Payment for order flow involves brokers receiving compensation from market makers for directing clients' trade orders to them, potentially affecting execution quality. Smart order routing technology dynamically searches multiple trading venues to secure the best available prices and optimal trade execution for investors. Discover how these mechanisms impact your trading strategy and market transparency.

Why it is important

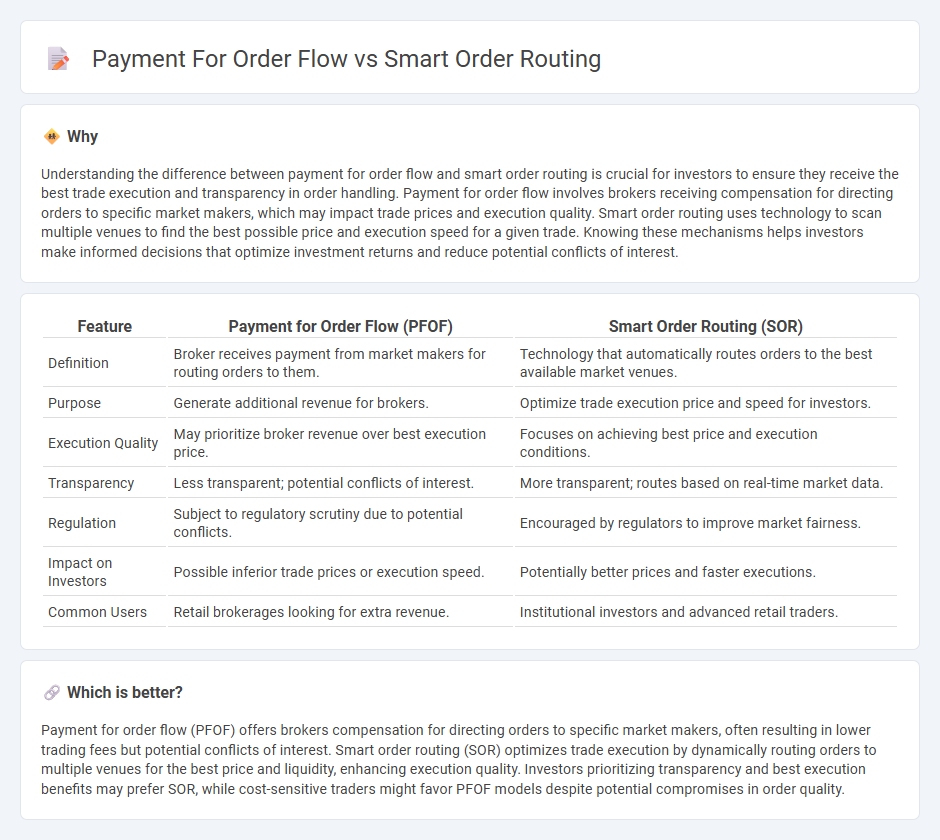

Understanding the difference between payment for order flow and smart order routing is crucial for investors to ensure they receive the best trade execution and transparency in order handling. Payment for order flow involves brokers receiving compensation for directing orders to specific market makers, which may impact trade prices and execution quality. Smart order routing uses technology to scan multiple venues to find the best possible price and execution speed for a given trade. Knowing these mechanisms helps investors make informed decisions that optimize investment returns and reduce potential conflicts of interest.

Comparison Table

| Feature | Payment for Order Flow (PFOF) | Smart Order Routing (SOR) |

|---|---|---|

| Definition | Broker receives payment from market makers for routing orders to them. | Technology that automatically routes orders to the best available market venues. |

| Purpose | Generate additional revenue for brokers. | Optimize trade execution price and speed for investors. |

| Execution Quality | May prioritize broker revenue over best execution price. | Focuses on achieving best price and execution conditions. |

| Transparency | Less transparent; potential conflicts of interest. | More transparent; routes based on real-time market data. |

| Regulation | Subject to regulatory scrutiny due to potential conflicts. | Encouraged by regulators to improve market fairness. |

| Impact on Investors | Possible inferior trade prices or execution speed. | Potentially better prices and faster executions. |

| Common Users | Retail brokerages looking for extra revenue. | Institutional investors and advanced retail traders. |

Which is better?

Payment for order flow (PFOF) offers brokers compensation for directing orders to specific market makers, often resulting in lower trading fees but potential conflicts of interest. Smart order routing (SOR) optimizes trade execution by dynamically routing orders to multiple venues for the best price and liquidity, enhancing execution quality. Investors prioritizing transparency and best execution benefits may prefer SOR, while cost-sensitive traders might favor PFOF models despite potential compromises in order quality.

Connection

Payment for order flow incentivizes brokers to route client orders to specific market makers or trading venues, influencing execution quality. Smart order routing systems leverage this practice by dynamically directing orders to venues that offer optimal pricing and liquidity, potentially benefiting from payment arrangements. Together, they shape order execution strategies by balancing cost, speed, and market depth in financial trading.

Key Terms

Order Execution

Smart Order Routing (SOR) optimizes order execution by dynamically directing trades to the best available market venues based on real-time data, liquidity, and price improvement opportunities. Payment for Order Flow (PFOF) involves brokers receiving compensation from market makers to route orders to them, which may impact execution quality and transparency despite potential cost benefits for retail investors. Explore more about how SOR and PFOF influence order execution efficiency and market fairness.

Best Price

Smart order routing prioritizes executing trades across multiple venues to secure the best available price for investors, dynamically routing orders to optimize execution quality. Payment for order flow involves brokers receiving compensation from market makers for directing orders, which can sometimes influence trade routing decisions away from the best price. Explore the detailed impact of both strategies on achieving optimal trade execution and investor outcomes.

Broker Incentives

Smart order routing optimizes trade execution by dynamically selecting venues offering the best prices and liquidity, enhancing broker incentives through improved client satisfaction and reduced market impact. Payment for order flow compensates brokers for directing orders to specific market makers, potentially compromising execution quality despite additional revenue streams. Explore how these mechanisms influence broker incentives and market fairness in greater detail.

Source and External Links

Smart Order Routing: Prioritize Fulfillment Locations and Deliver Products Faster to Your Customers - Smart order routing automatically directs orders to the best fulfillment location such as warehouses or retail stores based on inventory availability, proximity to the customer, and predefined prioritization rules to speed up delivery and efficiency in order fulfillment.

Smart Order Routing (SOR): definition and function explained simply - Smart Order Routing in trading uses advanced algorithms to execute orders optimally across multiple trading venues by considering factors like liquidity, fees, and prices to achieve the best execution and minimize costs and slippage.

What is Smart Order Routing? (The Complete Guide) - Smart Order Routing algorithms route orders to venues with the best price and liquidity and can be configured to prioritize fill speed, fill price, or access to dark pools, depending on trading strategies and broker-provided routes.

dowidth.com

dowidth.com