Quantamental investing combines quantitative models and fundamental analysis to identify undervalued stocks with strong growth potential, leveraging big data and machine learning algorithms. Discretionary investing relies on the expertise and intuition of portfolio managers to make investment decisions based on market trends and economic indicators. Explore the distinct advantages and strategies of quantamental versus discretionary investing to optimize your financial portfolio.

Why it is important

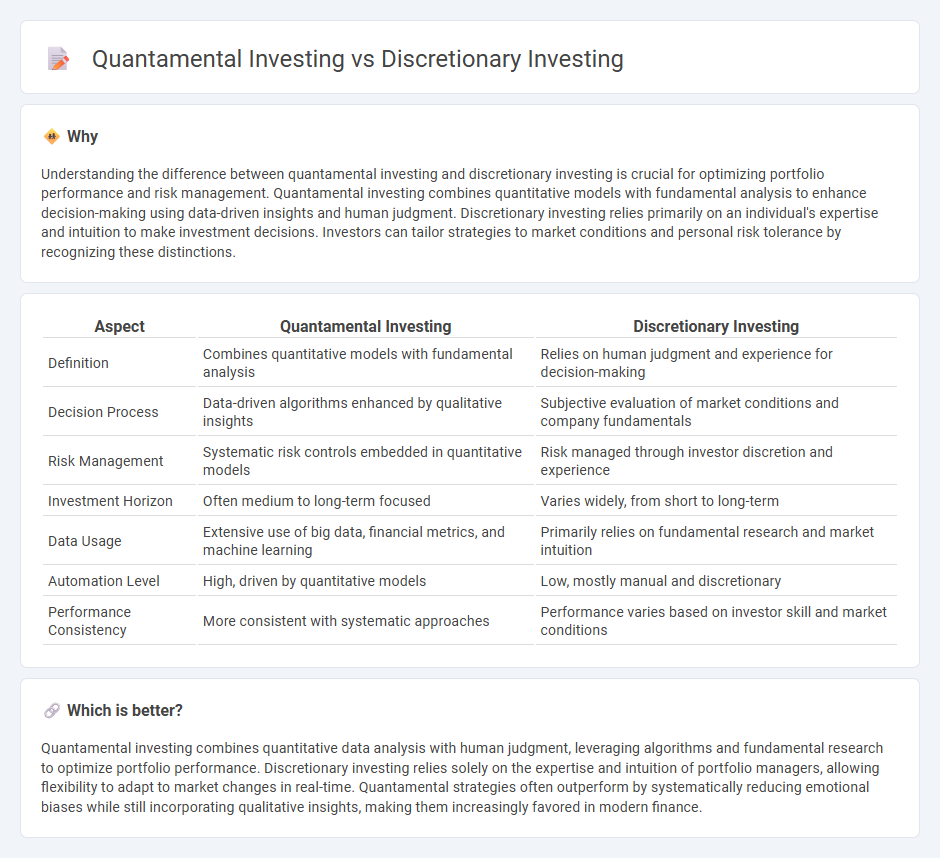

Understanding the difference between quantamental investing and discretionary investing is crucial for optimizing portfolio performance and risk management. Quantamental investing combines quantitative models with fundamental analysis to enhance decision-making using data-driven insights and human judgment. Discretionary investing relies primarily on an individual's expertise and intuition to make investment decisions. Investors can tailor strategies to market conditions and personal risk tolerance by recognizing these distinctions.

Comparison Table

| Aspect | Quantamental Investing | Discretionary Investing |

|---|---|---|

| Definition | Combines quantitative models with fundamental analysis | Relies on human judgment and experience for decision-making |

| Decision Process | Data-driven algorithms enhanced by qualitative insights | Subjective evaluation of market conditions and company fundamentals |

| Risk Management | Systematic risk controls embedded in quantitative models | Risk managed through investor discretion and experience |

| Investment Horizon | Often medium to long-term focused | Varies widely, from short to long-term |

| Data Usage | Extensive use of big data, financial metrics, and machine learning | Primarily relies on fundamental research and market intuition |

| Automation Level | High, driven by quantitative models | Low, mostly manual and discretionary |

| Performance Consistency | More consistent with systematic approaches | Performance varies based on investor skill and market conditions |

Which is better?

Quantamental investing combines quantitative data analysis with human judgment, leveraging algorithms and fundamental research to optimize portfolio performance. Discretionary investing relies solely on the expertise and intuition of portfolio managers, allowing flexibility to adapt to market changes in real-time. Quantamental strategies often outperform by systematically reducing emotional biases while still incorporating qualitative insights, making them increasingly favored in modern finance.

Connection

Quantamental investing integrates quantitative data analysis with discretionary judgment to enhance investment decisions, combining algorithmic models with human insight. This approach leverages big data, machine learning, and fundamental research to identify opportunities that pure discretionary investing might overlook. The synergy between systematic quant methods and intuitive expertise optimizes portfolio performance and risk management.

Key Terms

Fundamental Analysis

Discretionary investing relies heavily on fundamental analysis to evaluate a company's financial health, management quality, and market position, using qualitative judgments to make investment decisions. Quantamental investing combines quantitative models with fundamental analysis, leveraging data-driven techniques alongside traditional qualitative insights to optimize portfolio performance. Discover how integrating both approaches can enhance investment strategies through deeper fundamental analysis.

Quantitative Models

Quantitative models in discretionary investing rely on human judgment complemented by data analysis, allowing portfolio managers to apply insights and experience to investment decisions. Quantamental investing integrates systematic quantitative techniques with fundamental analysis, leveraging advanced algorithms to process vast datasets and identify patterns that enhance stock selection. Explore the advantages and methodologies behind quantitative models in both investment styles to understand their impact on portfolio performance.

Human Judgment

Discretionary investing relies heavily on human judgment, where portfolio managers use experience and intuition to make investment decisions based on qualitative and quantitative analyses. Quantamental investing combines quantitative models with fundamental analysis, enhancing human judgment through data-driven insights and algorithmic support to optimize investment outcomes. Explore the key differences and benefits of each approach to better understand their roles in modern portfolio management.

Source and External Links

Discretionary investment management - Wikipedia - Discretionary investment management is a professional service where an investment manager makes all buying and selling decisions on behalf of clients based on their judgement to meet clients' risk tolerance and financial goals, often serving institutional clients or high-net-worth individuals.

Discretionary Investment Management - Corporate Finance Institute - This investing style grants portfolio managers full discretion to make trading decisions for clients, requiring high trust and adherence to ethical standards while charging management fees for their active role.

What Is Discretionary Fund Management? And Who Is It For? - Discretionary fund management lets professional managers actively manage and adjust your investment portfolio within agreed parameters according to your financial goals and risk tolerance without needing your prior approval for each transaction.

dowidth.com

dowidth.com