Laddered bond ETFs strategically invest in bonds with staggered maturities to balance yield and interest rate risk, offering predictable income streams. Ultra-short bond funds focus on very short-duration debt instruments to minimize interest rate sensitivity while maintaining liquidity. Explore the differences to determine which fixed-income strategy aligns with your investment goals.

Why it is important

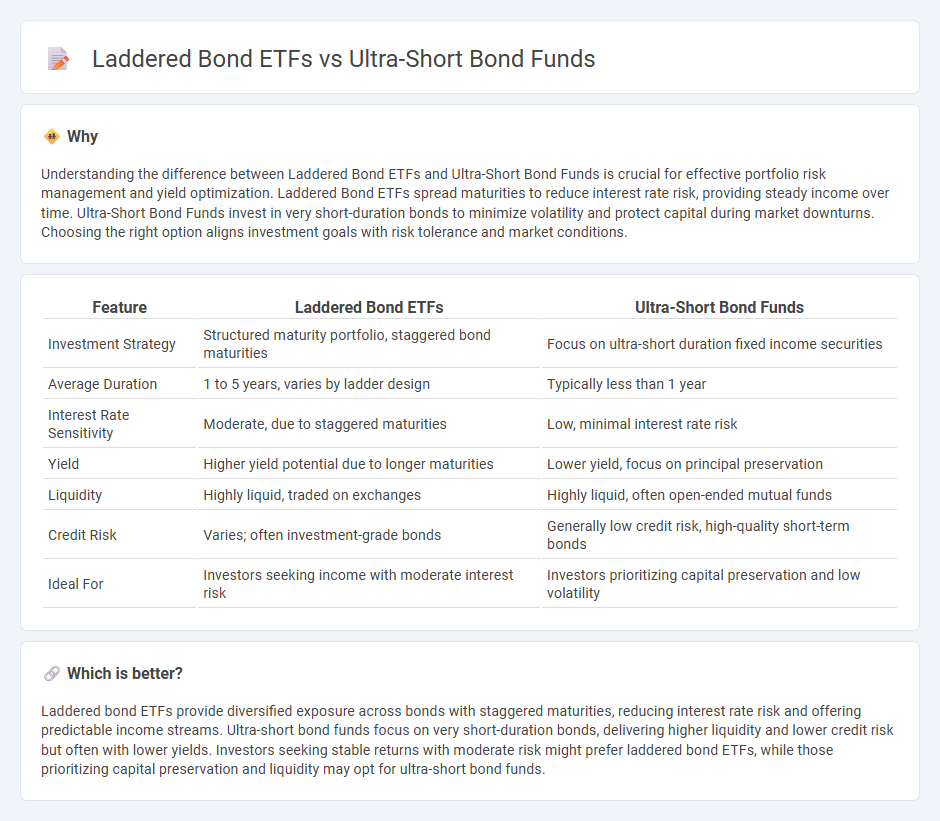

Understanding the difference between Laddered Bond ETFs and Ultra-Short Bond Funds is crucial for effective portfolio risk management and yield optimization. Laddered Bond ETFs spread maturities to reduce interest rate risk, providing steady income over time. Ultra-Short Bond Funds invest in very short-duration bonds to minimize volatility and protect capital during market downturns. Choosing the right option aligns investment goals with risk tolerance and market conditions.

Comparison Table

| Feature | Laddered Bond ETFs | Ultra-Short Bond Funds |

|---|---|---|

| Investment Strategy | Structured maturity portfolio, staggered bond maturities | Focus on ultra-short duration fixed income securities |

| Average Duration | 1 to 5 years, varies by ladder design | Typically less than 1 year |

| Interest Rate Sensitivity | Moderate, due to staggered maturities | Low, minimal interest rate risk |

| Yield | Higher yield potential due to longer maturities | Lower yield, focus on principal preservation |

| Liquidity | Highly liquid, traded on exchanges | Highly liquid, often open-ended mutual funds |

| Credit Risk | Varies; often investment-grade bonds | Generally low credit risk, high-quality short-term bonds |

| Ideal For | Investors seeking income with moderate interest risk | Investors prioritizing capital preservation and low volatility |

Which is better?

Laddered bond ETFs provide diversified exposure across bonds with staggered maturities, reducing interest rate risk and offering predictable income streams. Ultra-short bond funds focus on very short-duration bonds, delivering higher liquidity and lower credit risk but often with lower yields. Investors seeking stable returns with moderate risk might prefer laddered bond ETFs, while those prioritizing capital preservation and liquidity may opt for ultra-short bond funds.

Connection

Laddered bond ETFs and ultra-short bond funds both aim to balance interest rate risk and liquidity by investing in fixed-income securities with staggered maturities. Laddered bond ETFs spread investments across bonds that mature at different intervals, reducing reinvestment risk and providing steady income streams. Ultra-short bond funds focus on very short maturities, offering higher yields than money market funds while maintaining lower volatility, making them complementary strategies in fixed-income portfolio management.

Key Terms

Duration

Ultra-short bond funds typically maintain durations under one year, reducing interest rate risk and providing greater capital stability compared to laddered bond ETFs, which often have longer durations reflecting a stepped maturity structure. Laddered bond ETFs invest in bonds with staggered maturities, aiming to balance yield and liquidity while exposing investors to varying interest rate sensitivities. Explore how duration impacts your fixed income portfolio strategy by learning more about the advantages and trade-offs of these bond investment vehicles.

Interest Rate Risk

Ultra-short bond funds offer lower interest rate risk due to their extremely short durations, typically under one year, which minimizes sensitivity to rate fluctuations. Laddered bond ETFs spread maturities across a series of bonds, reducing reinvestment risk but exposing the portfolio to greater interest rate volatility compared to ultra-short funds. Explore how these strategies balance risk and return to optimize your fixed-income allocation.

Liquidity

Ultra-short bond funds offer high liquidity with quick access to capital and minimal interest rate sensitivity, making them ideal for conservative investors seeking stability. Laddered bond ETFs provide diversified maturity exposure across various bonds, balancing yield and interest rate risk while maintaining reasonable liquidity through ETF trading on exchanges. Explore deeper insights into liquidity profiles and investment strategies for these bond instruments to enhance your portfolio management.

Source and External Links

Ultra-Short Bond Funds: Know Where You're Parking Your Money - Ultra-short bond funds invest in fixed income securities with very short maturities and generally aim for higher yields than money market funds by taking on more risk, with fluctuating net asset values (NAV) due to lack of strict diversification and maturity standards.

A guide to ultra-short-term bond funds for cash investors - Ultra-short bond funds offer potential higher income than money market funds with some NAV volatility, making them suitable for cash needed between 1 and 12 months or longer-term strategic cash holdings.

LUBAX | Ultra Short Bond Fund Class A - Lord Abbett - The Lord Abbett Ultra Short Bond Fund seeks current income consistent with capital preservation, holding a diversified portfolio of over 550 securities and charging an expense ratio of 0.43%, with performance competitive against peers and benchmarks over multiple time frames.

dowidth.com

dowidth.com