Altcoins staking involves locking digital assets to secure a blockchain network and earn passive rewards, while governance participation allows token holders to influence protocol decisions and strategic development. Staking often provides predictable income streams based on network inflation or transaction fees, whereas governance engagement grants voting power on proposals that can affect the project's future direction. Explore the differences between altcoins staking and governance participation to optimize your crypto investment strategy.

Why it is important

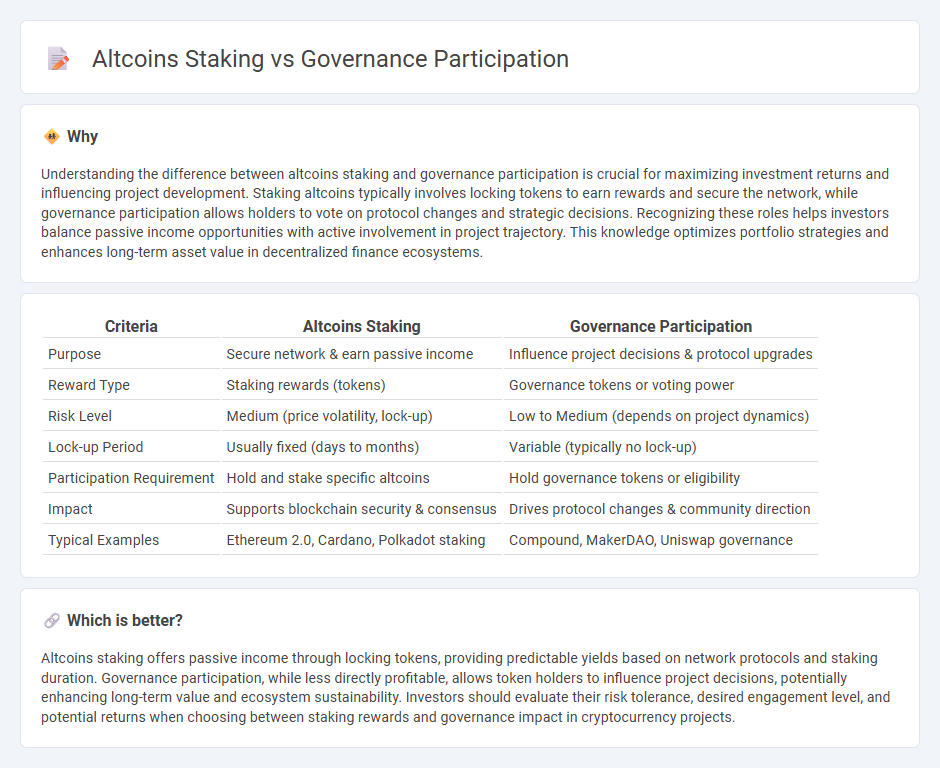

Understanding the difference between altcoins staking and governance participation is crucial for maximizing investment returns and influencing project development. Staking altcoins typically involves locking tokens to earn rewards and secure the network, while governance participation allows holders to vote on protocol changes and strategic decisions. Recognizing these roles helps investors balance passive income opportunities with active involvement in project trajectory. This knowledge optimizes portfolio strategies and enhances long-term asset value in decentralized finance ecosystems.

Comparison Table

| Criteria | Altcoins Staking | Governance Participation |

|---|---|---|

| Purpose | Secure network & earn passive income | Influence project decisions & protocol upgrades |

| Reward Type | Staking rewards (tokens) | Governance tokens or voting power |

| Risk Level | Medium (price volatility, lock-up) | Low to Medium (depends on project dynamics) |

| Lock-up Period | Usually fixed (days to months) | Variable (typically no lock-up) |

| Participation Requirement | Hold and stake specific altcoins | Hold governance tokens or eligibility |

| Impact | Supports blockchain security & consensus | Drives protocol changes & community direction |

| Typical Examples | Ethereum 2.0, Cardano, Polkadot staking | Compound, MakerDAO, Uniswap governance |

Which is better?

Altcoins staking offers passive income through locking tokens, providing predictable yields based on network protocols and staking duration. Governance participation, while less directly profitable, allows token holders to influence project decisions, potentially enhancing long-term value and ecosystem sustainability. Investors should evaluate their risk tolerance, desired engagement level, and potential returns when choosing between staking rewards and governance impact in cryptocurrency projects.

Connection

Altcoins staking enhances network security by locking tokens, which grants holders voting power in governance decisions, aligning financial incentives with protocol development. Active governance participation enables stakers to influence key parameters, such as inflation rates and feature upgrades, directly affecting the value and stability of their staked assets. This interconnected mechanism fosters a decentralized ecosystem where financial rewards depend on responsible stewardship and consensus-building.

Key Terms

Voting Power

Governance participation in blockchain networks grants token holders voting power proportional to their stake, influencing project direction and protocol upgrades. Altcoins staking often increases voting power by locking tokens, enabling more significant influence in decision-making processes across decentralized autonomous organizations (DAOs). Explore the dynamics of governance voting power and staking strategies to optimize your impact within crypto ecosystems.

Validator

Validator participation in governance involves actively voting on protocol upgrades and proposals, directly influencing the future of blockchain networks. Unlike altcoins staking, which primarily aims to earn rewards by securing the network, governance participation ensures stakeholders shape decision-making processes and protocol parameters. Explore how validator roles impact decentralization and token value to deepen your understanding.

Token Utility

Governance participation empowers token holders to influence protocol decisions, enhancing decentralization and aligning community interests with project development, whereas altcoins staking primarily secures network operations and earns passive rewards. Token utility in governance involves voting rights and proposal submissions, driving active engagement and long-term value creation, while staking utility focuses on network stability and liquidity provision. Explore how each mechanism amplifies token functionality and community impact by learning more about their distinct roles in blockchain ecosystems.

Source and External Links

Strong Citizen Participation as a backbone of democratic governance - Citizen participation strengthens democracy through more transparent policy-making, better-informed decisions, greater inclusivity, and increased legitimacy, fostering trust in public institutions.

Good Governance and Citizen Participation - Citizen participation is key to good governance, enabling people to influence, monitor, and hold public decisions accountable, thus enhancing transparency, responsibility, and responsiveness in government.

Public Participation Guide: Introduction to Public Participation - Public participation involves varying levels from informing to empowering citizens in decision-making, resulting in better decisions reflecting public interests and fostering community capacity to address social challenges.

dowidth.com

dowidth.com