Tokenized treasuries offer enhanced liquidity and transparency by digitizing government debt securities on blockchain platforms, enabling fractional ownership and real-time settlement. Money Market Funds (MMFs) provide investors with diversified, low-risk portfolios of short-term debt instruments, prioritizing capital preservation and daily liquidity. Explore how these financial instruments compare in risk, accessibility, and returns to optimize your investment strategy.

Why it is important

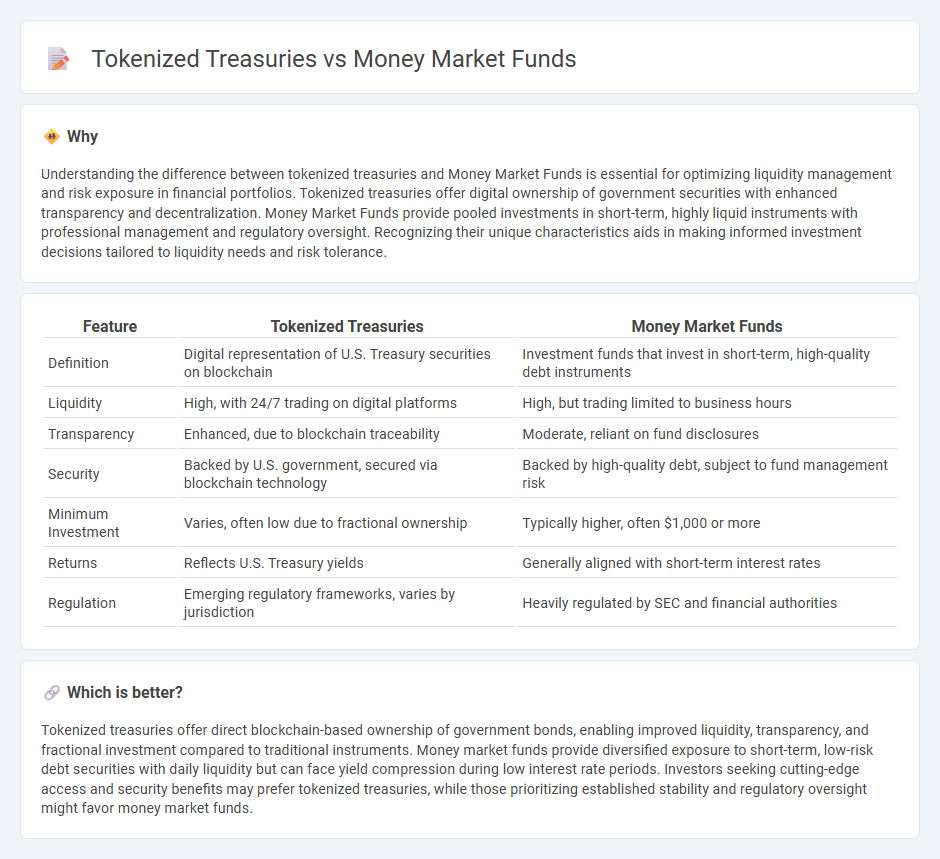

Understanding the difference between tokenized treasuries and Money Market Funds is essential for optimizing liquidity management and risk exposure in financial portfolios. Tokenized treasuries offer digital ownership of government securities with enhanced transparency and decentralization. Money Market Funds provide pooled investments in short-term, highly liquid instruments with professional management and regulatory oversight. Recognizing their unique characteristics aids in making informed investment decisions tailored to liquidity needs and risk tolerance.

Comparison Table

| Feature | Tokenized Treasuries | Money Market Funds |

|---|---|---|

| Definition | Digital representation of U.S. Treasury securities on blockchain | Investment funds that invest in short-term, high-quality debt instruments |

| Liquidity | High, with 24/7 trading on digital platforms | High, but trading limited to business hours |

| Transparency | Enhanced, due to blockchain traceability | Moderate, reliant on fund disclosures |

| Security | Backed by U.S. government, secured via blockchain technology | Backed by high-quality debt, subject to fund management risk |

| Minimum Investment | Varies, often low due to fractional ownership | Typically higher, often $1,000 or more |

| Returns | Reflects U.S. Treasury yields | Generally aligned with short-term interest rates |

| Regulation | Emerging regulatory frameworks, varies by jurisdiction | Heavily regulated by SEC and financial authorities |

Which is better?

Tokenized treasuries offer direct blockchain-based ownership of government bonds, enabling improved liquidity, transparency, and fractional investment compared to traditional instruments. Money market funds provide diversified exposure to short-term, low-risk debt securities with daily liquidity but can face yield compression during low interest rate periods. Investors seeking cutting-edge access and security benefits may prefer tokenized treasuries, while those prioritizing established stability and regulatory oversight might favor money market funds.

Connection

Tokenized treasuries enable fractional ownership and increased liquidity of government debt, making them an efficient asset for Money Market Funds (MMFs) seeking low-risk, liquid investments. By integrating blockchain technology, tokenized treasuries enhance settlement speed and transparency, which aligns with MMFs' objectives of capital preservation and accessibility. This connection facilitates greater participation from a wider range of investors while improving operational efficiency in short-term debt markets.

Key Terms

Liquidity

Money market funds offer high liquidity through daily redemptions and stable net asset value, making them a reliable option for short-term cash management. Tokenized treasuries enhance liquidity further by enabling real-time trading on blockchain platforms, reducing settlement times from days to minutes. Discover how these financial instruments compare in liquidity and suitability for your portfolio.

Settlement

Money Market Funds typically settle transactions within one to two business days, relying on traditional banking systems for liquidity and fund transfers. Tokenized treasuries leverage blockchain technology to enable near-instant settlement, drastically reducing counterparty risk and increasing transaction transparency. Explore the advantages of blockchain-based settlement mechanisms in modern treasury management.

Yield

Money Market Funds traditionally offer stable, low-risk yields by investing in short-term government securities and commercial paper. Tokenized treasuries provide competitive yields with enhanced liquidity and transparency through blockchain technology, enabling faster settlement and lower transaction costs. Explore the benefits and risks of each investment option to optimize your portfolio yield.

Source and External Links

Money market fund - Wikipedia - A money market fund is an open-end mutual fund investing in short-term debt securities such as US Treasury bills, seeking to maintain stable asset value and provide income, regulated under the Investment Company Act of 1940 with restrictions on quality, maturity, and diversity of investments to limit risks.

What is a money market fund and how do they work? - Vanguard - Money market funds are low-risk mutual funds investing in short-term, high-quality debt instruments designed for safety, liquidity, and modest returns, often used for emergency funds or short-term goals and differ from FDIC-insured money market accounts offered by banks.

Money Market Funds | Charles Schwab - Money market funds invest in short-term, high-quality securities and provide high liquidity with low risk; types include Prime, Government, Treasury, and Municipal money market funds, each targeting different investors and debt instruments.

dowidth.com

dowidth.com