Private credit and direct lending both offer alternative financing solutions outside traditional bank loans, focusing primarily on mid-market companies and underserved borrowers. Private credit involves pooled funds from institutional investors, while direct lending typically refers to non-bank lenders providing loans directly to businesses, often with more flexible terms and faster execution. Explore more to understand which financing option aligns best with your investment goals and risk appetite.

Why it is important

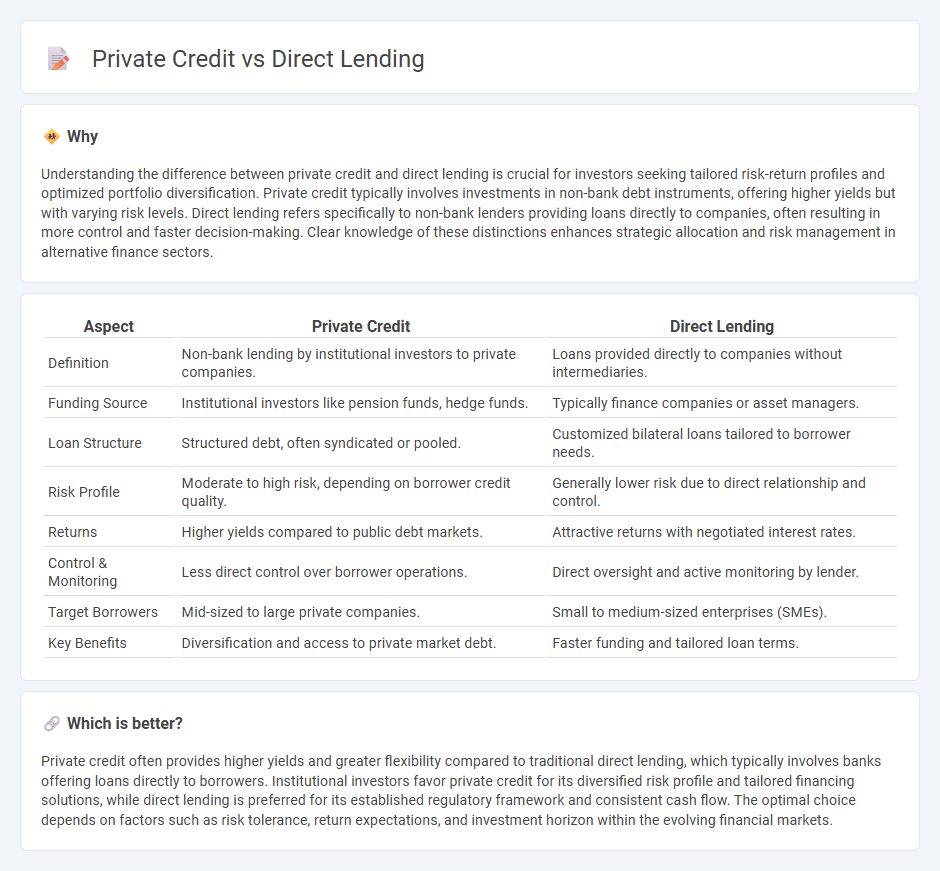

Understanding the difference between private credit and direct lending is crucial for investors seeking tailored risk-return profiles and optimized portfolio diversification. Private credit typically involves investments in non-bank debt instruments, offering higher yields but with varying risk levels. Direct lending refers specifically to non-bank lenders providing loans directly to companies, often resulting in more control and faster decision-making. Clear knowledge of these distinctions enhances strategic allocation and risk management in alternative finance sectors.

Comparison Table

| Aspect | Private Credit | Direct Lending |

|---|---|---|

| Definition | Non-bank lending by institutional investors to private companies. | Loans provided directly to companies without intermediaries. |

| Funding Source | Institutional investors like pension funds, hedge funds. | Typically finance companies or asset managers. |

| Loan Structure | Structured debt, often syndicated or pooled. | Customized bilateral loans tailored to borrower needs. |

| Risk Profile | Moderate to high risk, depending on borrower credit quality. | Generally lower risk due to direct relationship and control. |

| Returns | Higher yields compared to public debt markets. | Attractive returns with negotiated interest rates. |

| Control & Monitoring | Less direct control over borrower operations. | Direct oversight and active monitoring by lender. |

| Target Borrowers | Mid-sized to large private companies. | Small to medium-sized enterprises (SMEs). |

| Key Benefits | Diversification and access to private market debt. | Faster funding and tailored loan terms. |

Which is better?

Private credit often provides higher yields and greater flexibility compared to traditional direct lending, which typically involves banks offering loans directly to borrowers. Institutional investors favor private credit for its diversified risk profile and tailored financing solutions, while direct lending is preferred for its established regulatory framework and consistent cash flow. The optimal choice depends on factors such as risk tolerance, return expectations, and investment horizon within the evolving financial markets.

Connection

Private credit and direct lending are closely connected as direct lending represents a significant segment within the private credit market, where non-bank institutions provide loans directly to mid-sized companies. This relationship allows borrowers to access customized financing solutions outside traditional banking channels, often with greater flexibility and faster execution. Investors in private credit benefit from higher yields and diversified risk profiles driven by direct lending strategies.

Key Terms

Capital Structure

Direct lending typically involves non-bank lenders providing loans directly to middle-market companies, often secured by senior debt positions within the capital structure, offering lenders priority in repayment. Private credit encompasses a broader range of debt instruments, including mezzanine and subordinated loans, which occupy lower tiers of the capital stack and carry higher risk and yield profiles. Explore the nuances between direct lending and private credit to better understand their implications on capital structure and investment strategies.

Risk Profile

Direct lending typically involves loans made directly to small and mid-sized businesses, often secured by assets, resulting in a moderate risk profile with predictable cash flows. Private credit encompasses a broader spectrum, including mezzanine debt and distressed loans, carrying higher risk due to leverage and borrower credit quality variability. Explore further to understand how risk profiles influence return expectations in these alternative lending strategies.

Regulatory Oversight

Direct lending operates with lighter regulatory oversight compared to private credit, which often involves more complex structures and is subject to stricter financial regulations. Regulatory bodies like the SEC and the FDIC monitor private credit funds to ensure transparency, investor protection, and compliance with lending standards. Explore the nuances of regulatory environments impacting direct lending and private credit for better investment strategies.

Source and External Links

Direct lending - Wikipedia - Direct lending is a form of corporate debt where non-bank lenders provide loans directly to smaller or mid-sized companies without intermediaries, typically focusing on senior, secured first lien debt with regular interest payments, and has grown significantly in assets under management over the past decade.

Direct Lending Evolution: Driving Force of Private Credit Market - Direct lending is a private credit strategy giving illiquid loans to middle market companies outside banks, growing due to banks withdrawing from middle market lending and strong demand from private equity and investors seeking higher yield in a constrained banking environment.

Direct lending: benefits, risks and opportunities (Oaktree Capital) - Direct lending involves non-bank creditors making loans to middle-market companies, financing buyouts, acquisitions, growth, and recapitalizations, offering a vast market with over 200,000 companies accounting for a large segment of private-sector GDP and employment in the US and Europe.

dowidth.com

dowidth.com