Tax loss harvesting involves selling securities at a loss to offset taxable capital gains, thereby reducing overall tax liability. Capital gains realization occurs when an investor sells an asset at a profit, triggering taxable gains that can impact the investor's tax bill. Explore the strategic benefits of both methods to optimize your investment portfolio's tax efficiency.

Why it is important

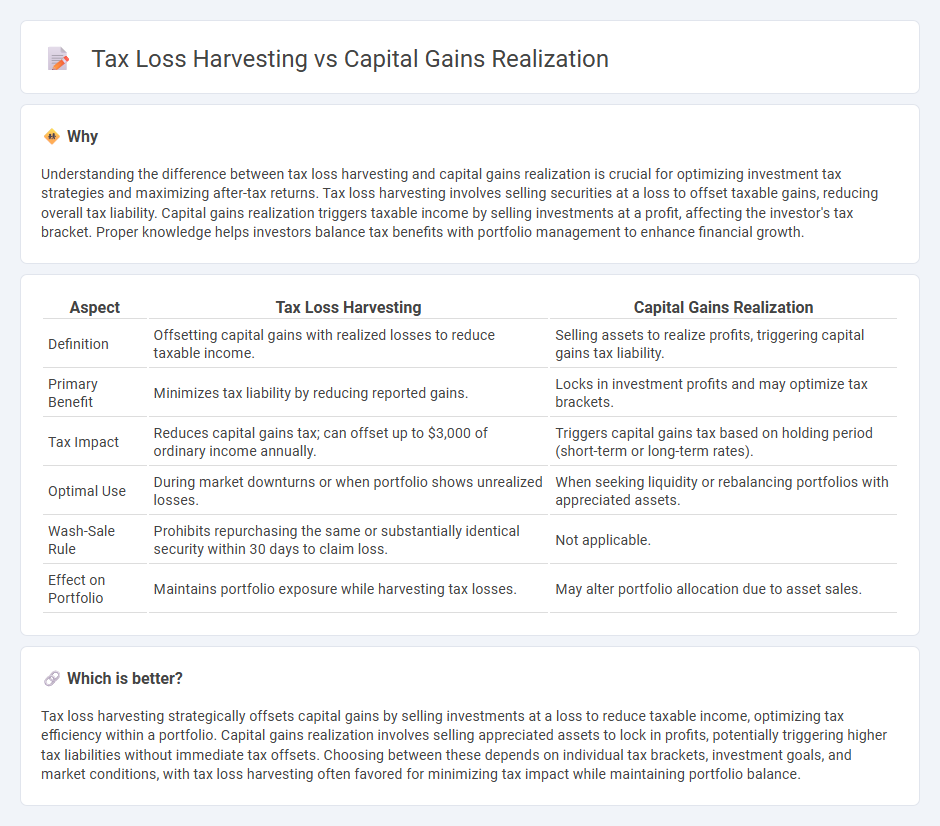

Understanding the difference between tax loss harvesting and capital gains realization is crucial for optimizing investment tax strategies and maximizing after-tax returns. Tax loss harvesting involves selling securities at a loss to offset taxable gains, reducing overall tax liability. Capital gains realization triggers taxable income by selling investments at a profit, affecting the investor's tax bracket. Proper knowledge helps investors balance tax benefits with portfolio management to enhance financial growth.

Comparison Table

| Aspect | Tax Loss Harvesting | Capital Gains Realization |

|---|---|---|

| Definition | Offsetting capital gains with realized losses to reduce taxable income. | Selling assets to realize profits, triggering capital gains tax liability. |

| Primary Benefit | Minimizes tax liability by reducing reported gains. | Locks in investment profits and may optimize tax brackets. |

| Tax Impact | Reduces capital gains tax; can offset up to $3,000 of ordinary income annually. | Triggers capital gains tax based on holding period (short-term or long-term rates). |

| Optimal Use | During market downturns or when portfolio shows unrealized losses. | When seeking liquidity or rebalancing portfolios with appreciated assets. |

| Wash-Sale Rule | Prohibits repurchasing the same or substantially identical security within 30 days to claim loss. | Not applicable. |

| Effect on Portfolio | Maintains portfolio exposure while harvesting tax losses. | May alter portfolio allocation due to asset sales. |

Which is better?

Tax loss harvesting strategically offsets capital gains by selling investments at a loss to reduce taxable income, optimizing tax efficiency within a portfolio. Capital gains realization involves selling appreciated assets to lock in profits, potentially triggering higher tax liabilities without immediate tax offsets. Choosing between these depends on individual tax brackets, investment goals, and market conditions, with tax loss harvesting often favored for minimizing tax impact while maintaining portfolio balance.

Connection

Tax loss harvesting and capital gains realization are interconnected strategies used to optimize investment tax efficiency by offsetting realized capital gains with realized losses. Investors systematically sell securities at a loss to reduce taxable capital gains incurred from profitable asset sales, effectively minimizing their overall tax liability. This practice leverages IRS rules on netting capital gains and losses within a tax year, enhancing after-tax portfolio growth.

Key Terms

Cost basis

Capital gains realization occurs when an asset is sold for a profit exceeding its cost basis, triggering taxable income based on that gain. Tax loss harvesting involves selling securities at a loss to offset capital gains, effectively lowering taxable income while resetting the cost basis to a new, lower level. Explore more to understand how strategic management of cost basis influences overall tax efficiency.

Realized gains/losses

Realized gains refer to the profits earned from selling an asset at a price higher than its purchase cost, triggering a taxable event. Tax loss harvesting involves intentionally selling securities at a loss to offset realized gains, thereby reducing the overall tax liability. Explore effective strategies to balance realized gains and tax loss harvesting for optimized investment tax outcomes.

Wash-sale rule

Capital gains realization involves selling assets at a profit, triggering taxable gains, whereas tax loss harvesting strategically sells securities at a loss to offset gains and reduce tax liability. The Wash-sale rule prohibits claiming a tax loss if the same or substantially identical security is repurchased within 30 days before or after the sale, preventing immediate tax benefits from the loss. Explore further to master tax-efficient investing strategies and compliance with IRS regulations.

Source and External Links

Understanding Realized and Unrealized Capital Gains Under Current Tax Law - Realized capital gains occur when you sell an asset and the profit becomes taxable, while unrealized gains are increases in value that are not taxed until the asset is sold.

What are capital gains taxes and how could they be reformed? - Capital gains are taxed upon realization, meaning when the asset is sold, and this approach simplifies valuation and aligns tax payment with liquidity of the gain.

What is capital gains tax? | Vanguard - Capital gains are "realized" when an investment is sold at a higher price than the purchase price, triggering a taxable event, with tax rates varying based on the holding period of the asset.

dowidth.com

dowidth.com