Special Purpose Acquisition Companies (SPACs) have surged as an alternative to traditional Venture Capital (VC), offering quicker public market access without prolonged fundraising cycles. Unlike VC funds that invest in early-stage startups for long-term growth, SPACs raise capital through public offerings to acquire or merge with private companies, accelerating liquidity events. Explore the distinct mechanisms, risk profiles, and market impacts of SPACs versus Venture Capital to understand which financing route suits your investment strategy best.

Why it is important

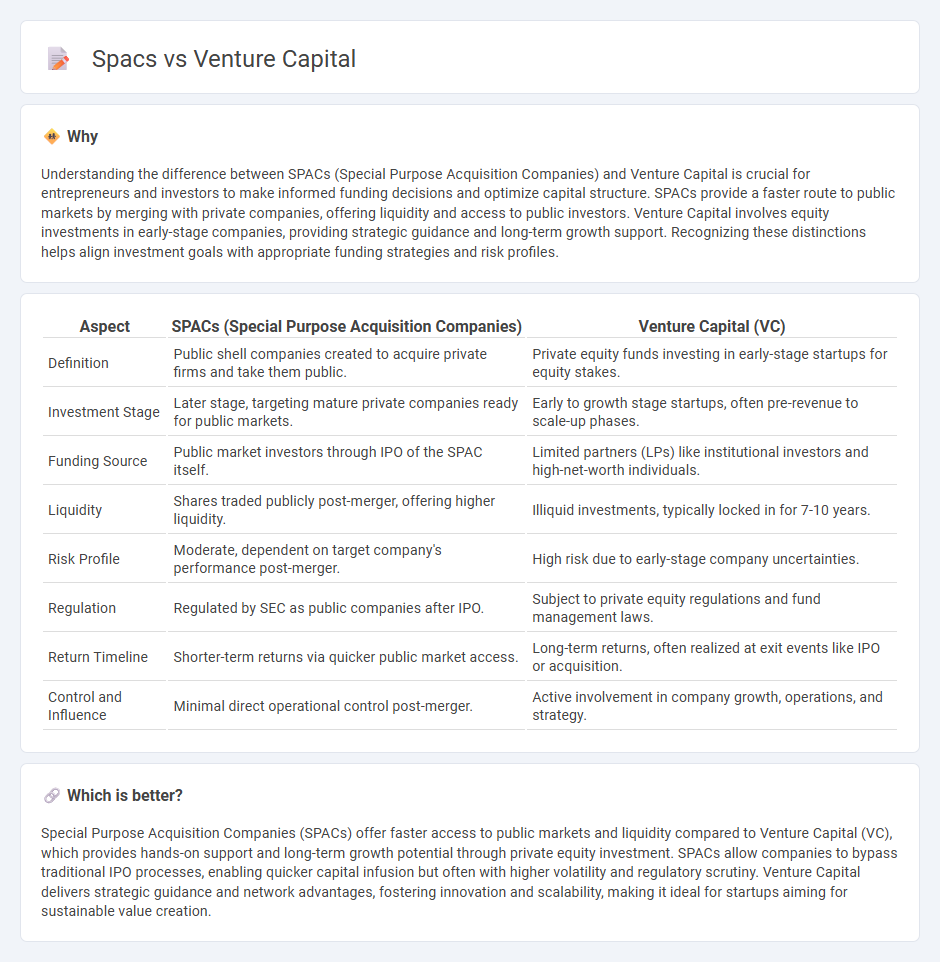

Understanding the difference between SPACs (Special Purpose Acquisition Companies) and Venture Capital is crucial for entrepreneurs and investors to make informed funding decisions and optimize capital structure. SPACs provide a faster route to public markets by merging with private companies, offering liquidity and access to public investors. Venture Capital involves equity investments in early-stage companies, providing strategic guidance and long-term growth support. Recognizing these distinctions helps align investment goals with appropriate funding strategies and risk profiles.

