Liquid staking offers users the ability to earn staking rewards while maintaining liquidity of their assets, unlike traditional staking which locks funds for a fixed period. Staking derivatives represent tokenized versions of staked assets, enabling traders to utilize staked funds in decentralized finance (DeFi) protocols without relinquishing staking benefits. Explore deeper insights to understand how these innovations impact your investment strategies.

Why it is important

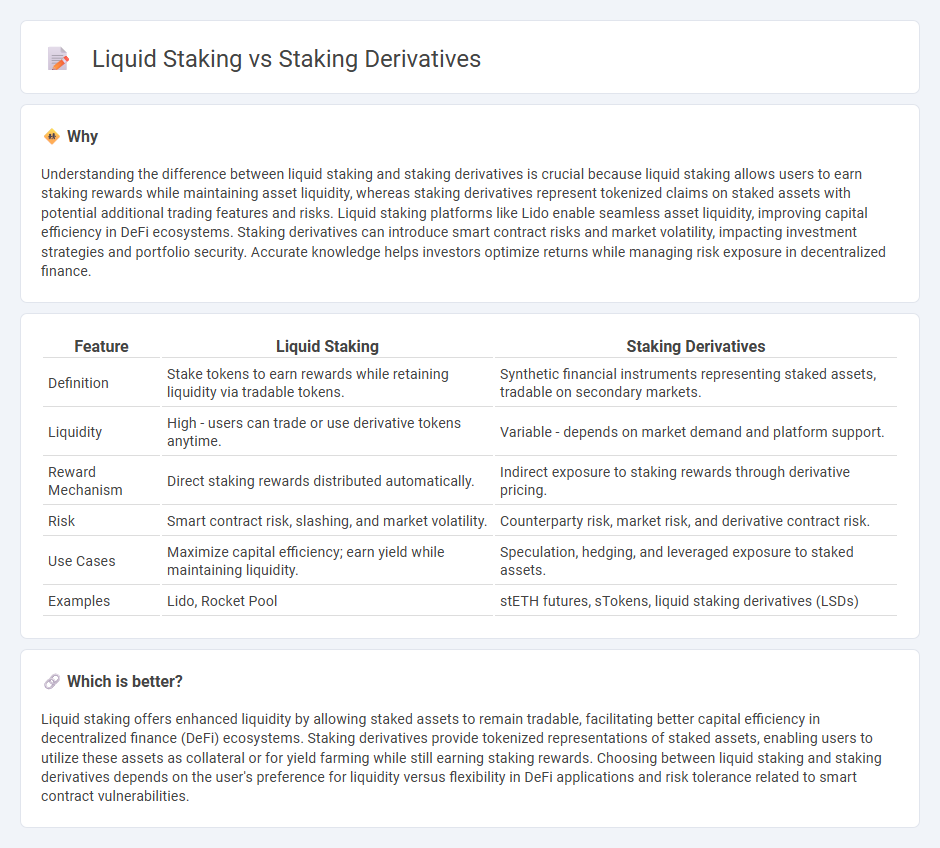

Understanding the difference between liquid staking and staking derivatives is crucial because liquid staking allows users to earn staking rewards while maintaining asset liquidity, whereas staking derivatives represent tokenized claims on staked assets with potential additional trading features and risks. Liquid staking platforms like Lido enable seamless asset liquidity, improving capital efficiency in DeFi ecosystems. Staking derivatives can introduce smart contract risks and market volatility, impacting investment strategies and portfolio security. Accurate knowledge helps investors optimize returns while managing risk exposure in decentralized finance.

Comparison Table

| Feature | Liquid Staking | Staking Derivatives |

|---|---|---|

| Definition | Stake tokens to earn rewards while retaining liquidity via tradable tokens. | Synthetic financial instruments representing staked assets, tradable on secondary markets. |

| Liquidity | High - users can trade or use derivative tokens anytime. | Variable - depends on market demand and platform support. |

| Reward Mechanism | Direct staking rewards distributed automatically. | Indirect exposure to staking rewards through derivative pricing. |

| Risk | Smart contract risk, slashing, and market volatility. | Counterparty risk, market risk, and derivative contract risk. |

| Use Cases | Maximize capital efficiency; earn yield while maintaining liquidity. | Speculation, hedging, and leveraged exposure to staked assets. |

| Examples | Lido, Rocket Pool | stETH futures, sTokens, liquid staking derivatives (LSDs) |

Which is better?

Liquid staking offers enhanced liquidity by allowing staked assets to remain tradable, facilitating better capital efficiency in decentralized finance (DeFi) ecosystems. Staking derivatives provide tokenized representations of staked assets, enabling users to utilize these assets as collateral or for yield farming while still earning staking rewards. Choosing between liquid staking and staking derivatives depends on the user's preference for liquidity versus flexibility in DeFi applications and risk tolerance related to smart contract vulnerabilities.

Connection

Liquid staking enables users to stake their crypto assets while maintaining liquidity through staking derivatives, which represent staked tokens on secondary markets. These derivatives facilitate trading, lending, and collateral use without unbonding periods, enhancing capital efficiency. By bridging staking rewards with asset flexibility, liquid staking and derivatives create a dynamic DeFi ecosystem.

Key Terms

Yield

Staking derivatives allow users to maintain liquidity while earning staking rewards by tokenizing staked assets, often resulting in slightly lower yields due to protocol fees and secondary market risks. Liquid staking offers direct participation in network validation with competitive yields driven by protocol incentives but can limit immediate asset transferability depending on the platform. Explore detailed yield comparisons and platform-specific metrics to optimize your staking strategy.

Liquidity

Staking derivatives provide token holders with tradable assets representing staked tokens, enhancing liquidity without requiring immediate unstaking. Liquid staking allows users to stake assets while receiving liquid tokens that can be used across DeFi platforms, improving capital efficiency and access to liquidity. Explore the nuances between these approaches to optimize your staking strategy and unlock greater liquidity benefits.

Tokenization

Staking derivatives enable users to tokenize staked assets, providing liquidity and flexibility by representing staked tokens as tradable derivatives. Liquid staking platforms tokenize staked tokens into liquid assets that maintain staking rewards while allowing seamless transfer, trading, or utilization in DeFi protocols. Discover how tokenization transforms staking by enhancing asset accessibility and unlocking new financial opportunities.

Source and External Links

What Are Liquid Staking Derivatives? - OSL - Liquid staking derivatives allow users to stake their cryptocurrency while receiving tokenized versions of their staked assets, enabling them to use these tokens in DeFi applications and maintain liquidity while earning staking rewards.

Liquid Staking Derivatives Definition | CoinMarketCap - Liquid Staking Derivatives are tokens representing staked assets in a DeFi protocol, which users can trade, lend, or use as collateral while still earning staking rewards.

Liquid staking and restaking - Matcha - Blog - Liquid staking derivatives tokenize staked assets so users retain liquidity and can deploy the derivatives in other Web3 activities while their original assets continue earning staking rewards, enhancing capital efficiency.

dowidth.com

dowidth.com