite revisit time) |

| Use Cases in Finance | Price prediction, market analysis, sentiment evaluation | Commodity monitoring, infrastructure analysis, macroeconomic trends |

| Data Volume | Structured, moderate volume | High volume, unstructured |

| Complexity | Moderate - requires parsing HTML, API management | High - requires image processing, machine learning |

| Cost | Low to moderate - mostly software and API fees | High - satellite access, computing resources |

| Regulatory Considerations | Compliance with website terms, data privacy | Data licensing, international regulations |

| Data Accuracy | High for numerical stock data | Variable - depends on satellite resolution and processing |

Which is better?

Web scraping for stock data offers real-time access to financial metrics, news, and sentiment analysis, enabling timely decision-making in volatile markets. Satellite data analysis provides unique insights into commodity production, supply chain logistics, and economic activity through geospatial intelligence, enhancing predictive accuracy in asset valuation. Integrating both methods can yield a comprehensive investment strategy by combining granular market data with macro-level economic indicators.

Connection

Web scraping for stock data enables real-time collection of financial metrics, while satellite data analysis provides insights into economic activities such as crop yields, factory output, and retail traffic. Integrating these datasets enhances predictive models by correlating market trends with tangible, geo-spatial indicators, offering investors a competitive edge in identifying asset price movements. Advanced machine learning algorithms leverage this combined information to improve accuracy in forecasting stock performance and market volatility.

Key Terms

Alternative Data

Satellite data analysis offers high-resolution, real-time insights by capturing earth observations relevant to economic activities, such as monitoring supply chain movement or gathering agricultural yield estimates. Web scraping extracts vast volumes of structured and unstructured financial data from websites, news portals, earnings reports, and social media to detect market sentiment and corporate performance indicators. Explore how integrating these alternative data sources can enhance predictive accuracy and investment strategies.

Market Sentiment

Satellite data analysis leverages high-resolution imagery and geospatial intelligence to gauge economic activities influencing market sentiment, such as shipping traffic and factory output. Web scraping collects real-time textual data from financial news, social media, and forums to capture investor sentiment and market trends. Explore how these advanced methods can enhance your market sentiment insights.

Alpha Generation

Satellite data analysis offers unique insights into real-world economic activities by monitoring supply chains, inventory levels, and industrial output from space, enabling quantitative hedge funds to generate alpha from alternative data sources. Web scraping collects vast amounts of real-time financial news, social media sentiment, and company reports, providing a rich dataset for machine learning models to exploit market inefficiencies. Explore how these cutting-edge techniques enhance alpha generation strategies in modern quantitative finance.

Source and External Links

A Beginner's Guide to Satellite Data - This guide provides an introduction to satellite data, explaining how it is collected and analyzed using sensors and spectral bands.

Flow of Satellite Data Analysis - This resource outlines the steps involved in analyzing satellite data, including finding and downloading data, selecting analysis methods, and loading the data for processing.

Satellite Data Analytics By EOSDA - EOSDA offers advanced satellite data analytics tools and services, focusing on AI-powered solutions for industries like agriculture and forestry.

dowidth.com

dowidth.com