Dim Sum bonds are Chinese yuan-denominated bonds issued outside mainland China, primarily in Hong Kong, attracting investors seeking exposure to China's currency without mainland restrictions. Kangaroo bonds are Australian dollar-denominated bonds issued in the Australian market by foreign entities, offering diversification and access to Australia's stable financial environment. Explore further to understand the key differences and strategic advantages of each bond type.

Why it is important

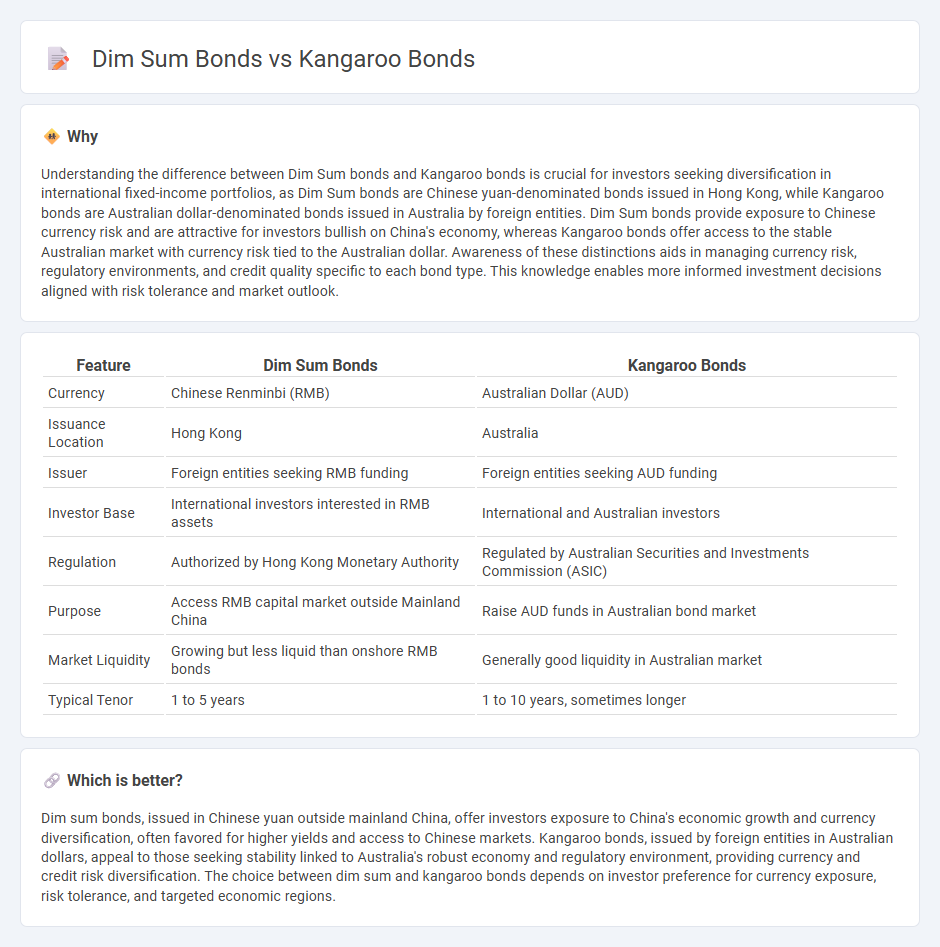

Understanding the difference between Dim Sum bonds and Kangaroo bonds is crucial for investors seeking diversification in international fixed-income portfolios, as Dim Sum bonds are Chinese yuan-denominated bonds issued in Hong Kong, while Kangaroo bonds are Australian dollar-denominated bonds issued in Australia by foreign entities. Dim Sum bonds provide exposure to Chinese currency risk and are attractive for investors bullish on China's economy, whereas Kangaroo bonds offer access to the stable Australian market with currency risk tied to the Australian dollar. Awareness of these distinctions aids in managing currency risk, regulatory environments, and credit quality specific to each bond type. This knowledge enables more informed investment decisions aligned with risk tolerance and market outlook.

