Collateralized reinsurance involves a reinsurer setting aside collateral to secure coverage, ensuring prompt payment in the event of a claim, while catastrophe bonds transfer disaster risk to investors by issuing bonds that pay high yields unless a specified catastrophe occurs. Both mechanisms provide alternative risk financing solutions for insurers facing large-scale exposure to natural disasters, improving capital efficiency and risk diversification. Explore the nuances and advantages of collateralized reinsurance and catastrophe bonds to optimize your risk management strategy.

Why it is important

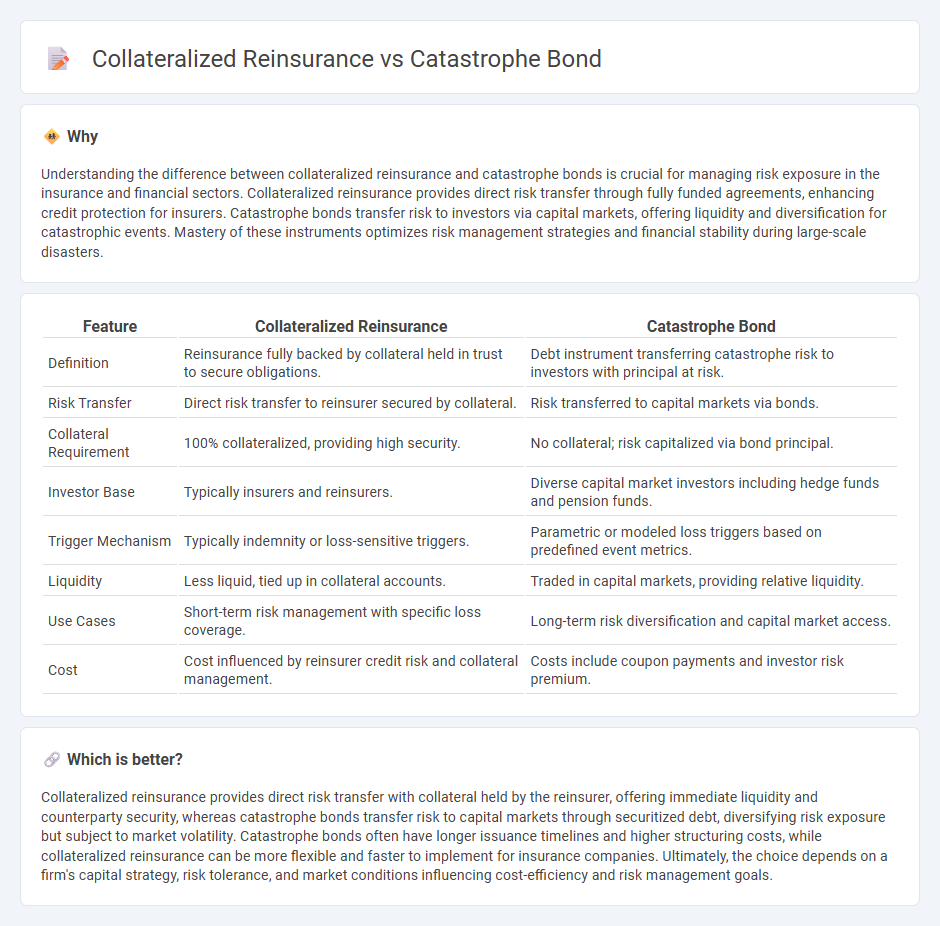

Understanding the difference between collateralized reinsurance and catastrophe bonds is crucial for managing risk exposure in the insurance and financial sectors. Collateralized reinsurance provides direct risk transfer through fully funded agreements, enhancing credit protection for insurers. Catastrophe bonds transfer risk to investors via capital markets, offering liquidity and diversification for catastrophic events. Mastery of these instruments optimizes risk management strategies and financial stability during large-scale disasters.

