Bucket investing segments assets into time-specific portfolios to manage liquidity and risk, while total return investing focuses on maximizing overall portfolio growth through income and capital appreciation. Bucket investing emphasizes short-term cash needs and long-term growth, whereas total return strategies aim for consistent reinvestment and compounding over time. Explore the unique benefits and strategies of bucket investing versus total return investing to optimize your financial goals.

Why it is important

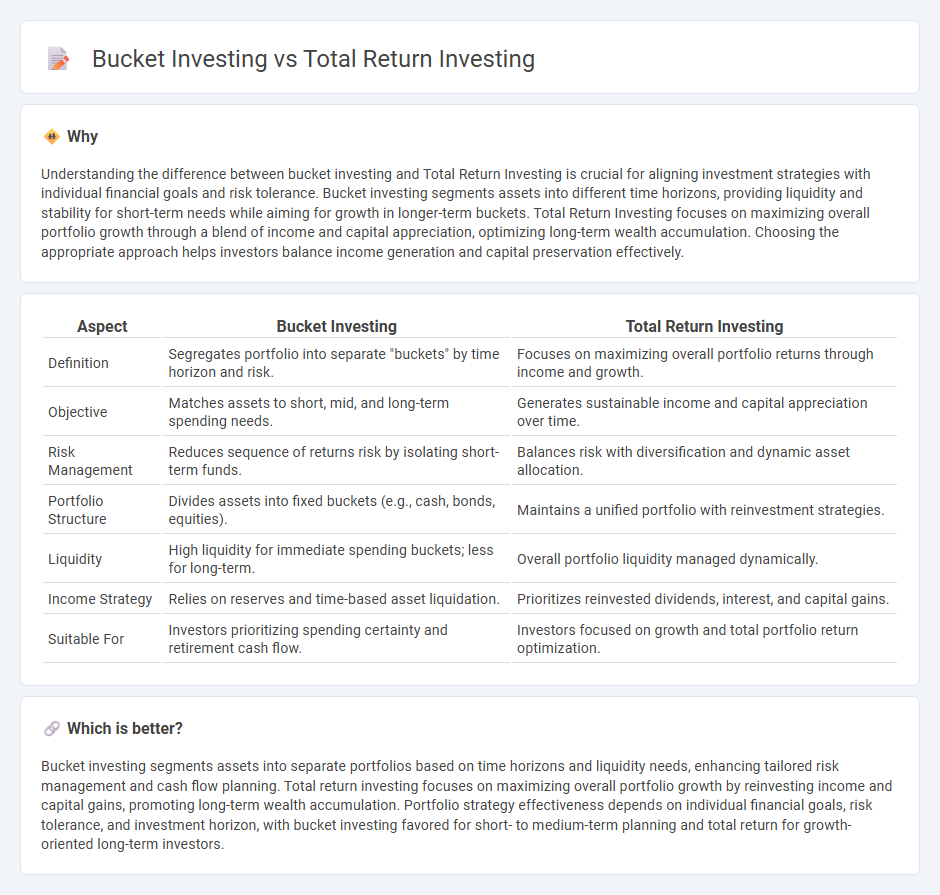

Understanding the difference between bucket investing and Total Return Investing is crucial for aligning investment strategies with individual financial goals and risk tolerance. Bucket investing segments assets into different time horizons, providing liquidity and stability for short-term needs while aiming for growth in longer-term buckets. Total Return Investing focuses on maximizing overall portfolio growth through a blend of income and capital appreciation, optimizing long-term wealth accumulation. Choosing the appropriate approach helps investors balance income generation and capital preservation effectively.

Comparison Table

| Aspect | Bucket Investing | Total Return Investing |

|---|---|---|

| Definition | Segregates portfolio into separate "buckets" by time horizon and risk. | Focuses on maximizing overall portfolio returns through income and growth. |

| Objective | Matches assets to short, mid, and long-term spending needs. | Generates sustainable income and capital appreciation over time. |

| Risk Management | Reduces sequence of returns risk by isolating short-term funds. | Balances risk with diversification and dynamic asset allocation. |

| Portfolio Structure | Divides assets into fixed buckets (e.g., cash, bonds, equities). | Maintains a unified portfolio with reinvestment strategies. |

| Liquidity | High liquidity for immediate spending buckets; less for long-term. | Overall portfolio liquidity managed dynamically. |

| Income Strategy | Relies on reserves and time-based asset liquidation. | Prioritizes reinvested dividends, interest, and capital gains. |

| Suitable For | Investors prioritizing spending certainty and retirement cash flow. | Investors focused on growth and total portfolio return optimization. |

Which is better?

Bucket investing segments assets into separate portfolios based on time horizons and liquidity needs, enhancing tailored risk management and cash flow planning. Total return investing focuses on maximizing overall portfolio growth by reinvesting income and capital gains, promoting long-term wealth accumulation. Portfolio strategy effectiveness depends on individual financial goals, risk tolerance, and investment horizon, with bucket investing favored for short- to medium-term planning and total return for growth-oriented long-term investors.

Connection

Bucket investing segments assets into time-based portfolios to manage risk and liquidity, aligning investments with cash flow needs. Total Return Investing focuses on maximizing overall portfolio gains through income, capital appreciation, and reinvestment strategies. Integrating bucket investing with Total Return Investing enhances long-term wealth growth while ensuring short-term financial stability.

Key Terms

Asset Allocation

Total Return Investing centers on maximizing overall portfolio growth by strategically balancing equities, bonds, and alternative assets to optimize risk-adjusted returns. Bucket Investing segments assets into different time-horizon buckets--short-term, intermediate, and long-term--focusing on liquidity and income stability to meet sequential spending needs. Explore how tailored asset allocation strategies can enhance retirement planning and wealth preservation by learning more about these investment approaches.

Withdrawal Strategy

Total Return Investing maximizes growth by maintaining a diversified portfolio aiming for long-term capital appreciation and income, enabling flexible withdrawals based on portfolio performance. Bucket investing segments assets into time-specific buckets, ensuring short-term liquidity and stable withdrawals by matching investment risk with the intended withdrawal timeline. Explore these withdrawal strategies further to determine which aligns best with your retirement goals and risk tolerance.

Income Generation

Total return investing emphasizes combining capital appreciation and income through dividends and interest, aiming for a balanced growth of portfolio value over time. Bucket investing segments assets into distinct categories aligned with time horizons, ensuring stable income generation for immediate needs while preserving growth potential in longer-term buckets. Explore key strategies to optimize income generation by blending total return and bucket investing approaches.

Source and External Links

Building a Strong Retirement: The Total-Return Investment Approach - Total-return investing seeks the best balance among dividends, interest, and capital gains to maximize overall portfolio return while managing market risk according to individual financial circumstances, rather than focusing solely on income yield.

Total Return Investing - Financial Edge Training - This approach aims for higher returns by combining capital growth with income sources such as dividends and interest, typically suited for long-term investors seeking performance beyond just income yield.

Which Makes More Sense for Retirees: A Total-Return or Income Portfolio? - Total-return investing for retirees involves diversified portfolios designed to provide greater, steadier income over time through growth and income, as opposed to relying solely on interest and dividend income which may risk principal drawdown.

dowidth.com

dowidth.com