Decentralized over-the-counter (OTC) trading enables peer-to-peer asset exchanges without intermediaries, offering increased privacy and flexibility compared to traditional centralized platforms. Direct Market Access (DMA) allows traders to interact directly with financial markets through institutional-grade technology, providing faster execution and enhanced transparency. Explore the detailed differences and benefits of these trading methods to optimize your investment strategies.

Why it is important

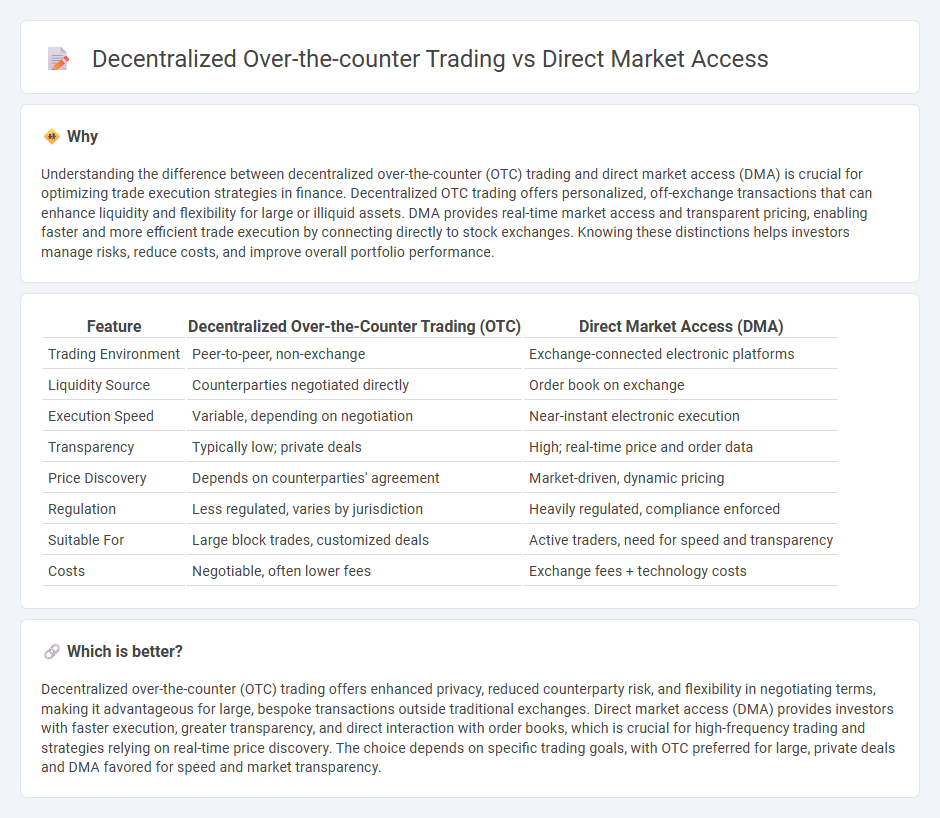

Understanding the difference between decentralized over-the-counter (OTC) trading and direct market access (DMA) is crucial for optimizing trade execution strategies in finance. Decentralized OTC trading offers personalized, off-exchange transactions that can enhance liquidity and flexibility for large or illiquid assets. DMA provides real-time market access and transparent pricing, enabling faster and more efficient trade execution by connecting directly to stock exchanges. Knowing these distinctions helps investors manage risks, reduce costs, and improve overall portfolio performance.

Comparison Table

| Feature | Decentralized Over-the-Counter Trading (OTC) | Direct Market Access (DMA) |

|---|---|---|

| Trading Environment | Peer-to-peer, non-exchange | Exchange-connected electronic platforms |

| Liquidity Source | Counterparties negotiated directly | Order book on exchange |

| Execution Speed | Variable, depending on negotiation | Near-instant electronic execution |

| Transparency | Typically low; private deals | High; real-time price and order data |

| Price Discovery | Depends on counterparties' agreement | Market-driven, dynamic pricing |

| Regulation | Less regulated, varies by jurisdiction | Heavily regulated, compliance enforced |

| Suitable For | Large block trades, customized deals | Active traders, need for speed and transparency |

| Costs | Negotiable, often lower fees | Exchange fees + technology costs |

Which is better?

Decentralized over-the-counter (OTC) trading offers enhanced privacy, reduced counterparty risk, and flexibility in negotiating terms, making it advantageous for large, bespoke transactions outside traditional exchanges. Direct market access (DMA) provides investors with faster execution, greater transparency, and direct interaction with order books, which is crucial for high-frequency trading and strategies relying on real-time price discovery. The choice depends on specific trading goals, with OTC preferred for large, private deals and DMA favored for speed and market transparency.

Connection

Decentralized over-the-counter (OTC) trading enhances liquidity by enabling direct market access (DMA) for institutional investors, bypassing traditional exchanges and intermediaries. This connection allows seamless execution of large-volume trades with reduced market impact and improved price transparency. Integrating DMA with decentralized OTC platforms streamlines transaction efficiency and risk management in financial markets.

Key Terms

Liquidity

Direct market access (DMA) offers traders immediate liquidity by connecting them directly to centralized exchanges, enabling faster order execution and transparent price discovery. Decentralized over-the-counter (OTC) trading provides access to liquidity pools without intermediaries, enhancing privacy but often resulting in wider spreads and potentially lower liquidity depth. Explore the nuances of liquidity dynamics in DMA and decentralized OTC to optimize your trading strategy.

Counterparty risk

Direct market access (DMA) offers traders immediate execution of orders on centralized exchanges, significantly reducing counterparty risk through transparent and regulated environments. In contrast, decentralized over-the-counter (OTC) trading lacks a central intermediary, exposing participants to higher counterparty risk due to the reliance on peer-to-peer trust and smart contract security. Explore the nuances of counterparty risk management in DMA and decentralized OTC trading to optimize your trading strategy.

Price transparency

Direct Market Access (DMA) offers superior price transparency by allowing traders to view real-time order books and execute trades directly on exchanges, ensuring accurate market pricing. Decentralized Over-the-Counter (OTC) trading often lacks this transparency, with prices negotiated privately and less immediate access to price data. Explore the nuances of price transparency in DMA and decentralized OTC trading to optimize your trading strategy.

Source and External Links

Direct Market Access (DMA) - Overview, How It Works, Users - Direct Market Access is an electronic trading method allowing investors to interact directly with an exchange's order book, bypassing brokers to set their own trade prices; it's typically used by advanced traders for various securities including equities and derivatives.

What is Direct Market Access (DMA) Trading Online? - Saxo Bank - DMA trading involves placing orders directly with an exchange's order book, usually accessible to institutional and high-net-worth investors, requiring specialized software and knowledge of buy or sell side market interactions.

What is Direct Market Access (DMA) in Trading? - IG - DMA offers traders direct interaction with exchange order books for greater market transparency and control over trade pricing, often used with CFD trading, but recommended only for experienced traders due to its complexity and risks.

dowidth.com

dowidth.com