Dark pool routing enables institutional investors to execute large trades privately within non-public exchanges, minimizing market impact and price slippage. Smart order routing technology optimizes trade execution by scanning multiple trading venues, including dark pools and lit markets, to find the best price and liquidity. Discover more about how these advanced trading methods revolutionize financial market strategies.

Why it is important

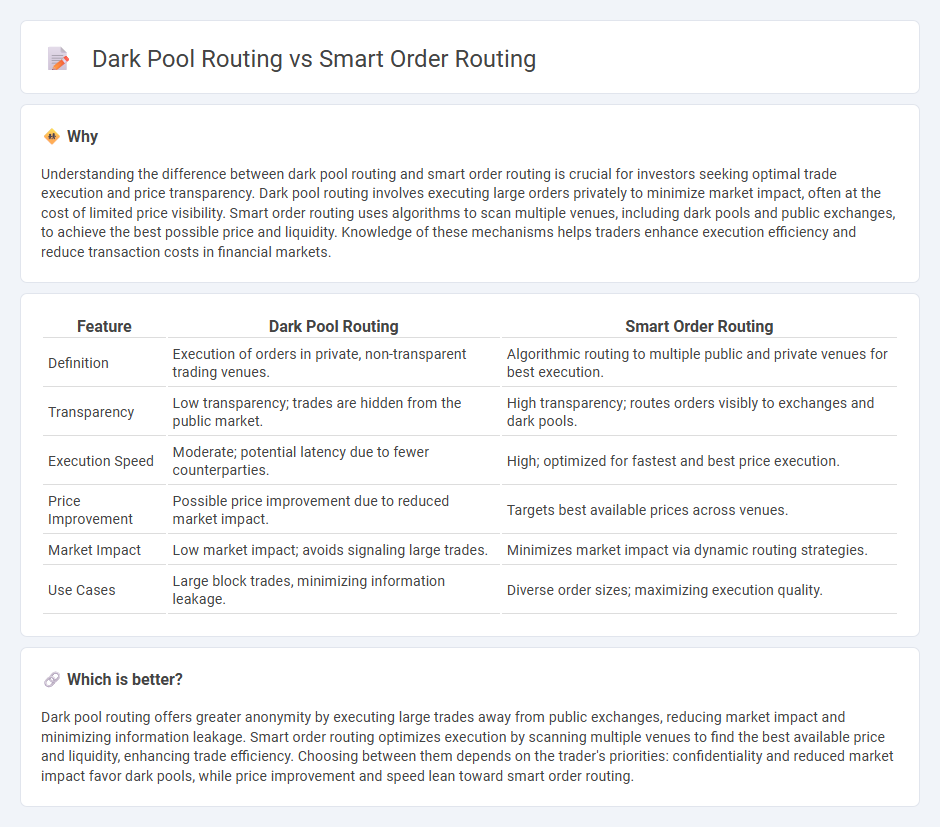

Understanding the difference between dark pool routing and smart order routing is crucial for investors seeking optimal trade execution and price transparency. Dark pool routing involves executing large orders privately to minimize market impact, often at the cost of limited price visibility. Smart order routing uses algorithms to scan multiple venues, including dark pools and public exchanges, to achieve the best possible price and liquidity. Knowledge of these mechanisms helps traders enhance execution efficiency and reduce transaction costs in financial markets.

Comparison Table

| Feature | Dark Pool Routing | Smart Order Routing |

|---|---|---|

| Definition | Execution of orders in private, non-transparent trading venues. | Algorithmic routing to multiple public and private venues for best execution. |

| Transparency | Low transparency; trades are hidden from the public market. | High transparency; routes orders visibly to exchanges and dark pools. |

| Execution Speed | Moderate; potential latency due to fewer counterparties. | High; optimized for fastest and best price execution. |

| Price Improvement | Possible price improvement due to reduced market impact. | Targets best available prices across venues. |

| Market Impact | Low market impact; avoids signaling large trades. | Minimizes market impact via dynamic routing strategies. |

| Use Cases | Large block trades, minimizing information leakage. | Diverse order sizes; maximizing execution quality. |

Which is better?

Dark pool routing offers greater anonymity by executing large trades away from public exchanges, reducing market impact and minimizing information leakage. Smart order routing optimizes execution by scanning multiple venues to find the best available price and liquidity, enhancing trade efficiency. Choosing between them depends on the trader's priorities: confidentiality and reduced market impact favor dark pools, while price improvement and speed lean toward smart order routing.

Connection

Dark pool routing and smart order routing are connected through their roles in optimizing trade execution by accessing multiple liquidity sources while minimizing market impact. Smart order routing algorithms automatically direct orders between dark pools and public exchanges to secure the best possible price and reduce slippage. This integration enhances market efficiency by increasing order transparency and leveraging hidden liquidity in dark pools.

Key Terms

Liquidity

Smart order routing optimizes trade execution by intelligently directing orders across multiple venues to capture the best available liquidity from lit markets, ensuring transparency and price improvement. Dark pool routing, on the other hand, seeks liquidity within private, non-displayed trading venues, enabling large orders to be executed with minimal market impact but often at the cost of reduced price transparency. Discover how leveraging these routing strategies can maximize your trading efficiency and liquidity access.

Execution Venue

Smart order routing intelligently scans multiple execution venues, including dark pools, lit exchanges, and alternative trading systems, to find the best price and liquidity for trades. Dark pool routing specifically targets private, non-transparent venues where large orders can be executed with minimal market impact. Explore the nuances between these routing methods to optimize your trading execution strategies.

Order Visibility

Smart order routing enhances order visibility by dynamically directing trades to multiple liquidity venues, ensuring optimal execution prices and minimizing market impact. Dark pool routing selectively accesses private trading venues where order visibility is limited to reduce market exposure but may sacrifice transparency and price discovery. Explore the nuances of order visibility and execution strategies to optimize your trading performance.

Source and External Links

Smart Order Routing: Prioritize Fulfillment Locations and Deliver Products Faster to Your Customers - Smart order routing automatically directs orders to the best fulfillment location (warehouse, store, or 3PL) based on rules like closest location, inventory availability, or market proximity, improving fulfillment speed and efficiency for retailers.

Smart Order Routing (SOR): definition and function explained simply - In trading, smart order routing uses algorithms to execute orders across different platforms optimally by considering liquidity, fees, and prices to get the best execution and minimize slippage.

What is Smart Order Routing? (The Complete Guide) - Smart order routing algorithms scan multiple trading venues including dark pools to optimize objectives like fill speed, fill price, and liquidity, making order execution automated, faster, and more efficient for traders.

dowidth.com

dowidth.com