Yield farming leverages decentralized finance (DeFi) protocols to earn returns by staking or lending cryptocurrencies, often involving liquidity pools on platforms like Uniswap and Compound. Crowdfunding raises capital through collective contributions from individuals, typically via platforms such as Kickstarter or Indiegogo, supporting projects or startups without giving equity. Explore the distinct benefits and risks of yield farming versus crowdfunding to make informed financial decisions.

Why it is important

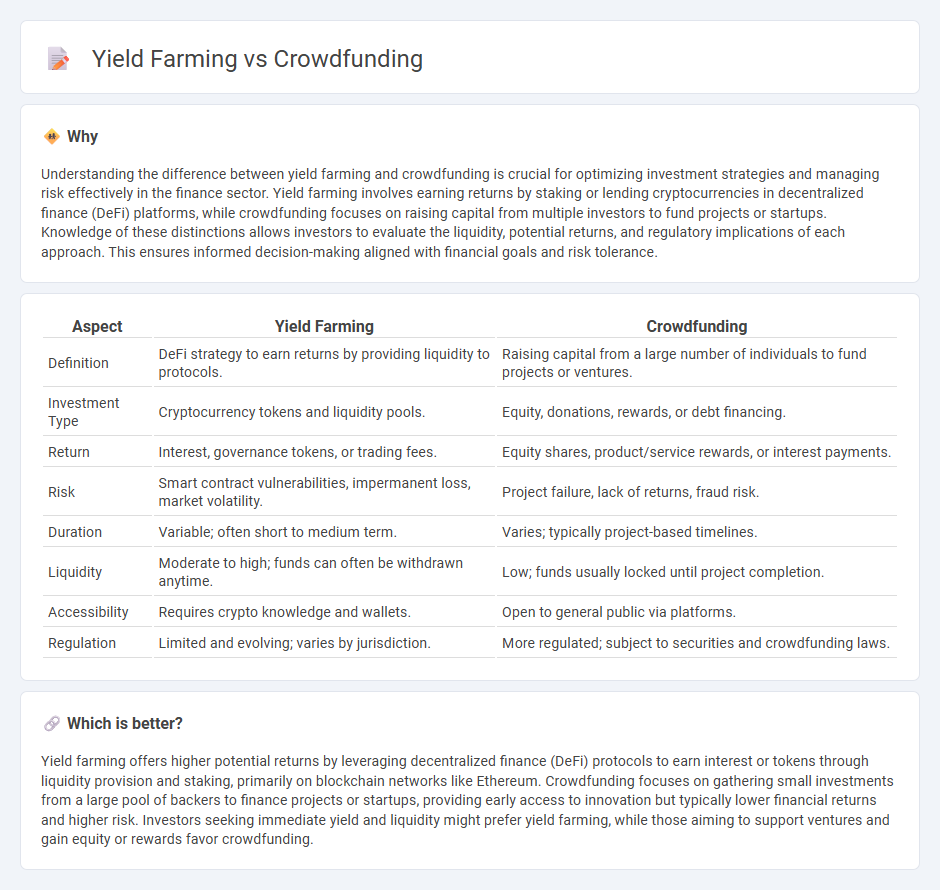

Understanding the difference between yield farming and crowdfunding is crucial for optimizing investment strategies and managing risk effectively in the finance sector. Yield farming involves earning returns by staking or lending cryptocurrencies in decentralized finance (DeFi) platforms, while crowdfunding focuses on raising capital from multiple investors to fund projects or startups. Knowledge of these distinctions allows investors to evaluate the liquidity, potential returns, and regulatory implications of each approach. This ensures informed decision-making aligned with financial goals and risk tolerance.

Comparison Table

| Aspect | Yield Farming | Crowdfunding |

|---|---|---|

| Definition | DeFi strategy to earn returns by providing liquidity to protocols. | Raising capital from a large number of individuals to fund projects or ventures. |

| Investment Type | Cryptocurrency tokens and liquidity pools. | Equity, donations, rewards, or debt financing. |

| Return | Interest, governance tokens, or trading fees. | Equity shares, product/service rewards, or interest payments. |

| Risk | Smart contract vulnerabilities, impermanent loss, market volatility. | Project failure, lack of returns, fraud risk. |

| Duration | Variable; often short to medium term. | Varies; typically project-based timelines. |

| Liquidity | Moderate to high; funds can often be withdrawn anytime. | Low; funds usually locked until project completion. |

| Accessibility | Requires crypto knowledge and wallets. | Open to general public via platforms. |

| Regulation | Limited and evolving; varies by jurisdiction. | More regulated; subject to securities and crowdfunding laws. |

Which is better?

Yield farming offers higher potential returns by leveraging decentralized finance (DeFi) protocols to earn interest or tokens through liquidity provision and staking, primarily on blockchain networks like Ethereum. Crowdfunding focuses on gathering small investments from a large pool of backers to finance projects or startups, providing early access to innovation but typically lower financial returns and higher risk. Investors seeking immediate yield and liquidity might prefer yield farming, while those aiming to support ventures and gain equity or rewards favor crowdfunding.

Connection

Yield farming and crowdfunding intersect in decentralized finance (DeFi) as both utilize blockchain technology to mobilize capital from individual investors. Yield farming allows participants to earn returns by providing liquidity to DeFi protocols, while crowdfunding enables pooled investments to fund projects or startups. Together, they democratize access to investment opportunities, leveraging smart contracts to ensure transparency and automated distribution of returns.

Key Terms

Capital Raising (Crowdfunding)

Crowdfunding enables startups and projects to raise capital by collecting small investments from a large pool of individual backers, offering equity or rewards in exchange. It provides accessible funding opportunities for entrepreneurs without relying on traditional financial institutions, promoting community engagement and market validation. Explore the key differences and strategic advantages of crowdfunding to maximize your capital-raising efforts.

Liquidity Pools (Yield Farming)

Liquidity pools in yield farming are decentralized finance (DeFi) protocols where users supply cryptocurrency assets to facilitate trading and earn rewards, typically transaction fees or token incentives. Unlike crowdfunding, which pools funds for a project or venture in exchange for equity or products, liquidity pools allow yield farmers to earn passive income by providing liquidity to decentralized exchanges (DEXs). Explore more about how liquidity pools optimize returns and manage risks in yield farming strategies.

Investor Returns

Crowdfunding offers investors potential returns through project equity, rewards, or interest, often with longer time horizons and varying risk levels depending on project success. Yield farming provides liquidity providers with cryptocurrency rewards based on the amount and duration of assets staked, delivering comparatively faster but more volatile returns influenced by market conditions and platform risks. Explore the detailed comparisons and strategies to maximize investor returns in both crowdfunding and yield farming.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of raising money from a large number of people, typically via the internet, to fund projects or ventures without traditional financial intermediaries.

What is crowdfunding? Here are four types for startups to know - Stripe - Crowdfunding enables startups and projects to raise funds through collective efforts of individuals online, providing an alternative to traditional financing methods.

Crowdfunding explained - European Commission - Crowdfunding is an online method to finance projects by collecting money from a large number of people, often used by startups and SMEs to access alternative capital and market insights.

dowidth.com

dowidth.com