Robo advisory leverages algorithms and artificial intelligence to automatically manage investment portfolios with lower fees and consistent risk management, making it ideal for cost-conscious investors seeking passive strategies. In contrast, active portfolio management relies on human expertise to analyze market trends, select securities, and adjust allocations dynamically, aiming for higher returns but often accompanied by increased costs and risks. Explore in-depth insights on how these investment approaches compare to choose the best fit for your financial goals.

Why it is important

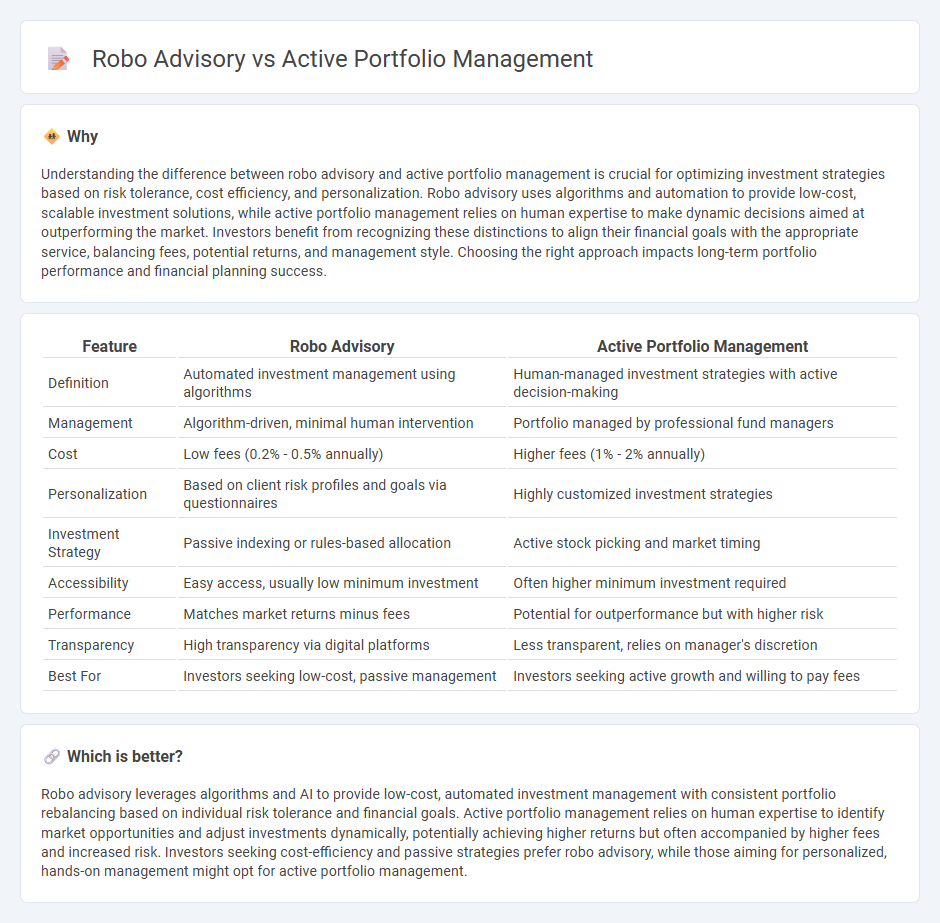

Understanding the difference between robo advisory and active portfolio management is crucial for optimizing investment strategies based on risk tolerance, cost efficiency, and personalization. Robo advisory uses algorithms and automation to provide low-cost, scalable investment solutions, while active portfolio management relies on human expertise to make dynamic decisions aimed at outperforming the market. Investors benefit from recognizing these distinctions to align their financial goals with the appropriate service, balancing fees, potential returns, and management style. Choosing the right approach impacts long-term portfolio performance and financial planning success.

Comparison Table

| Feature | Robo Advisory | Active Portfolio Management |

|---|---|---|

| Definition | Automated investment management using algorithms | Human-managed investment strategies with active decision-making |

| Management | Algorithm-driven, minimal human intervention | Portfolio managed by professional fund managers |

| Cost | Low fees (0.2% - 0.5% annually) | Higher fees (1% - 2% annually) |

| Personalization | Based on client risk profiles and goals via questionnaires | Highly customized investment strategies |

| Investment Strategy | Passive indexing or rules-based allocation | Active stock picking and market timing |

| Accessibility | Easy access, usually low minimum investment | Often higher minimum investment required |

| Performance | Matches market returns minus fees | Potential for outperformance but with higher risk |

| Transparency | High transparency via digital platforms | Less transparent, relies on manager's discretion |

| Best For | Investors seeking low-cost, passive management | Investors seeking active growth and willing to pay fees |

Which is better?

Robo advisory leverages algorithms and AI to provide low-cost, automated investment management with consistent portfolio rebalancing based on individual risk tolerance and financial goals. Active portfolio management relies on human expertise to identify market opportunities and adjust investments dynamically, potentially achieving higher returns but often accompanied by higher fees and increased risk. Investors seeking cost-efficiency and passive strategies prefer robo advisory, while those aiming for personalized, hands-on management might opt for active portfolio management.

Connection

Robo advisory integrates algorithm-driven financial planning with active portfolio management to optimize investment strategies through real-time data analysis and automated rebalancing. This synergy enhances portfolio diversification, risk assessment, and cost efficiency, leveraging AI and machine learning for tailored asset allocation. As a result, investors gain access to dynamic, personalized wealth management solutions traditionally offered by human advisors.

Key Terms

Alpha

Active portfolio management seeks to generate alpha by leveraging market expertise and dynamic investment strategies to outperform benchmarks. Robo advisory relies on algorithms and automation to optimize asset allocation, often prioritizing cost-efficiency and passive indexing over alpha generation. Discover how each approach impacts your investment returns and risk profile.

Algorithm

Active portfolio management relies on human portfolio managers using algorithms combined with market research to make buy/sell decisions, aiming to outperform benchmarks through tactical asset allocation and security selection. Robo advisory uses fully automated algorithms programmed to manage portfolios based on client risk profiles and goals, emphasizing low-cost, passive investment strategies and continuous rebalancing. Explore the detailed differences in algorithmic strategies and performance metrics to understand which approach suits your investment style.

Human Oversight

Active portfolio management leverages human expertise to continuously analyze market trends, enabling dynamic decision-making tailored to individual investor goals. Robo advisory relies on algorithmic models and automation, offering cost-effective portfolio rebalancing but limited human judgment in volatile markets. Explore how combining active management with robo technology can enhance investment outcomes through strategic human oversight.

Source and External Links

Active Management - Overview, How It Works, Process - Active portfolio management uses human judgment and analytical research to select securities and allocate assets dynamically to optimize returns and manage risk through a strategic, responsive process.

What Is Active Management? - Investment Adviser Association - Active portfolio management involves selecting investments via fundamental or quantitative analysis, managing security selection and asset allocation actively rather than passively tracking indices.

Active Portfolio Management - Brandeis - The foundations of active portfolio management include managing return, risk, and benchmarks effectively using information ratios and preference-based decision making for superior investment outcomes.

dowidth.com

dowidth.com