Green bond laddering involves structuring a portfolio with multiple green bonds maturing at different intervals to manage liquidity and reduce reinvestment risk. Climate bonds specifically finance projects targeting climate change mitigation and adaptation, often verified by recognized standards to ensure environmental impact. Explore how these strategies optimize sustainable investing by diving deeper into their differences and benefits.

Why it is important

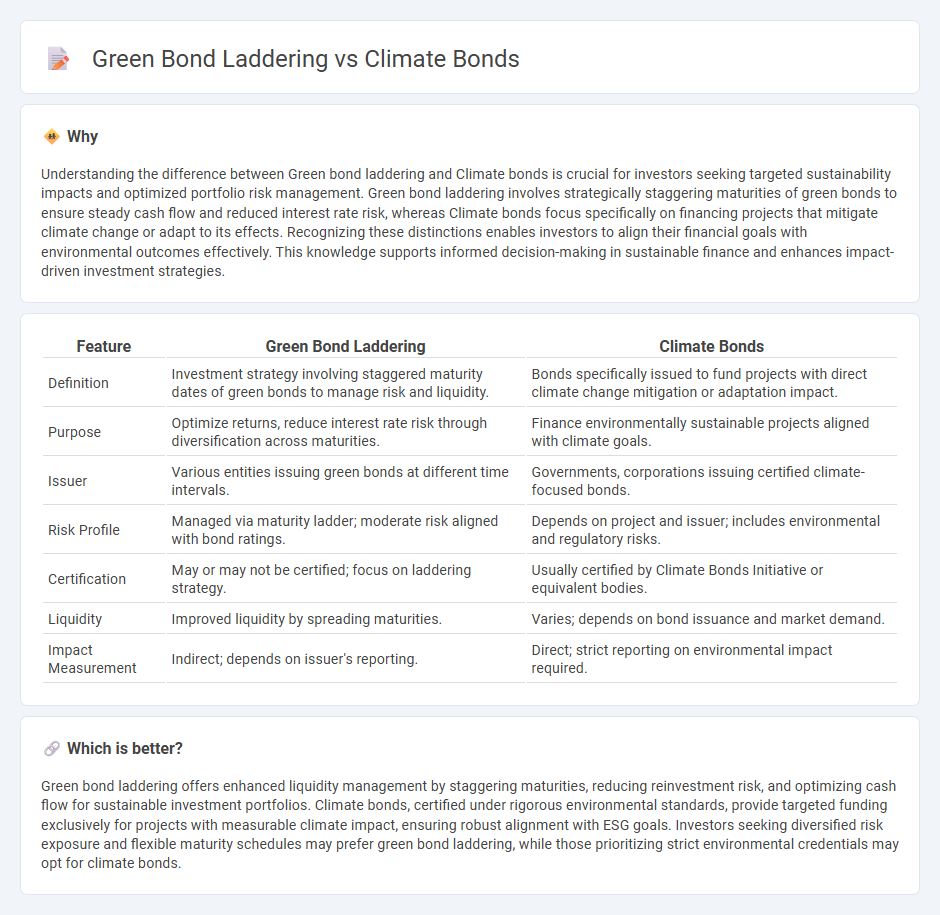

Understanding the difference between Green bond laddering and Climate bonds is crucial for investors seeking targeted sustainability impacts and optimized portfolio risk management. Green bond laddering involves strategically staggering maturities of green bonds to ensure steady cash flow and reduced interest rate risk, whereas Climate bonds focus specifically on financing projects that mitigate climate change or adapt to its effects. Recognizing these distinctions enables investors to align their financial goals with environmental outcomes effectively. This knowledge supports informed decision-making in sustainable finance and enhances impact-driven investment strategies.

Comparison Table

| Feature | Green Bond Laddering | Climate Bonds |

|---|---|---|

| Definition | Investment strategy involving staggered maturity dates of green bonds to manage risk and liquidity. | Bonds specifically issued to fund projects with direct climate change mitigation or adaptation impact. |

| Purpose | Optimize returns, reduce interest rate risk through diversification across maturities. | Finance environmentally sustainable projects aligned with climate goals. |

| Issuer | Various entities issuing green bonds at different time intervals. | Governments, corporations issuing certified climate-focused bonds. |

| Risk Profile | Managed via maturity ladder; moderate risk aligned with bond ratings. | Depends on project and issuer; includes environmental and regulatory risks. |

| Certification | May or may not be certified; focus on laddering strategy. | Usually certified by Climate Bonds Initiative or equivalent bodies. |

| Liquidity | Improved liquidity by spreading maturities. | Varies; depends on bond issuance and market demand. |

| Impact Measurement | Indirect; depends on issuer's reporting. | Direct; strict reporting on environmental impact required. |

Which is better?

Green bond laddering offers enhanced liquidity management by staggering maturities, reducing reinvestment risk, and optimizing cash flow for sustainable investment portfolios. Climate bonds, certified under rigorous environmental standards, provide targeted funding exclusively for projects with measurable climate impact, ensuring robust alignment with ESG goals. Investors seeking diversified risk exposure and flexible maturity schedules may prefer green bond laddering, while those prioritizing strict environmental credentials may opt for climate bonds.

Connection

Green bond laddering and climate bonds both focus on financing sustainable projects by structuring investments across different maturities to optimize returns and manage risk. Climate bonds, which are debt instruments specifically designated for funding climate-positive initiatives, benefit from laddering strategies that enhance liquidity and align cash flows with environmental impact goals. This connection enables investors to support long-term sustainability while achieving diversified exposure to climate-focused assets.

Key Terms

Climate Bonds Certification

Climate Bonds Certification enhances the credibility of green bonds by verifying their alignment with rigorous environmental standards set by the Climate Bonds Initiative, unlike traditional green bond laddering focused mainly on staggered maturity. This certification ensures transparency and investor confidence, promoting significant capital flow into sustainable projects that mitigate climate change impact. Explore the full benefits and processes of Climate Bonds Certification to maximize your sustainable investment strategy.

Green Bond Principles

Climate bonds and green bond laddering both adhere to the Green Bond Principles (GBP), which provide a framework for transparency, disclosure, and reporting to ensure environmental benefits. Climate bonds typically finance specific projects with measurable climate impact, while green bond laddering involves issuing a series of bonds with staggered maturities to optimize funding and investor access. Explore how the Green Bond Principles enhance market integrity and investor confidence in sustainable finance.

Maturity Ladder

Climate bonds align projects with environmental goals by funding renewable energy and sustainable infrastructure, while green bond laddering strategically staggers bond maturities to optimize liquidity and risk management. Maturity laddering in green bonds ensures a steady cash flow and minimizes reinvestment risk by spreading maturities over time, enhancing portfolio stability. Discover more about how maturity laddering can maximize the efficiency of green bond investments.

Source and External Links

Introduction to the Climate Bonds Taxonomy Released ... - TodayESG - The Climate Bonds Taxonomy provides a scientific classification system for climate-related assets to guide issuers and investors on investments that contribute to climate action aligned with the 2degC Paris Agreement target.

Climate Bonds | Homepage - Climate Bonds Initiative is an international organization that mobilizes global capital for climate action by certifying green bonds through a science-based standard, with aligned sustainable debt now exceeding USD 6 trillion.

Green bond - Wikipedia - Green bonds, also known as climate bonds when funding climate change mitigation, are fixed-income instruments dedicated to financing projects with positive environmental impacts such as renewable energy and clean transportation, following Green Bond Principles.

dowidth.com

dowidth.com