Comparison Table

| Feature | Dim Sum Bonds | Kangaroo Bonds |

|---|---|---|

| Currency | Chinese Renminbi (RMB) | Australian Dollar (AUD) |

| Issuance Location | Hong Kong | Australia |

| Issuer | Foreign entities seeking RMB funding | Foreign entities seeking AUD funding |

| Investor Base | International investors interested in RMB assets | International and Australian investors |

| Regulation | Authorized by Hong Kong Monetary Authority | Regulated by Australian Securities and Investments Commission (ASIC) |

| Purpose | Access RMB capital market outside Mainland China | Raise AUD funds in Australian bond market |

| Market Liquidity | Growing but less liquid than onshore RMB bonds | Generally good liquidity in Australian market |

| Typical Tenor | 1 to 5 years | 1 to 10 years, sometimes longer |

Which is better?

Dim sum bonds, issued in Chinese yuan outside mainland China, offer investors exposure to China's economic growth and currency diversification, often favored for higher yields and access to Chinese markets. Kangaroo bonds, issued by foreign entities in Australian dollars, appeal to those seeking stability linked to Australia's robust economy and regulatory environment, providing currency and credit risk diversification. The choice between dim sum and kangaroo bonds depends on investor preference for currency exposure, risk tolerance, and targeted economic regions.

Connection

Dim sum bonds and Kangaroo bonds are both types of foreign bonds issued in foreign currencies within specific markets, with dim sum bonds being yuan-denominated bonds issued in Hong Kong and Kangaroo bonds being Australian dollar-denominated bonds issued in Australia by foreign entities. These financial instruments provide issuers with access to capital in regional markets while offering investors opportunities to diversify their portfolios with foreign currency assets. Their connection lies in their role as offshore bonds that enhance liquidity and cross-border investment flows in the Asia-Pacific financial system.

Key Terms

Currency denomination

Kangaroo bonds are bonds issued by foreign entities in the Australian market and denominated in Australian dollars (AUD), while Dim Sum bonds are offshore bonds issued in Hong Kong and denominated in Chinese yuan (CNY). Both instruments allow issuers to tap into specific currency investor bases, with Kangaroo bonds attracting AUD investors and Dim Sum bonds targeting those interested in CNY exposure. Explore further to understand how these currency denominations impact investor demand and risk profiles.

Issuing market

Kangaroo bonds are Australian dollar-denominated bonds issued by foreign entities in the Australian market, attracting international investors seeking exposure to Australia's robust economy. Dim sum bonds are Chinese yuan-denominated bonds issued outside mainland China, primarily in Hong Kong, targeting foreign investors interested in gaining yuan exposure while avoiding mainland capital controls. Explore the unique dynamics of these two offshore bond markets to better understand their strategic roles in global financing.

Foreign investors

Kangaroo bonds are Australian dollar-denominated bonds issued in Australia by foreign entities, attracting global investors seeking exposure to the stable Australian market. Dim sum bonds are yuan-denominated bonds issued in Hong Kong, offering foreign investors a gateway to Chinese currency investments outside mainland China. Explore how these bond types serve diverse foreign investment strategies and risk profiles.

Source and External Links

Kangaroo Bond: Understanding Its Function and Impact - A Kangaroo bond, also known as a "matilda bond," is an Australian dollar-denominated bond issued by non-Australian entities in the Australian financial market, allowing them to raise capital and diversify funding sources while offering Australian investors currency risk-free investments.

Exceptional value in kangaroo bonds - Kangaroo bonds are AUD-denominated bonds issued by foreign companies in Australia to raise capital, typically offering attractive yields and serving as an opportunity for investors to diversify and access senior secured or tier 2 debt, demonstrated recently by issuances from NatWest, Mizuho, and Lloyds.

Kangaroo Bond - Overview, How It Works, Significance - Kangaroo bonds are issued by non-Australian sovereign, supranational, and agency entities in Australian dollars, often carrying high credit ratings and serving as AAA-rated securities in the Australian bond market, providing a valuable diversification tool and collateral for the Reserve Bank of Australia.

dowidth.com

dowidth.com