Crowdlending involves individuals or institutions lending money directly to businesses or projects in exchange for interest payments, creating an alternative financing route with clear debt obligations. Crowdfunding, on the other hand, relies on raising small amounts of capital from a large number of people, often in exchange for rewards, equity, or donations, focusing more on creative ventures and startups. Explore the detailed differences and benefits of crowdlending and crowdfunding to optimize your investment strategy.

Why it is important

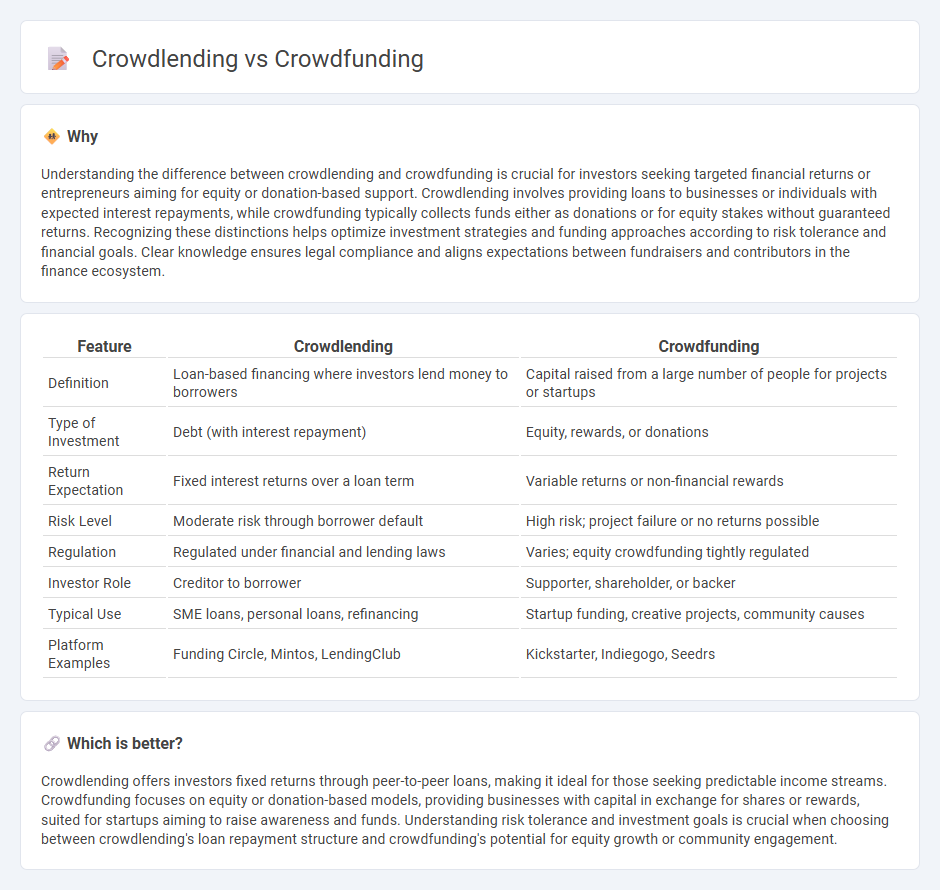

Understanding the difference between crowdlending and crowdfunding is crucial for investors seeking targeted financial returns or entrepreneurs aiming for equity or donation-based support. Crowdlending involves providing loans to businesses or individuals with expected interest repayments, while crowdfunding typically collects funds either as donations or for equity stakes without guaranteed returns. Recognizing these distinctions helps optimize investment strategies and funding approaches according to risk tolerance and financial goals. Clear knowledge ensures legal compliance and aligns expectations between fundraisers and contributors in the finance ecosystem.

Comparison Table

| Feature | Crowdlending | Crowdfunding |

|---|---|---|

| Definition | Loan-based financing where investors lend money to borrowers | Capital raised from a large number of people for projects or startups |

| Type of Investment | Debt (with interest repayment) | Equity, rewards, or donations |

| Return Expectation | Fixed interest returns over a loan term | Variable returns or non-financial rewards |

| Risk Level | Moderate risk through borrower default | High risk; project failure or no returns possible |

| Regulation | Regulated under financial and lending laws | Varies; equity crowdfunding tightly regulated |

| Investor Role | Creditor to borrower | Supporter, shareholder, or backer |

| Typical Use | SME loans, personal loans, refinancing | Startup funding, creative projects, community causes |

| Platform Examples | Funding Circle, Mintos, LendingClub | Kickstarter, Indiegogo, Seedrs |

Which is better?

Crowdlending offers investors fixed returns through peer-to-peer loans, making it ideal for those seeking predictable income streams. Crowdfunding focuses on equity or donation-based models, providing businesses with capital in exchange for shares or rewards, suited for startups aiming to raise awareness and funds. Understanding risk tolerance and investment goals is crucial when choosing between crowdlending's loan repayment structure and crowdfunding's potential for equity growth or community engagement.

Connection

Crowdlending and crowdfunding both leverage online platforms to connect investors directly with projects or businesses seeking capital, enhancing access to finance outside traditional banking systems. Crowdlending specifically involves lending money to businesses or individuals with the expectation of repayment plus interest, while crowdfunding generally entails raising funds through small contributions from a large group without necessarily expecting financial returns. Both models utilize the collective power of the crowd to democratize investment opportunities and fuel economic growth.

Key Terms

Equity

Crowdfunding allows investors to acquire equity shares in startups or businesses, providing ownership stakes and potential dividends. Crowdlending involves lending money to companies or individuals with fixed interest returns, without gaining equity ownership. Explore how equity crowdfunding can empower investors to become partial owners and influence business growth.

Debt

Crowdlending involves individuals lending money to businesses or projects in exchange for interest payments, whereas crowdfunding typically refers to raising funds through donations or equity investments without guaranteed returns. Debt-based platforms facilitate transparent terms, fixed repayment schedules, and potential risk assessments to protect lenders. Explore how crowdlending can optimize your investment portfolio by learning more about its mechanisms and benefits.

Platform

Crowdfunding platforms facilitate capital raising by pooling small investments from numerous contributors, whereas crowdlending platforms specifically connect borrowers with individual lenders for debt financing. Key platforms in crowdfunding include Kickstarter and Indiegogo, popular for creative projects, while crowdlending platforms like LendingClub and Funding Circle specialize in peer-to-peer loans with structured repayment terms. Explore further to understand platform-specific features and how they impact funding success.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, acting as an alternative to traditional financial intermediaries.

What is crowdfunding? Here are four types for startups to know - Stripe - Crowdfunding allows startups to raise money through the collective efforts of many individuals online, enabling fundraising without relying on traditional investors or lenders.

Crowdfunding explained - European Commission - Crowdfunding uses online platforms to collect small financial contributions from many people, helping entrepreneurs and small businesses access funding, gain market insight, and build communities.

dowidth.com

dowidth.com