Comparison Table

| Aspect | SPACs (Special Purpose Acquisition Companies) | Venture Capital (VC) |

|---|---|---|

| Definition | Public shell companies created to acquire private firms and take them public. | Private equity funds investing in early-stage startups for equity stakes. |

| Investment Stage | Later stage, targeting mature private companies ready for public markets. | Early to growth stage startups, often pre-revenue to scale-up phases. |

| Funding Source | Public market investors through IPO of the SPAC itself. | Limited partners (LPs) like institutional investors and high-net-worth individuals. |

| Liquidity | Shares traded publicly post-merger, offering higher liquidity. | Illiquid investments, typically locked in for 7-10 years. |

| Risk Profile | Moderate, dependent on target company's performance post-merger. | High risk due to early-stage company uncertainties. |

| Regulation | Regulated by SEC as public companies after IPO. | Subject to private equity regulations and fund management laws. |

| Return Timeline | Shorter-term returns via quicker public market access. | Long-term returns, often realized at exit events like IPO or acquisition. |

| Control and Influence | Minimal direct operational control post-merger. | Active involvement in company growth, operations, and strategy. |

Which is better?

Special Purpose Acquisition Companies (SPACs) offer faster access to public markets and liquidity compared to Venture Capital (VC), which provides hands-on support and long-term growth potential through private equity investment. SPACs allow companies to bypass traditional IPO processes, enabling quicker capital infusion but often with higher volatility and regulatory scrutiny. Venture Capital delivers strategic guidance and network advantages, fostering innovation and scalability, making it ideal for startups aiming for sustainable value creation.

Connection

Special Purpose Acquisition Companies (SPACs) provide an alternative exit strategy for venture capital-backed startups by enabling quicker public market access compared to traditional IPOs. Venture capital firms often invest in SPACs to capitalize on high-growth opportunities and accelerate liquidity for their portfolio companies. This synergy enhances capital flow efficiency and fosters innovation within the startup ecosystem.

Key Terms

Equity Stake

Venture capital investments typically secure significant equity stakes in startups, ranging from 10% to 40%, offering investors substantial control and influence. In contrast, SPACs (Special Purpose Acquisition Companies) acquire public companies, often resulting in diluted equity stakes for initial investors due to post-merger share structures. Explore the detailed differences in equity positions and control mechanisms between venture capital and SPACs to make informed investment decisions.

IPO (Initial Public Offering)

Venture capital-backed companies typically undergo an IPO to raise substantial funds and gain market credibility, often taking years to reach this stage with rigorous regulatory scrutiny. SPACs (Special Purpose Acquisition Companies) offer a faster, less conventional IPO route by merging with private firms, enabling quicker access to public markets but sometimes with higher volatility and regulatory uncertainty. Explore the nuances of IPO strategies with venture capital and SPACs to determine the optimal path for company growth and investment return.

PIPE (Private Investment in Public Equity)

Private Investment in Public Equity (PIPE) transactions serve as a crucial financing mechanism in both venture capital and SPAC deals, enabling investors to inject capital directly into public companies at negotiated prices. In venture capital, PIPEs often provide growth-stage firms with essential liquidity, while in SPACs, PIPE financing is typically deployed post-de-SPAC merger to fuel expansion and operational scaling. Discover how PIPE structures uniquely impact investor returns and capital formation by exploring detailed case studies and market data.

Source and External Links

What is Venture Capital? - Venture capital transforms innovative ideas and research into high-growth companies by providing long-term, high-risk equity investments and active partnership to entrepreneurs.

What is venture capital? - Venture capital is private equity funding for startups and early-stage companies with high growth potential, offered in exchange for equity and with the expectation of significant returns if the company succeeds, despite the high risk of loss.

Fund your business | U.S. Small Business Administration - Venture capital focuses on high-growth businesses, provides funding in return for ownership and often a board seat, and involves a longer, riskier investment horizon compared to traditional loans.

dowidth.com

dowidth.com