Green bonds are debt instruments specifically earmarked for financing environmentally sustainable projects, such as renewable energy or clean transportation, offering investors a way to support eco-friendly initiatives while earning returns. Conventional bonds, by contrast, fund a wide range of general corporate or government activities without targeted environmental benefits. Discover the key differences and investment opportunities between green and conventional bonds to optimize your sustainable finance strategy.

Why it is important

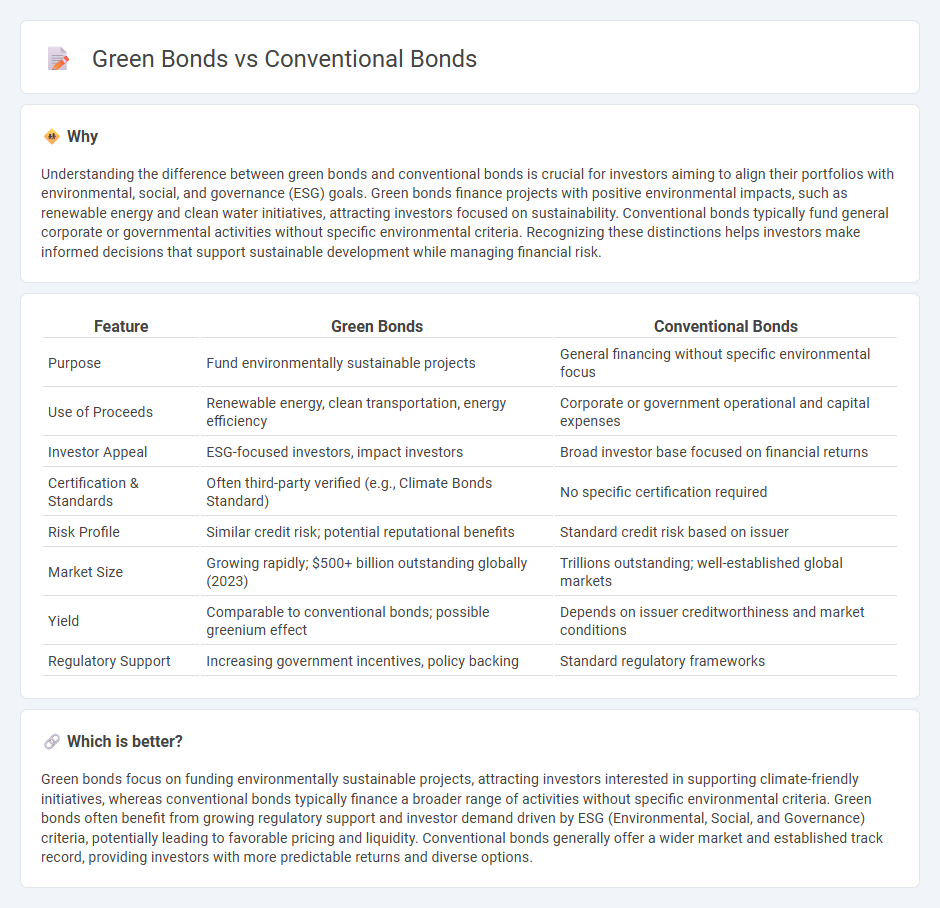

Understanding the difference between green bonds and conventional bonds is crucial for investors aiming to align their portfolios with environmental, social, and governance (ESG) goals. Green bonds finance projects with positive environmental impacts, such as renewable energy and clean water initiatives, attracting investors focused on sustainability. Conventional bonds typically fund general corporate or governmental activities without specific environmental criteria. Recognizing these distinctions helps investors make informed decisions that support sustainable development while managing financial risk.

Comparison Table

| Feature | Green Bonds | Conventional Bonds |

|---|---|---|

| Purpose | Fund environmentally sustainable projects | General financing without specific environmental focus |

| Use of Proceeds | Renewable energy, clean transportation, energy efficiency | Corporate or government operational and capital expenses |

| Investor Appeal | ESG-focused investors, impact investors | Broad investor base focused on financial returns |

| Certification & Standards | Often third-party verified (e.g., Climate Bonds Standard) | No specific certification required |

| Risk Profile | Similar credit risk; potential reputational benefits | Standard credit risk based on issuer |

| Market Size | Growing rapidly; $500+ billion outstanding globally (2023) | Trillions outstanding; well-established global markets |

| Yield | Comparable to conventional bonds; possible greenium effect | Depends on issuer creditworthiness and market conditions |

| Regulatory Support | Increasing government incentives, policy backing | Standard regulatory frameworks |

Which is better?

Green bonds focus on funding environmentally sustainable projects, attracting investors interested in supporting climate-friendly initiatives, whereas conventional bonds typically finance a broader range of activities without specific environmental criteria. Green bonds often benefit from growing regulatory support and investor demand driven by ESG (Environmental, Social, and Governance) criteria, potentially leading to favorable pricing and liquidity. Conventional bonds generally offer a wider market and established track record, providing investors with more predictable returns and diverse options.

Connection

Green bonds and conventional bonds share the fundamental structure of debt instruments used by organizations to raise capital, with green bonds specifically earmarked for environmentally sustainable projects. Both bond types offer fixed income returns to investors, but green bonds integrate ESG (Environmental, Social, and Governance) criteria, attracting investors focused on sustainable finance. Market trends show growing investor demand for green bonds, bridging conventional fixed-income markets with the global push for climate finance.

Key Terms

Use of Proceeds

Conventional bonds typically finance a wide range of business activities without specific allocation requirements, whereas green bonds are strictly earmarked for environmentally friendly projects such as renewable energy, pollution prevention, and sustainable agriculture. Investors in green bonds benefit from increased transparency and impact reporting tied directly to the projects funded. Explore more about the distinct benefits and criteria of green bonds to make informed investment choices.

Environmental Impact

Conventional bonds fund a wide range of projects without a specific focus on environmental outcomes, whereas green bonds are dedicated to financing environmentally beneficial initiatives such as renewable energy, clean transportation, and sustainable water management. Green bonds often come with stricter transparency and reporting standards to verify their positive environmental impact. Explore detailed comparisons to understand how green bonds drive sustainability in investment portfolios.

Reporting Standards

Conventional bonds typically follow general financial reporting standards such as IFRS or GAAP, focusing on financial performance and risk disclosures. Green bonds require specialized reporting frameworks like the Green Bond Principles or the Climate Bonds Standard, emphasizing the environmental impact and use of proceeds aligned with sustainability goals. Explore detailed compliance and verification processes to understand the distinct reporting requirements of green bonds.

Source and External Links

Statutory vs. Conventional Bonds: What's the Difference? - Conventional bonds are governed by the specific language and terms set out in their bond documents, and these bonds can be tailored with qualifications, conditions, or limitations as permitted by law, unlike statutory bonds, which must strictly follow legislative requirements.

Conventional bonds - finiki, the Canadian financial wiki - Conventional bonds (also called nominal bonds) are debt securities issued by various institutions such as governments, municipalities, and corporations, offering fixed interest and principal payments but are not indexed to inflation.

Sustainable Versus Conventional Bonds: A Comparative Analysis - Conventional corporate bonds are financial instruments issued by nonfinancial firms globally that differ from sustainable bonds mainly in their lack of explicit environmental, social, or governance (ESG) objectives, and they are typically priced based on traditional credit risk factors.

dowidth.com

dowidth.com