Sovereign debt restructuring involves negotiating new terms with creditors to reduce or reschedule a country's debt burden, aiming to restore financial stability without external financial aid. In contrast, a bailout provides immediate financial assistance, often from international organizations or other nations, to prevent default and support economic recovery. Explore the key differences and impacts of these financial strategies in global economics.

Why it is important

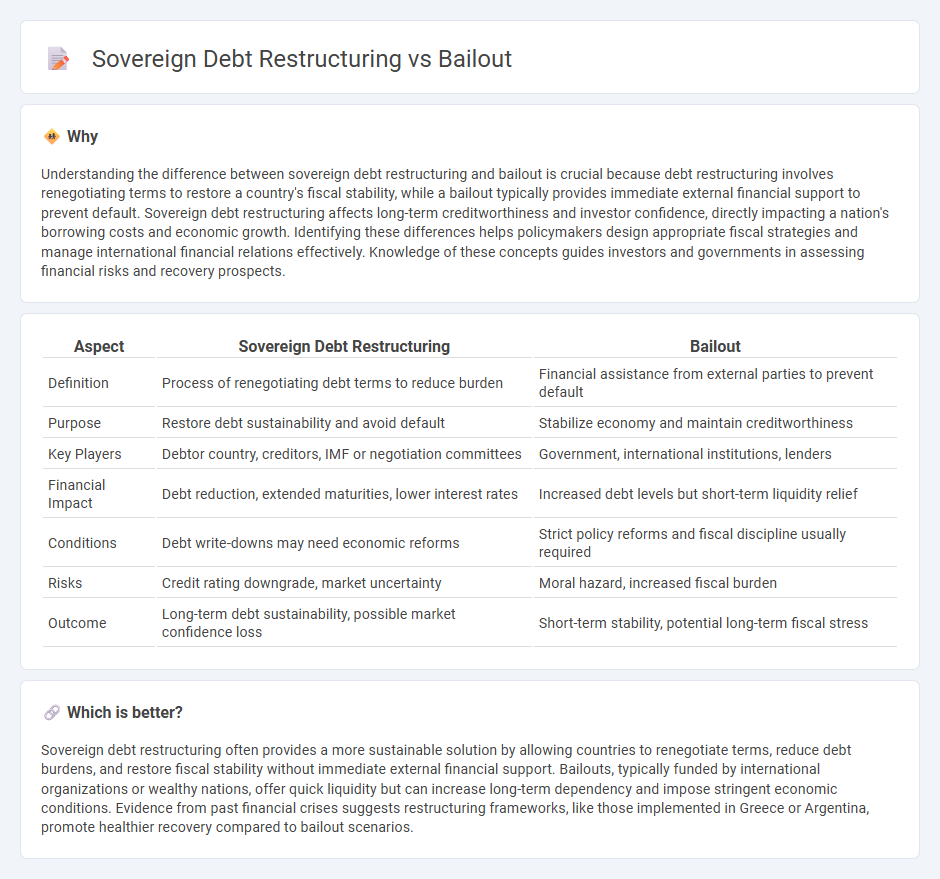

Understanding the difference between sovereign debt restructuring and bailout is crucial because debt restructuring involves renegotiating terms to restore a country's fiscal stability, while a bailout typically provides immediate external financial support to prevent default. Sovereign debt restructuring affects long-term creditworthiness and investor confidence, directly impacting a nation's borrowing costs and economic growth. Identifying these differences helps policymakers design appropriate fiscal strategies and manage international financial relations effectively. Knowledge of these concepts guides investors and governments in assessing financial risks and recovery prospects.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Bailout |

|---|---|---|

| Definition | Process of renegotiating debt terms to reduce burden | Financial assistance from external parties to prevent default |

| Purpose | Restore debt sustainability and avoid default | Stabilize economy and maintain creditworthiness |

| Key Players | Debtor country, creditors, IMF or negotiation committees | Government, international institutions, lenders |

| Financial Impact | Debt reduction, extended maturities, lower interest rates | Increased debt levels but short-term liquidity relief |

| Conditions | Debt write-downs may need economic reforms | Strict policy reforms and fiscal discipline usually required |

| Risks | Credit rating downgrade, market uncertainty | Moral hazard, increased fiscal burden |

| Outcome | Long-term debt sustainability, possible market confidence loss | Short-term stability, potential long-term fiscal stress |

Which is better?

Sovereign debt restructuring often provides a more sustainable solution by allowing countries to renegotiate terms, reduce debt burdens, and restore fiscal stability without immediate external financial support. Bailouts, typically funded by international organizations or wealthy nations, offer quick liquidity but can increase long-term dependency and impose stringent economic conditions. Evidence from past financial crises suggests restructuring frameworks, like those implemented in Greece or Argentina, promote healthier recovery compared to bailout scenarios.

Connection

Sovereign debt restructuring involves modifying the terms of a country's existing debt to achieve debt sustainability, often through extended maturities, reduced interest rates, or principal haircuts. Bailouts provide urgent financial support from international organizations or other countries to prevent default and stabilize the economy during a debt crisis. Both mechanisms aim to restore fiscal stability, reduce default risk, and maintain investor confidence by ensuring government solvency.

Key Terms

Moral Hazard

Bailouts typically involve direct government intervention to rescue failing sovereign states, often creating moral hazard by encouraging reckless fiscal behavior due to anticipated future assistance. Sovereign debt restructuring, by contrast, realigns debt obligations without outright financial rescue, promoting fiscal discipline by imposing costs on creditors and sometimes the sovereign itself. Explore the nuances of how moral hazard influences international financial stability and policy choices.

Haircut

A bailout involves external financial support to a country without necessarily altering the debt's terms, while sovereign debt restructuring often includes a "haircut," a negotiated reduction in the debt's principal or interest to restore debt sustainability. The "haircut" percentage varies by case, with recent restructurings averaging around 30%-50% reduction to ease repayment burdens. Explore the impact of haircuts on sovereign debt sustainability and economic recovery models to understand their strategic differences.

Conditionality

Bailouts typically involve financial aid with strict conditionality requiring governance reforms, austerity measures, or policy adjustments imposed by international institutions like the IMF or World Bank. Sovereign debt restructuring negotiates terms with creditors directly, often avoiding external conditionality but focusing on debt relief and longer repayment periods to ensure sustainability. Explore the nuances of conditionality in these mechanisms to understand their impact on economic recovery strategies.

Source and External Links

bailout | Wex | US Law | LII / Legal Information Institute - A bailout is the rescue of a financially troubled entity through capital injection, often by government, aiming to prevent systemic economic failure and frequently accompanied by regulation changes to maintain market stability.

Bailout - A bailout provides financial help to corporations or countries on the brink of bankruptcy and contrasts with a bail-in where rescue comes via internal recapitalization by creditors, avoiding external government funds.

A bailout or not? Did the federal government bailout Silicon Valley Bank and Signature Bank? - Recent government intervention to protect depositors in failed regional banks is distinguished from traditional bailouts, as the funds protect depositors rather than the banks themselves, reflecting evolving bailout strategies post-2008 crisis.

dowidth.com

dowidth.com