Comparison Table

| Feature | Collateralized Reinsurance | Catastrophe Bond |

|---|---|---|

| Definition | Reinsurance fully backed by collateral held in trust to secure obligations. | Debt instrument transferring catastrophe risk to investors with principal at risk. |

| Risk Transfer | Direct risk transfer to reinsurer secured by collateral. | Risk transferred to capital markets via bonds. |

| Collateral Requirement | 100% collateralized, providing high security. | No collateral; risk capitalized via bond principal. |

| Investor Base | Typically insurers and reinsurers. | Diverse capital market investors including hedge funds and pension funds. |

| Trigger Mechanism | Typically indemnity or loss-sensitive triggers. | Parametric or modeled loss triggers based on predefined event metrics. |

| Liquidity | Less liquid, tied up in collateral accounts. | Traded in capital markets, providing relative liquidity. |

| Use Cases | Short-term risk management with specific loss coverage. | Long-term risk diversification and capital market access. |

| Cost | Cost influenced by reinsurer credit risk and collateral management. | Costs include coupon payments and investor risk premium. |

Which is better?

Collateralized reinsurance provides direct risk transfer with collateral held by the reinsurer, offering immediate liquidity and counterparty security, whereas catastrophe bonds transfer risk to capital markets through securitized debt, diversifying risk exposure but subject to market volatility. Catastrophe bonds often have longer issuance timelines and higher structuring costs, while collateralized reinsurance can be more flexible and faster to implement for insurance companies. Ultimately, the choice depends on a firm's capital strategy, risk tolerance, and market conditions influencing cost-efficiency and risk management goals.

Connection

Collateralized reinsurance and catastrophe bonds both transfer insurance risk from insurers to capital market investors, enhancing financial capacity to absorb large-scale losses from natural disasters. Collateralized reinsurance involves fully collateralized contracts where funds are set aside to cover claims, while catastrophe bonds provide investors with higher yields in exchange for potential loss of principal if specified events occur. Both instruments improve risk diversification and liquidity in the insurance-linked securities market.

Key Terms

Risk Transfer

Catastrophe bonds transfer insurance risk to capital market investors by issuing securities that pay off in specified disaster scenarios, enabling insurers to access diversified funding. Collateralized reinsurance requires upfront collateral from reinsurers to cover potential claims, ensuring direct risk coverage with secured funds. Explore further to understand which risk transfer method suits your risk management strategy best.

Collateralization

Catastrophe bonds provide risk transfer through capital markets, while collateralized reinsurance involves the reinsurer's funds being fully collateralized to cover potential losses, enhancing credit protection for cedents. Collateralization ensures immediate availability of capital to pay claims, reducing default risk and improving transparency in exposure management. Explore how collateralization impacts risk financing strategies and capital efficiency in insurance.

Trigger Mechanism

Catastrophe bonds use parametric or index triggers based on predefined events like earthquake magnitude or hurricane wind speed, enabling rapid payouts without loss adjustment. Collateralized reinsurance typically employs indemnity triggers tied to actual losses sustained by the cedent, requiring detailed loss verification before payment. Explore how varying trigger mechanisms impact risk transfer efficiency and investor return profiles in these instruments.

Source and External Links

Catastrophe bond - Wikipedia - Catastrophe bonds (cat bonds) are insurance-linked securities that transfer risks from a sponsor, usually an insurer or reinsurer, to investors, allowing sponsors to cover losses from major natural disasters by issuing bonds that investors lose principal on if a defined catastrophe occurs, and otherwise earn premiums and floating interest rates over an average maturity of about three years.

Cat Bond Primer - Wharton ESG Initiative - Catastrophe bonds are structured by the sponsor creating a special purpose vehicle (SPV) that issues the bonds and invests the principal safely, paying premiums and floating returns to investors while transferring the catastrophic risk from the sponsor to investors who lose principal if the bond's trigger event occurs.

What is a catastrophe bond? - Artemis Resource Library - Catastrophe bonds provide coverage for single or multiple catastrophic loss events and can be structured for per-occurrence or aggregate cover, enabling insurers and corporations to transfer natural disaster risk to capital markets efficiently.

dowidth.com

dowidth.com